34++ Opportunistic real estate funds Stock

Home » Exchange » 34++ Opportunistic real estate funds StockYour Opportunistic real estate funds mining are obtainable. Opportunistic real estate funds are a news that is most popular and liked by everyone this time. You can Find and Download the Opportunistic real estate funds files here. Download all royalty-free news.

If you’re looking for opportunistic real estate funds pictures information related to the opportunistic real estate funds keyword, you have come to the right site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Opportunistic Real Estate Funds. Ad List of 242 real estate hedge funds Download now in Excel format. Ad List of 242 real estate hedge funds Download now in Excel format. KKR has reached the final closing of its Real Estate Partners Americas III a 43 billion fund focused on opportunistic real estate investments predominantly in the US the global investment firm announced Monday. Opportunistic real estate private equity funds also known as value-added funds and opportunity funds are increasingly popular.

Blackstone Said To Seek 18b For Biggest Real Estate Fund From dealstreetasia.com

Blackstone Said To Seek 18b For Biggest Real Estate Fund From dealstreetasia.com

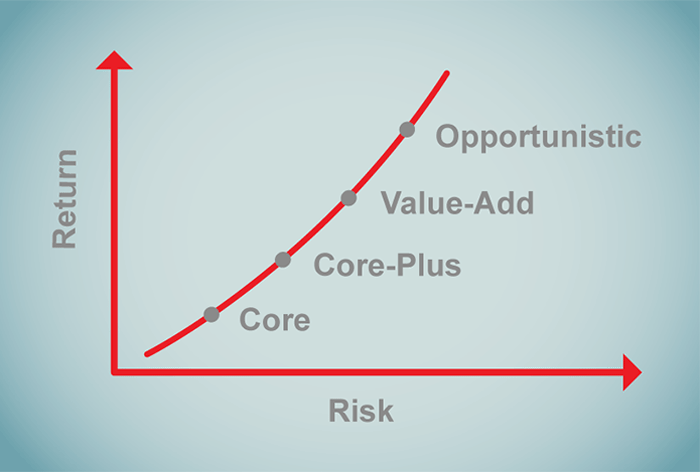

In terms of total limited partners fund commitment the CA Real Estate benchmark is 71 Opportunistic and 29 Value-Added. In conjunction with. Opportunistic real estate investments follow the value add approach but take it a step further on the risk spectrum. The Funds subadvisor American Assets Capital Advisors AACA is a specialist focused on. Their investment structures tend to be modelled after private equity investment vehicles. OVER THE LASTdecade the real estate private equity funds sector has flour-ished.

The AltegrisAACA Opportunistic Real Estate Fund RAAAX RAAIX RAANX offers investors a way to capitalize on real estate opportunities across a wide swath of REIT segments.

View analyze the 0P0000ZR6W fund chart by total assets risk rating Min. 1580- Cohen Steers Realty Shares. Their investment structures tend to be modelled after private equity investment vehicles. Successor Fund Doubles Down on KKR Real Estate 10 Years after Business Launch. While operating amid widely disparate economic environments over the past 30 years our funds have shared a focus on acquiring assets with strong potential fundamentals at a significant discount to replacement cost. Investment market cap and category.

Source: pinterest.com

Source: pinterest.com

KKR has announced the final closing of KKR Real Estate Partners Americas III a 43 billion fund dedicated to opportunistic real estate investments primarily in the US. While operating amid widely disparate economic environments over the past 30 years our funds have shared a focus on acquiring assets with strong potential fundamentals at a significant discount to replacement cost. Their investment structures tend to be modelled after private equity investment vehicles. Opportunistic is the riskiest of all real estate investment strategies. View analyze the 0P0000ZR6W fund chart by total assets risk rating Min.

Source: stone-estate.swiss

Source: stone-estate.swiss

While operating amid widely disparate economic environments over the past 30 years our funds have shared a focus on acquiring assets with strong potential fundamentals at a significant discount to replacement cost. Opportunistic real estate fund. The first of these opportunistic real estate private equity funds were raised in. Opportunistic real estate investments follow the value add approach but take it a step further on the risk spectrum. In terms of total limited partners fund commitment the CA Real Estate benchmark is 71 Opportunistic and 29 Value-Added.

Source: nl.pinterest.com

Source: nl.pinterest.com

SCREP VI is the firms eighth opportunistic real estate fund. Opportunistic properties span all asset classes including apartment buildings and office buildings. Opportunistic real estate fund at more than 25 billion for its latest US. These are funds that typically target real estate investment in the higher risk categories. The fund closed in September 2017.

Source: crowdstreet.com

Source: crowdstreet.com

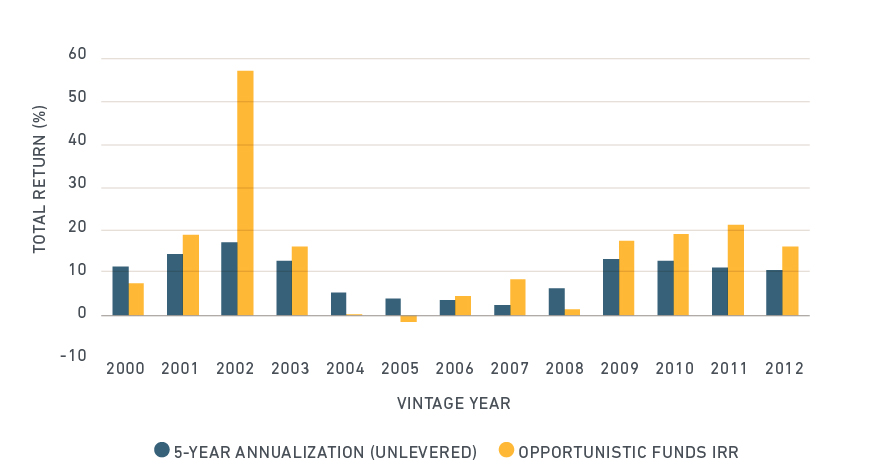

Potentially opportunistic real estate deals often even higher returns than those of equities though the risk may be higher as well. In addition in the United Kingdom this website and the information on it is intended only for and is directed only at persons who both i are capable of being treated by Principal Real Estate as professional clients or eligible counterparties as each term is defined in the rules of the FCA and ii fall within an exemption from Section 21 or in relation to communications by Principal Real Estate. Opportunistic is the riskiest of all real estate investment strategies. In conjunction with dedicated funds raised in Asia and Europe over the past 12 months KKRs global opportunistic real estate. Investment market cap and category.

Source: pinterest.com

Source: pinterest.com

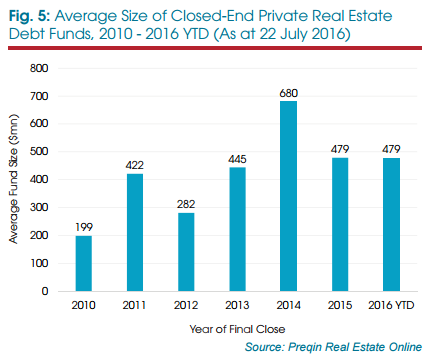

Investment market cap and category. This was the firms largest closed end fund ever according. Opportunistic real estate with 33 of opportunistic funds in market being raised by fi rst-time managers although these funds account for only 13 of capital sought due to emerging managers often setting lower fundraising targets. Our funds generally take an opportunistic approach to global real estate investing. KKR has announced the final closing of KKR Real Estate Partners Americas III a 43 billion fund dedicated to opportunistic real estate investments primarily in the US.

Source: msci.com

Source: msci.com

KKR has announced the final closing of KKR Real Estate Partners Americas III a 43 billion fund dedicated to opportunistic real estate investments primarily in the US. KKR has reached the final closing of its Real Estate Partners Americas III a 43 billion fund focused on opportunistic real estate investments predominantly in the US the global investment firm announced Monday. Opportunistic real estate fund at more than 25 billion for its latest US. Investment market cap and category. Opportunistic properties tend to need significant rehabilitation in order to realize their potential.

Source: medium.com

Source: medium.com

Ad List of 242 real estate hedge funds Download now in Excel format. Potentially opportunistic real estate deals often even higher returns than those of equities though the risk may be higher as well. It is also synonymous with growth in the stock market like value-add but it is even riskier. Opportunistic properties span all asset classes including apartment buildings and office buildings. DFA Real Estate Securities I.

Source: medium.com

Source: medium.com

KKR Closes 43 Billion Americas Opportunistic Real Estate Fund. Our funds generally take an opportunistic approach to global real estate investing. Their investment structures tend to be modelled after private equity investment vehicles. It is also synonymous with growth in the stock market like value-add but it is even riskier. In addition in the United Kingdom this website and the information on it is intended only for and is directed only at persons who both i are capable of being treated by Principal Real Estate as professional clients or eligible counterparties as each term is defined in the rules of the FCA and ii fall within an exemption from Section 21 or in relation to communications by Principal Real Estate.

Source: irei.com

Source: irei.com

Potentially opportunistic real estate deals often even higher returns than those of equities though the risk may be higher as well. Investors expect to be compensated for this risk and thats why opportunistic investments should have the highest expected returns. It is also synonymous with growth in the stock market like value-add but it is even riskier. Opportunistic is the riskiest of all real estate investment strategies. OVER THE LASTdecade the real estate private equity funds sector has flour-ished.

Source: review.chicagobooth.edu

Source: review.chicagobooth.edu

In addition in the United Kingdom this website and the information on it is intended only for and is directed only at persons who both i are capable of being treated by Principal Real Estate as professional clients or eligible counterparties as each term is defined in the rules of the FCA and ii fall within an exemption from Section 21 or in relation to communications by Principal Real Estate. Opportunistic investors take on the most complicated projects and may not see a return on their investment for three or more years. Opportunistic real estate investments follow the value add approach but take it a step further on the risk spectrum. In terms of limited partners total paid- in capital the CA Real Estate benchmark is 70 Opportunistic and 30 Value-Added. Opportunistic real estate fund at more than 25 billion for its latest US.

Source: medium.com

Source: medium.com

Opportunistic real estate with 33 of opportunistic funds in market being raised by fi rst-time managers although these funds account for only 13 of capital sought due to emerging managers often setting lower fundraising targets. DFA Real Estate Securities I. Investment market cap and category. Real estate value-added and oppor-tunity funds are perhaps the most promi-nent vehicles in this sector. SCREP VI is the firms eighth opportunistic real estate fund.

Source: medium.com

Source: medium.com

View analyze the 0P0000ZR6W fund chart by total assets risk rating Min. KKR has reached the final closing of its Real Estate Partners Americas III a 43 billion fund focused on opportunistic real estate investments predominantly in the US the global investment firm announced Monday. Harrison Street reported this week that 2021 was among most active periods in the investment management firms 16-year history including the final close of the firms eighth US. View analyze the 0P0000ZR6W fund chart by total assets risk rating Min. Our funds generally take an opportunistic approach to global real estate investing.

Source: researchgate.net

Source: researchgate.net

This paper discusses the results of an Ernst Young survey of 48 funds representing 723 billion of equity raised in 145 separate funds between 1988 and 2001. In terms of limited partners total paid- in capital the CA Real Estate benchmark is 70 Opportunistic and 30 Value-Added. KKR has announced the final closing of KKR Real Estate Partners Americas III a 43 billion fund dedicated to opportunistic real estate investments primarily in the US. Opportunistic investments are the real estate equivalent to venture capital where youre investing heavily in the earliest stages of development. KKR Closes 43 Billion Americas Opportunistic Real Estate Fund.

Source: bloomberg.com

Source: bloomberg.com

The Funds subadvisor American Assets Capital Advisors AACA is a specialist focused on. The first of these opportunistic real estate private equity funds were raised in. In terms of total limited partners fund commitment the CA Real Estate benchmark is 71 Opportunistic and 29 Value-Added. The fund closed in September 2017. In conjunction with.

Source: semanticscholar.org

Source: semanticscholar.org

Opportunistic real estate private equity funds also known as value-added funds and opportunity funds are increasingly popular. This paper discusses the results of an Ernst Young survey of 48 funds representing 723 billion of equity raised in 145 separate funds between 1988 and 2001. KKR Closes 43 Billion Americas Opportunistic Real Estate Fund. Why Invest in Opportunistic Real Estate. This was the firms largest closed end fund ever according.

Source: realassets.ipe.com

Source: realassets.ipe.com

In terms of total limited partners fund commitment the CA Real Estate benchmark is 71 Opportunistic and 29 Value-Added. Investors expect to be compensated for this risk and thats why opportunistic investments should have the highest expected returns. Vanguard Real Estate II Index Fund. Successor Fund Doubles Down on KKR Real Estate 10 Years after Business Launch. Investment market cap and category.

Source: hudsonpoint.com

Source: hudsonpoint.com

Investors expect to be compensated for this risk and thats why opportunistic investments should have the highest expected returns. Opportunistic investors take on the most complicated projects and may not see a return on their investment for three or more years. Find our live Altegrisaaca Opportunistic Real Estate Fund N fund basic information. The first of these opportunistic real estate private equity funds were raised in. Investors expect to be compensated for this risk and thats why opportunistic investments should have the highest expected returns.

Source: irei.com

Source: irei.com

Harrison Street reported this week that 2021 was among most active periods in the investment management firms 16-year history including the final close of the firms eighth US. Opportunistic is the riskiest of all real estate investment strategies. KKR has reached the final closing of its Real Estate Partners Americas III a 43 billion fund focused on opportunistic real estate investments predominantly in the US the global investment firm announced Monday. In conjunction with. The fund is focused on opportunistic property-related investments and distressed debt in Japan 65 and other opportunities across China Korea and other selected markets.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title opportunistic real estate funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 50+ Indigo paints market cap Popular

- 46++ International financial markets and instruments Coin

- 26++ The econometrics of financial markets List

- 50+ Best crypto exchange app ios Stock

- 40+ Bid ask List

- 46++ Spx market cap List

- 16++ Sell on etoro app Trading

- 20+ Coinmarketcap chiliz List

- 16++ Fractal market hypothesis Mining

- 15++ Financial derivatives market Trend