28+ Real estate opportunity zone funds Coin

Home » Exchange » 28+ Real estate opportunity zone funds CoinYour Real estate opportunity zone funds coin are available. Real estate opportunity zone funds are a coin that is most popular and liked by everyone now. You can Get the Real estate opportunity zone funds files here. News all free news.

If you’re searching for real estate opportunity zone funds pictures information linked to the real estate opportunity zone funds interest, you have pay a visit to the right site. Our website frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

Real Estate Opportunity Zone Funds. 300 rows Real Estate. Qualified opportunity zone funds allow individuals to roll gains from any capital asset into under-invested communities and defer the income taxes until Dec. Ad List of 242 real estate hedge funds Download now in Excel format. Real estate investment trusts are an allowable legal structure for opportunity zone funds so REITs will gain more advantage by investing in opportunity zone properties.

Opportunity Zones Wyoming Business Council From wyomingbusiness.org

Opportunity Zones Wyoming Business Council From wyomingbusiness.org

NORF 4 Opportunity Zone Fund. Opportunity Funds are investment vehicles that invest at least 90 percent of their capital in Qualified Opportunity Zones. Property held fewer than 5 years. Deferred taxes may also be reduced over time by 10 if redeployed by 12312021 into an Opportunity Zone Fund. The pros and cons of various real estate fund structures including REITs and PREPs related to depreciation capital raising and more. It is a combination of cultural historic natural and economic development.

The objective of the program is to promote economic development in low-income areas by offering investors substantial federal tax advantages.

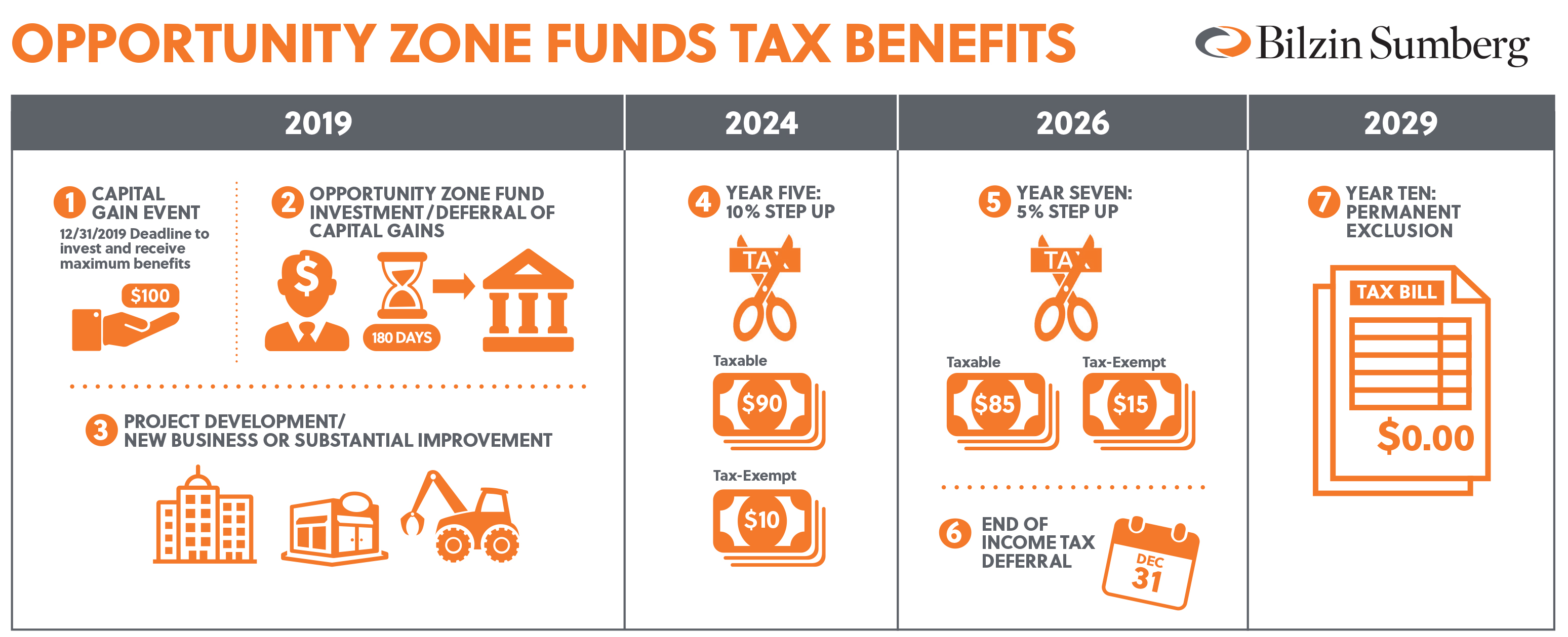

BURRELL touted Activated Capitals Opportunity Zone Funds for delivering consistent and stable cash flows to investors through targeted eight percent annual distributions. After the continuing success of NORF Companies first three private equity real estate investment funds NORF decided to build on their track record and launch their latest and by far the largest venture yet NORF 4 Opportunity Zone Fund. Real estate investment trusts are an allowable legal structure for opportunity zone funds so REITs will gain more advantage by investing in opportunity zone properties. BURRELL touted Activated Capitals Opportunity Zone Funds for delivering consistent and stable cash flows to investors through targeted eight percent annual distributions. Finding the Top 50 Opportunity Zones for Real Estate Investment looked at the increased presence of high-income households between the. Investors may defer capital gains taxes up to seven years on the sale of any existing asset including stocks bonds real estate operating businesses art etc.

Source: badermartin.com

Source: badermartin.com

Finding the Top 50 Opportunity Zones for Real Estate Investment looked at the increased presence of high-income households between the. A Qualified Opportunity Fund is any investment vehicle that is organized as a corporation or a partnership for the purpose of investing in Qualified Opportunity Zone property other than another Qualified Opportunity Fund that holds at least 90 of its assets in Qualified Opportunity Zone property. Property held fewer than 5 years. The Tax Benefits of Investing in Opportunity Zones. The IRS defines an Opportunity Zone as an economically-distressed community where new investments under certain conditions may be eligible for preferential tax treatment.

Source: longbeach.gov

Source: longbeach.gov

Property held fewer than 5 years. The Opportunity Zone Program promotes long-term investments to support existing businesses grow new businesses and finance much needed real estate projects in these communities. Qualified Opportunity Funds or QOFs are the designated investment vehicle used to invest in Opportunity Zones. Investors may defer capital gains taxes up to seven years on the sale of any existing asset including stocks bonds real estate operating businesses art etc. 300 rows Real Estate.

Source: wheda.com

Source: wheda.com

The path Belpointe took to becoming the first publicly traded Opportunity Zone fund. After the continuing success of NORF Companies first three private equity real estate investment funds NORF decided to build on their track record and launch their latest and by far the largest venture yet NORF 4 Opportunity Zone Fund. 300 rows Real Estate. To qualify for the tax. The path Belpointe took to becoming the first publicly traded Opportunity Zone fund.

Source: badermartin.com

Source: badermartin.com

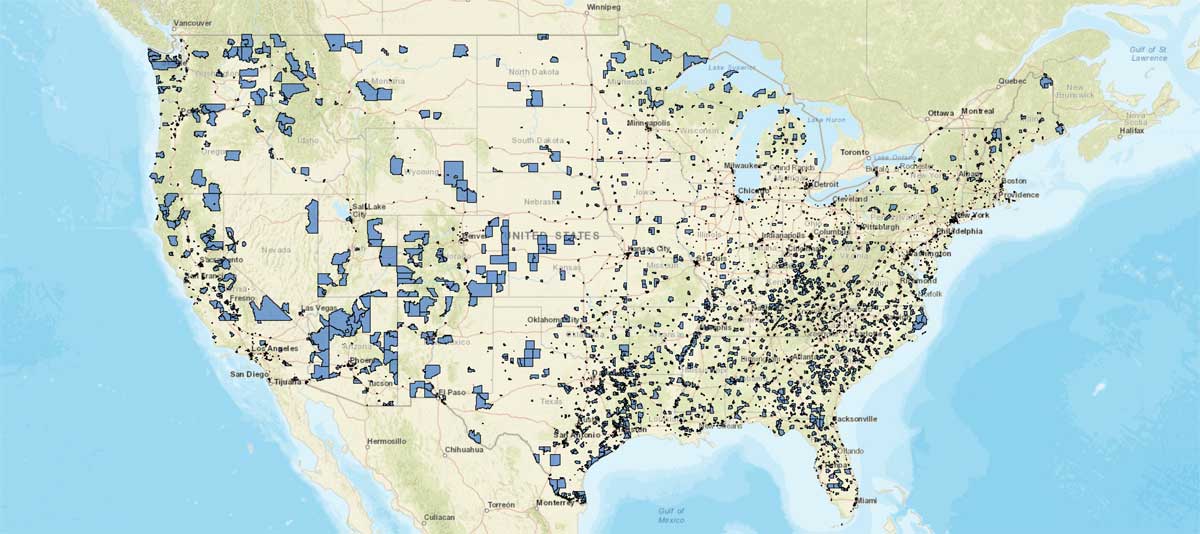

And its territories including Puerto Rico and the Virgin Islands. Qualified Opportunity Zones can be found in every state in the US housing market as well as the District of Columbia DC and Puerto Rico. Qualified opportunity zone funds allow individuals to roll gains from any capital asset into under-invested communities and defer the income taxes until Dec. In May of 2020 NORF Companies launched its latest real estate fund. A qualified opportunity fund is a private fund structured as a corporation or partnership that invests at least 90 of its capital into an opportunity zone.

Source: wheda.com

Source: wheda.com

The Opportunity Zone investment tool allows private investors to receive tax benefits by reinvesting capital gains into a Qualified Opportunity Fund QOF that in turn makes qualified investments in real estate or businesses located in distressed communities nationwide. It is a combination of cultural historic natural and economic development. Opportunity Funds are investment vehicles that invest at least 90 percent of their capital in Qualified Opportunity Zones. NORF 4 Opportunity Zone Fund. Qualified Opportunity Zones give real estate investors a new way to defer and potentially eliminate tax on capital gains.

Source: selectsbcounty.com

Source: selectsbcounty.com

The objective of the program is to promote economic development in low-income areas by offering investors substantial federal tax advantages. And its territories including Puerto Rico and the Virgin Islands. Investors may defer capital gains taxes up to seven years on the sale of any existing asset including stocks bonds real estate operating businesses art etc. The idea behind identifying real estate Opportunity Zones and their preferential tax treatment is simple to define the areas of greatest need and create an incentive. Phillipsburg and Easton Real Estate provide both the benefits from the Opportunity Zones tax incentives as well as a story of growth fueled by the location to natural resources.

Source: badermartin.com

Source: badermartin.com

A qualified opportunity fund is a private fund structured as a corporation or partnership that invests at least 90 of its capital into an opportunity zone. Phillipsburg and Easton Real Estate provide both the benefits from the Opportunity Zones tax incentives as well as a story of growth fueled by the location to natural resources. The Opportunity Zone program is designed to incentivize long-term real estate investments via the following stipulations. We are a Qualified Opportunity Zone Fund focused on the development and commercialization of Opportunity Zones designed to utilize the benefits of the recent Tax Cuts and Jobs Act of 2017 TCJA to invest in Opportunity Zones. Arctaris Opportunity Zone Fund.

Source: northeastpcg.com

Source: northeastpcg.com

Ad List of 242 real estate hedge funds Download now in Excel format. The objective of the program is to promote economic development in low-income areas by offering investors substantial federal tax advantages. Deferred taxes may also be reduced over time by 10 if redeployed by 12312021 into an Opportunity Zone Fund. The path Belpointe took to becoming the first publicly traded Opportunity Zone fund. Opportunity Funds are investment vehicles that invest at least 90 percent of their capital in Qualified Opportunity Zones.

Source: kitces.com

Source: kitces.com

Opportunities for non-accredited investors to access Opportunity Zone funds. Qualified Opportunity Funds or QOFs are the designated investment vehicle used to invest in Opportunity Zones. Ad List of 242 real estate hedge funds Download now in Excel format. Although OZ funds can accommodate a wide variety of businesses the opportunity zone legislation is particularly well-suited for certain types of real estate development projects certain infrastructure and energy projects and certain types of technology and service businesses. NORF 4 Opportunity Zone Fund.

Source: badermartin.com

Source: badermartin.com

Ad List of 242 real estate hedge funds Download now in Excel format. Real estate investment trusts are an allowable legal structure for opportunity zone funds so REITs will gain more advantage by investing in opportunity zone properties. Investors may defer capital gains taxes up to seven years on the sale of any existing asset including stocks bonds real estate operating businesses art etc. The Opportunity Zone Program promotes long-term investments to support existing businesses grow new businesses and finance much needed real estate projects in these communities. Qualified opportunity zone funds allow individuals to roll gains from any capital asset into under-invested communities and defer the income taxes until Dec.

It is a combination of cultural historic natural and economic development. Qualified Opportunity Zones give real estate investors a new way to defer and potentially eliminate tax on capital gains. And its territories including Puerto Rico and the Virgin Islands. Although OZ funds can accommodate a wide variety of businesses the opportunity zone legislation is particularly well-suited for certain types of real estate development projects certain infrastructure and energy projects and certain types of technology and service businesses. Ad List of 242 real estate hedge funds Download now in Excel format.

Source: northeastpcg.com

Source: northeastpcg.com

300 rows Real Estate. The Tax Benefits of Investing in Opportunity Zones. Ad List of 242 real estate hedge funds Download now in Excel format. After the continuing success of NORF Companies first three private equity real estate investment funds NORF decided to build on their track record and launch their latest and by far the largest venture yet NORF 4 Opportunity Zone Fund. The Opportunity Zone Program promotes long-term investments to support existing businesses grow new businesses and finance much needed real estate projects in these communities.

Source: wyomingbusiness.org

Source: wyomingbusiness.org

Ad List of 242 real estate hedge funds Download now in Excel format. BURRELL touted Activated Capitals Opportunity Zone Funds for delivering consistent and stable cash flows to investors through targeted eight percent annual distributions. The Opportunity Zone Program promotes long-term investments to support existing businesses grow new businesses and finance much needed real estate projects in these communities. The idea behind identifying real estate Opportunity Zones and their preferential tax treatment is simple to define the areas of greatest need and create an incentive. A recent ruling stated that a funds failure to meet the 90 asset test would not disqualify it from being classified as an opportunity fund but may result in a penalty.

Source: stessa.com

Source: stessa.com

Property held fewer than 5 years. Finding the Top 50 Opportunity Zones for Real Estate Investment looked at the increased presence of high-income households between the. Qualified Opportunity Funds or QOFs are the designated investment vehicle used to invest in Opportunity Zones. It is a combination of cultural historic natural and economic development. The Opportunity Zone investment tool allows private investors to receive tax benefits by reinvesting capital gains into a Qualified Opportunity Fund QOF that in turn makes qualified investments in real estate or businesses located in distressed communities nationwide.

Source: opportunitydb.com

Source: opportunitydb.com

The objective of the program is to promote economic development in low-income areas by offering investors substantial federal tax advantages. The Opportunity Zone program is designed to incentivize long-term real estate investments via the following stipulations. Property held fewer than 5 years. The study Wind at Your Back. Although OZ funds can accommodate a wide variety of businesses the opportunity zone legislation is particularly well-suited for certain types of real estate development projects certain infrastructure and energy projects and certain types of technology and service businesses.

Source: bilzin.com

Source: bilzin.com

300 rows Real Estate. The study Wind at Your Back. Property held fewer than 5 years. We are a Qualified Opportunity Zone Fund focused on the development and commercialization of Opportunity Zones designed to utilize the benefits of the recent Tax Cuts and Jobs Act of 2017 TCJA to invest in Opportunity Zones. Ad List of 242 real estate hedge funds Download now in Excel format.

Source: badermartin.com

Source: badermartin.com

It is a combination of cultural historic natural and economic development. The Opportunity Zone Program promotes long-term investments to support existing businesses grow new businesses and finance much needed real estate projects in these communities. The study Wind at Your Back. A recent ruling stated that a funds failure to meet the 90 asset test would not disqualify it from being classified as an opportunity fund but may result in a penalty. A qualified opportunity fund is a private fund structured as a corporation or partnership that invests at least 90 of its capital into an opportunity zone.

Source: ncsha.org

Source: ncsha.org

The objective of the program is to promote economic development in low-income areas by offering investors substantial federal tax advantages. The objective of the program is to promote economic development in low-income areas by offering investors substantial federal tax advantages. Qualified Opportunity Funds or QOFs are the designated investment vehicle used to invest in Opportunity Zones. The IRS defines an Opportunity Zone as an economically-distressed community where new investments under certain conditions may be eligible for preferential tax treatment. The Opportunity Zone investment tool allows private investors to receive tax benefits by reinvesting capital gains into a Qualified Opportunity Fund QOF that in turn makes qualified investments in real estate or businesses located in distressed communities nationwide.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title real estate opportunity zone funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 50+ Indigo paints market cap Popular

- 46++ International financial markets and instruments Coin

- 26++ The econometrics of financial markets List

- 50+ Best crypto exchange app ios Stock

- 40+ Bid ask List

- 46++ Spx market cap List

- 16++ Sell on etoro app Trading

- 20+ Coinmarketcap chiliz List

- 16++ Fractal market hypothesis Mining

- 15++ Financial derivatives market Trend