16++ Fractal market hypothesis Mining

Home » Exchange » 16++ Fractal market hypothesis MiningYour Fractal market hypothesis news are ready in this website. Fractal market hypothesis are a mining that is most popular and liked by everyone this time. You can Download the Fractal market hypothesis files here. Get all royalty-free coin.

If you’re looking for fractal market hypothesis pictures information connected with to the fractal market hypothesis interest, you have visit the right blog. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Fractal Market Hypothesis. His best known contribution is the Fractal Market Hypothesis FMH which was outlined in Peters 1994. Fractal Market Hypothesis FMH henceforth proposed by Peters 1994 incorporates these aforementioned issues into account and gives an alternative. The Fractal Market Hypothesis sets the conceptual framework for fractal market analysis. The world and markets look very different than they did at the start of 2020.

What The Father Of Fractals Can Teach Us About Finance By Jordan Shimabuku Medium From medium.com

What The Father Of Fractals Can Teach Us About Finance By Jordan Shimabuku Medium From medium.com

In this study an attempt is made to test the Fractal Markets Hypothesis FMH which states that a financial market can plunge into crisis when a particular trading time. The Efficient Market Hypothesis EMH has been repeatedly demonstrated to be an inferior or at best incomplete model of financial market behavior. As a Fractal Market Hypothesis it combines elements of fractals from Chapter 1 with parts of traditional CMT in Chapter 2. Download Full PDF Package. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset. Recent research has supported the FMH as well describing the Global Financial Crisis of 2008 as well as Tech Bubble of 2000.

Heart of the book.

What is the Fractal Markets Hypothesis. The world and markets look very different than they did at the start of 2020. The fractal markets hypothesis is an evolving model of investor and market behaviour which identifies repeating patterns in market prices and conditions. Fractal Market Hypothesis FMH henceforth proposed by Peters 1994 incorporates these aforementioned issues into account and gives an alternative. Einsteins Evolution Equation the Fractal Market Hypothesis Trend Analysis and Future Price Prediction PDF Econophysics and Fractional Calculus. In my 1994 book I outlined the Fractal Market Hypothesis FMH which addresses periods of instability like the one were going through.

Source: medium.com

Source: medium.com

Fractal Markets Hypothesis FMH is an investment theory that serves as an alternative to the popular Efficient Market Hypothesis EMH. The efficient market hypothesis fails to account for the many anomalies and recurring exploitable patterns within financial assets. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset. Fractal Market Hypothesis FMH henceforth proposed by Peters 1994 incorporates these aforementioned issues into account and gives an alternative. In an uncompromising book Benoit Mandelbrot French graduate from Ecole Polytechnique denounces the inconsistency of the orthodox theory of finance and presents his fractal vision of the markets.

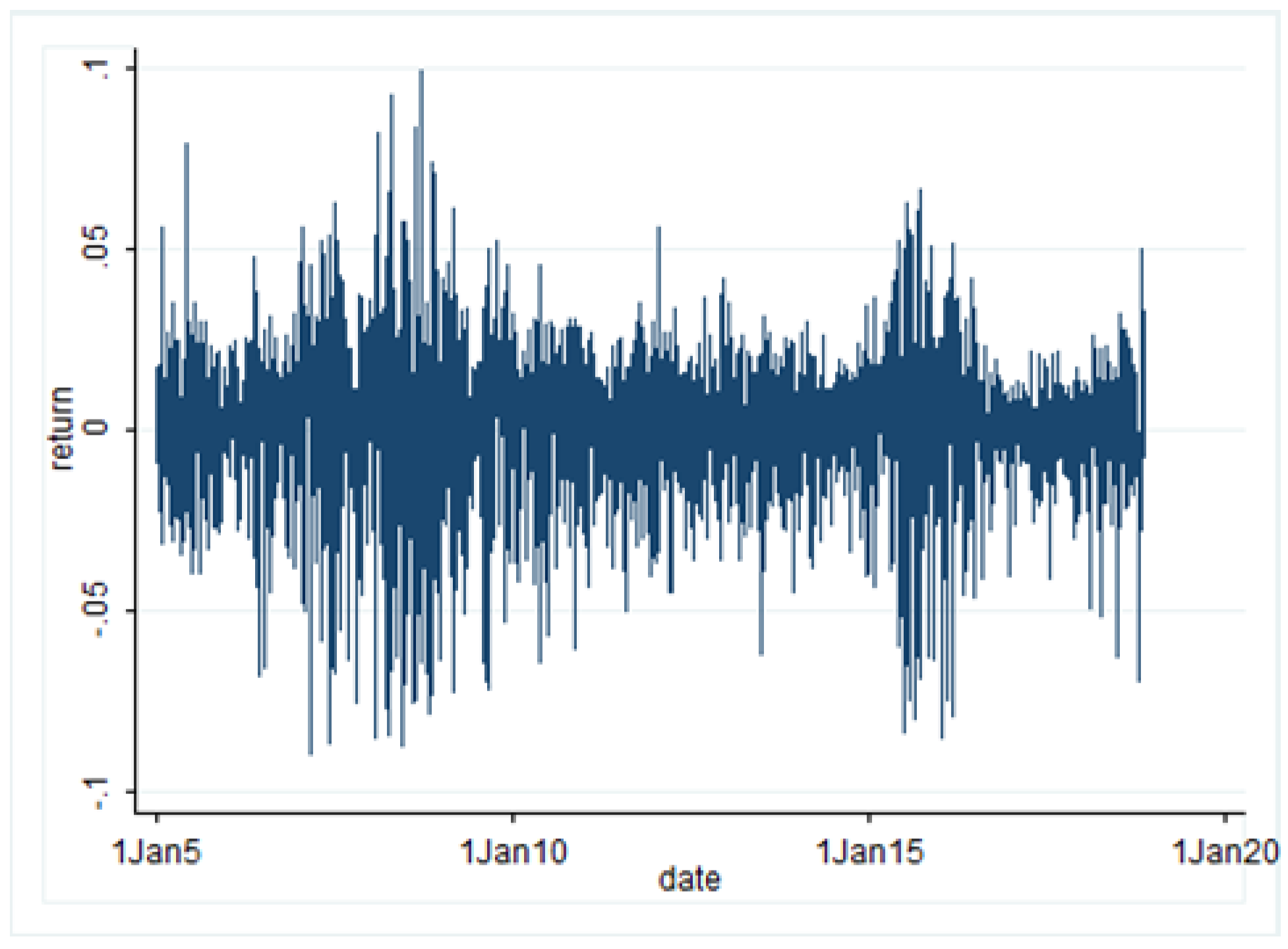

Source: mdpi.com

Source: mdpi.com

In this study an attempt is made to test the Fractal Markets Hypothesis FMH which states that a financial market can plunge into crisis when a particular trading time. If Independence is a virtue Benoît Mandelbrot is certainly one of the most tangible. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset. The Efficient Market Hypothesis EMH has been repeatedly demonstrated to be an inferior or at best incomplete model of financial market behavior. The fractal market hypothesis.

Source: medium.com

Source: medium.com

Fractal Markets Hypothesis FMH is an investment theory that serves as an alternative to the popular Efficient Market Hypothesis EMH. Applications to financial forecasting. In this study an attempt is made to test the Fractal Markets Hypothesis FMH which states that a financial market can plunge into crisis when a particular trading time. It examines investor horizons the role of liquidity and the impact of information through a full business cycle. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset.

Source: researchgate.net

Source: researchgate.net

If Independence is a virtue Benoît Mandelbrot is certainly one of the most tangible. The fractal market hypothesis. 35 Full PDFs related to this paper. In an uncompromising book Benoit Mandelbrot French graduate from Ecole Polytechnique denounces the inconsistency of the orthodox theory of finance and presents his fractal vision of the markets. The fractal market hypothesis.

As a Fractal Market Hypothesis it combines elements of fractals from Chapter 1 with parts of traditional CMT in Chapter 2. The efficient market hypothesis fails to account for the many anomalies and recurring exploitable patterns within financial assets. If Independence is a virtue Benoît Mandelbrot is certainly one of the most tangible. FRACTAL MARKET HYPOTHESIS. We investigate whether the fractal markets hypothesis and its focus on liquidity and investment horizons give reasonable predictions about the dynamics of the financial markets during turbulences such as the Global Financial Crisis of late 2000s.

Source: medium.com

Source: medium.com

The fractal markets hypothesis FMH on contrary is based on empirically observed characteristics of the financial markets and thus considers the. In an uncompromising book Benoit Mandelbrot French graduate from Ecole Polytechnique denounces the inconsistency of the orthodox theory of finance and presents his fractal vision of the markets. The Efficient Market Hypothesis EMH has been repeatedly demonstrated to be an inferior or at best incomplete model of financial market behavior. The Fractal Market Hypothesis sets the conceptual framework for fractal market analysis. Einsteins Evolution Equation the Fractal Market Hypothesis Trend Analysis and Future Price Prediction PDF Econophysics and Fractional Calculus.

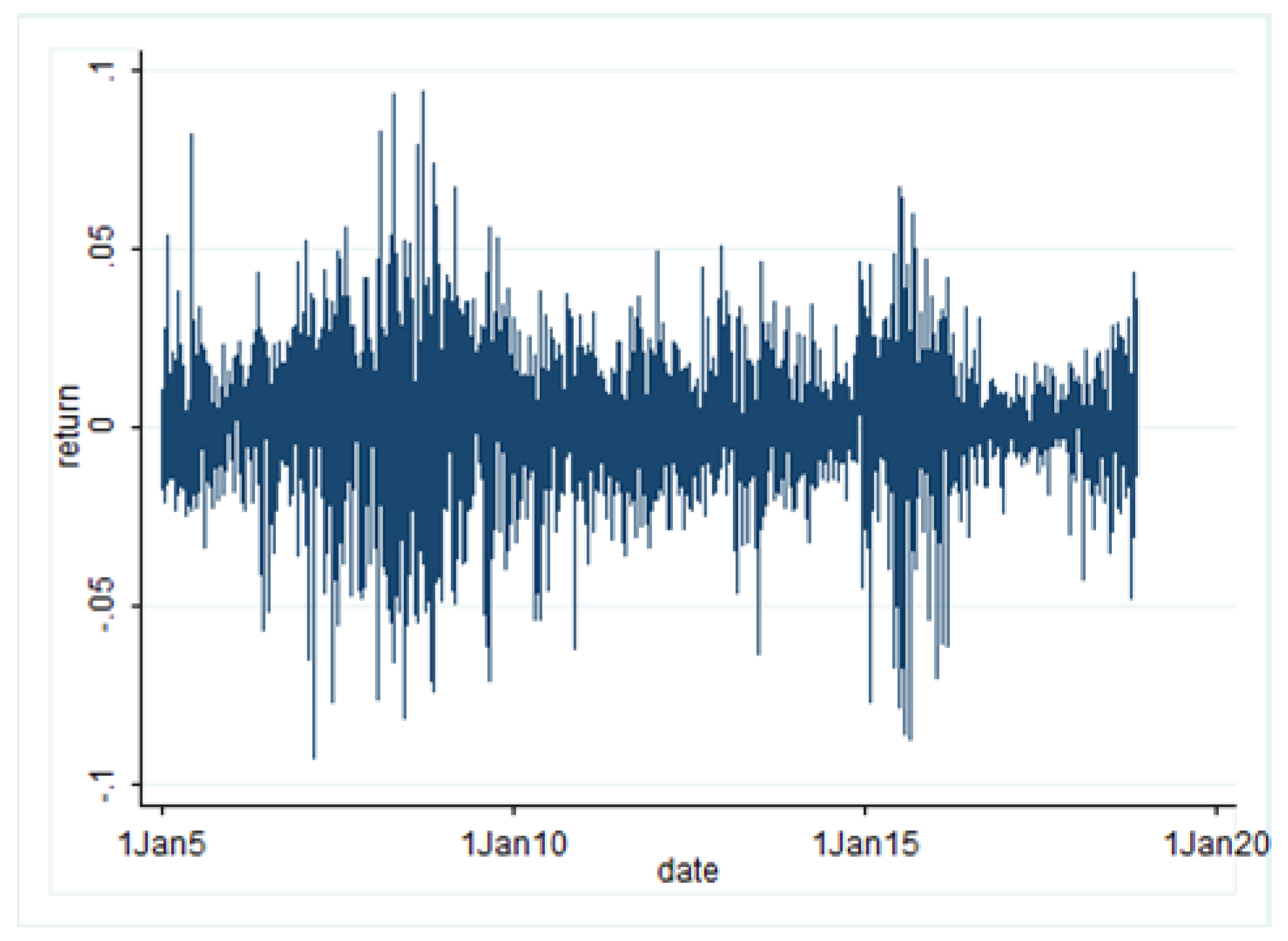

Source: mdpi.com

Source: mdpi.com

The world and markets look very different than they did at the start of 2020. Fractal Market Hypothesis FMH henceforth proposed by Peters 1994 incorporates these aforementioned issues into account and gives an alternative. In this study an attempt is made to test the Fractal Markets Hypothesis FMH which states that a financial market can plunge into crisis when a particular trading time. Fractal Markets Hypothesis FMH is an investment theory that serves as an alternative to the popular Efficient Market Hypothesis EMH. The fractal markets hypothesis is an evolving model of investor and market behaviour which identifies repeating patterns in market prices and conditions.

Fractal Market Hypothesis FMH henceforth proposed by Peters incorporates these aforementioned issues into account and gives an alternative to stable markets as opposed to efficient markets. FPH differs from EMH in the sense that it predicts and explains market behavior by factoring fractals chaos crises and crashes in the market. In terms of the Efficient Market Hypothesis. The fractal markets hypothesis is an evolving model of investor and market behaviour which identifies repeating patterns in market prices and conditions. The fractal market hypothesis states that 1 a market consists of many investors with different investment horizons and 2 the information set that is important to each investment horizon is.

Source: medium.com

Source: medium.com

Applications to financial forecasting. As a Fractal Market Hypothesis it combines elements of fractals from Chapter 1 with parts of traditional CMT in Chapter 2. His best known contribution is the Fractal Market Hypothesis FMH which was outlined in Peters 1994. The Efficient Market Hypothesis EMH has been repeatedly demonstrated to be an inferior or at best incomplete model of financial market behavior. Fractal Market Hypothesis FMH henceforth proposed by Peters 1994 incorporates these aforementioned issues into account and gives an alternative.

Source: learn.tradimo.com

Source: learn.tradimo.com

The fractal markets hypothesis FMH on contrary is based on empirically observed characteristics of the financial markets and thus considers the. Einsteins Evolution Equation the Fractal Market Hypothesis Trend Analysis and Future Price Prediction Raja Rani. The world and markets look very different than they did at the start of 2020. Einsteins Evolution Equation the Fractal Market Hypothesis Trend Analysis and Future Price Prediction PDF Econophysics and Fractional Calculus. A fractal view of the markets Benoit Mandelbrot.

Source: medium.com

Source: medium.com

Einsteins Evolution Equation the Fractal Market Hypothesis Trend Analysis and Future Price Prediction Raja Rani. A fractal view of the markets Benoit Mandelbrot. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset. FPH differs from EMH in the sense that it predicts and explains market behavior by factoring fractals chaos crises and crashes in the market. The fractal market hypothesis.

Source: medium.com

Source: medium.com

The Fractal Market Hypothesis sets the conceptual framework for fractal market analysis. The fractal markets hypothesis FMH on contrary is based on empirically observed characteristics of the financial markets and thus considers the. What is the Fractal Markets Hypothesis. Einsteins Evolution Equation the Fractal Market Hypothesis Trend Analysis and Future Price Prediction PDF Econophysics and Fractional Calculus. A fractal view of the markets Benoit Mandelbrot.

Source: medium.com

Source: medium.com

The fractal market hypothesis states that 1 a market consists of many investors with different investment horizons and 2 the information set that is important to each investment horizon is. The Fractal Market Hypothesis sets the conceptual framework for fractal market analysis. Recent research has supported the FMH as well describing the Global Financial Crisis of 2008 as well as Tech Bubble of 2000. It examines investor horizons the role of liquidity and the impact of information through a full business cycle. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset.

Source: sciencedirect.com

Source: sciencedirect.com

What is the Fractal Markets Hypothesis. I detail the Fractal Market Hypothesis as an alternative to the traditional theory discussed in Chapter 2. The world and markets look very different than they did at the start of 2020. Applications to financial forecasting. Fractal Market Hypothesis FMH henceforth proposed by Peters 1994 incorporates these aforementioned issues into account and gives an alternative.

Source: learn.tradimo.com

Source: learn.tradimo.com

The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset. His best known contribution is the Fractal Market Hypothesis FMH which was outlined in Peters 1994. We investigate whether the fractal markets hypothesis and its focus on liquidity and investment horizons give reasonable predictions about the dynamics of the financial markets during turbulences such as the Global Financial Crisis of late 2000s. By revisiting the principal conventional approaches to market analysis and the reasoning associated with them we develop a Fractal Market Hypothesis that is based on the application of non-stationary fractional dynamics using an operator of the type. Fractal Market Hypothesis FMH henceforth proposed by Peters incorporates these aforementioned issues into account and gives an alternative to stable markets as opposed to efficient markets.

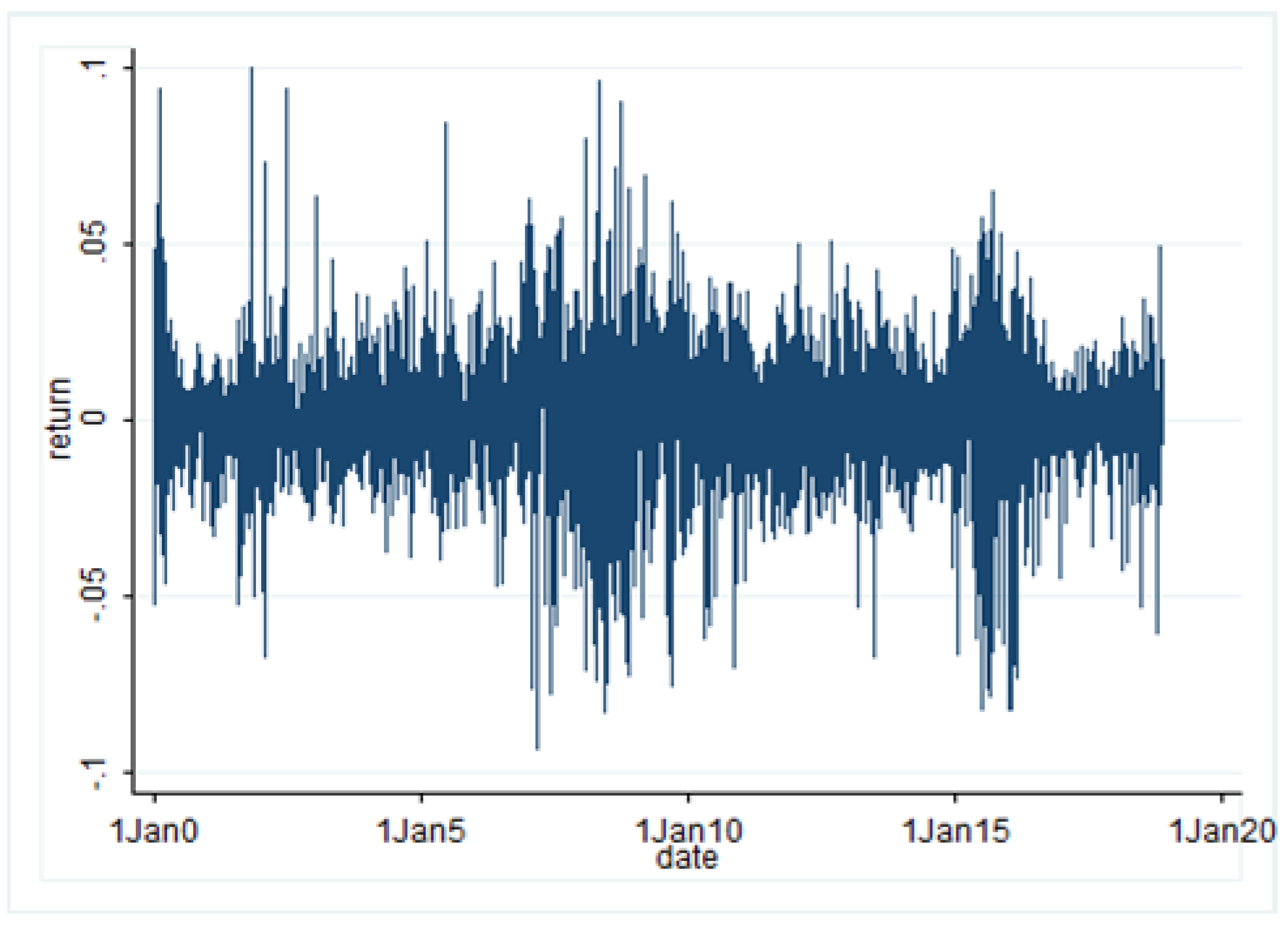

Source: mdpi.com

Source: mdpi.com

We investigate whether the fractal markets hypothesis and its focus on liquidity and investment horizons give reasonable predictions about the dynamics of the financial markets during turbulences such as the Global Financial Crisis of late 2000s. By revisiting the principal conventional approaches to market analysis and the reasoning associated with them we develop a Fractal Market Hypothesis that is based on the application of non-stationary fractional dynamics using an operator of the type. A fractal view of the markets Benoit Mandelbrot. Applications to financial forecasting. Fractal Markets Hypothesis FMH is an investment theory that serves as an alternative to the popular Efficient Market Hypothesis EMH.

Source: researchgate.net

Source: researchgate.net

Fractal Markets Hypothesis FMH is an investment theory that serves as an alternative to the popular Efficient Market Hypothesis EMH. Einsteins Evolution Equation the Fractal Market Hypothesis Trend Analysis and Future Price Prediction PDF Econophysics and Fractional Calculus. The fractal markets hypothesis is an evolving model of investor and market behaviour which identifies repeating patterns in market prices and conditions. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset. The Fractal Market Hypothesis FMH has.

Source: medium.com

Source: medium.com

What is the Fractal Markets Hypothesis. A short summary of this paper. Download Full PDF Package. The fractal markets hypothesis FMH on contrary is based on empirically observed characteristics of the financial markets and thus considers the. The major tenet of the FMH is the notion of liquidity the ease with which an investor is able to buysell an asset without causing discernible effect on the price of the asset.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fractal market hypothesis by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 50+ Indigo paints market cap Popular

- 46++ International financial markets and instruments Coin

- 26++ The econometrics of financial markets List

- 50+ Best crypto exchange app ios Stock

- 40+ Bid ask List

- 46++ Spx market cap List

- 16++ Sell on etoro app Trading

- 20+ Coinmarketcap chiliz List

- 15++ Financial derivatives market Trend

- 13++ Forex smart money strategy Trending