21+ Nikkei stock average volatility index Top

Home » Exchange » 21+ Nikkei stock average volatility index TopYour Nikkei stock average volatility index mining are ready. Nikkei stock average volatility index are a trading that is most popular and liked by everyone this time. You can Find and Download the Nikkei stock average volatility index files here. Find and Download all free bitcoin.

If you’re searching for nikkei stock average volatility index images information connected with to the nikkei stock average volatility index topic, you have come to the right blog. Our website always gives you hints for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

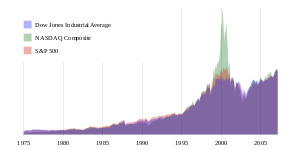

Nikkei Stock Average Volatility Index. Stock Price Index - Real Time Values. The greater the index values are the. NIKKEI 225s volatility is measured either by using standard deviation or beta. Nikkei 225 Futures Large Contracts.

U S Cpis Take Center Stage Australia Jobs And U K Gdp Early Tomorrow Investing Com From investing.com

U S Cpis Take Center Stage Australia Jobs And U K Gdp Early Tomorrow Investing Com From investing.com

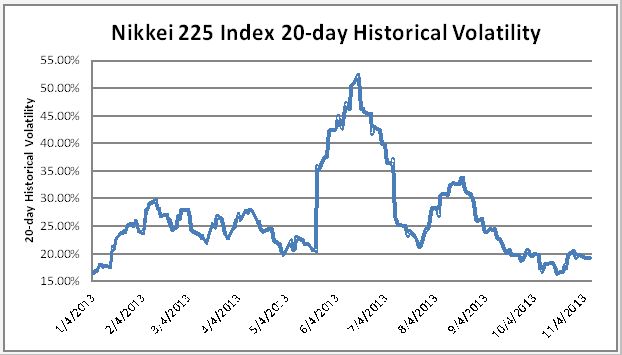

Volatility Prediction for Tuesday October 26th 2021. Dow Jones Utility Average Index. NIKKEI 225s volatility is measured either by using standard deviation or beta. For the details regarding the calculation formula for the VI please refer to the Index Guidebook for the Nikkei Stock Average Volatility Index. Nikkei Stock Average Volatility Index GJR-GARCH Volatility Analysis Whats on this page. The Nikkei 225 Index stalled with a 55-day simple moving average SMA and a 200-day SMA.

Dow Jones Utility Average Index.

Volatility Prediction for Tuesday October 26th 2021. Nikkei 225 up 009. Dow Jones Utility Average Index. Regulatory Measures etc Concerning Margin Trading. To avoid the bias on the realized volatility from the non-trading hours issue we calculate realized volatility separately in the two trading sessions ie. Underlying index The Nikkei Stock Average Volatility Index signals the expected volatility of the Nikkei 225 in one month period.

Source: id.pinterest.com

Source: id.pinterest.com

Total Stock Market Index. Each data point represents the closing value for that trading day and is denominated in japanese yen JPY. The Nikkei Stock Average Volatility Index signals the expected volatility of the Nikkei 225 in one month period. Interactive daily chart of Japans Nikkei 225 stock market index back to 1949. The 21-day SMA-based boring band is extremely wide demonstrating the volatility the market saw last month.

Source: wikiwand.com

Source: wikiwand.com

NIKKEI 225s volatility is measured either by using standard deviation or beta. The 21-day SMA-based boring band is extremely wide demonstrating the volatility the market saw last month. Nikkei 225 Touches 30000 as Reshuffle Extends Japan Stock Gains. NASDAQ 100 Index NASDAQ Calculation 1638098-19236. Nikkei Stock Average Volatility Index GJR-GARCH Volatility Analysis Whats on this page.

Source: researchgate.net

Source: researchgate.net

Total Stock Market Index. TOKYO – Nikkei Inc. 8 nearest serial contract months. For the details regarding the calculation formula for the VI please refer to the Index Guidebook for the Nikkei Stock Average Volatility Index. To avoid the bias on the realized volatility from the non-trading hours issue we calculate realized volatility separately in the two trading sessions ie.

Source: no.pinterest.com

Source: no.pinterest.com

Underlying index The Nikkei Stock Average Volatility Index signals the expected volatility of the Nikkei 225 in one month period. Total Stock Market Index. We calculate realized volatility of the Nikkei Stock Average Nikkei225 Index on the Tokyo Stock Exchange and investigate the return dynamics. Morning and afternoon of the Tokyo Stock Exchange and find that the microstructure noise. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future.

Source: globalbankingandfinance.com

Source: globalbankingandfinance.com

Daily Publication etc Concerning Margin Trading. 8 nearest serial contract months. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. Calculation method The Nikkei Stock Average Volatility Index are calculated by using prices of Nikkei 225 futures and Nikkei 225 options on the Osaka Exchange OSE. Nikkei Stock Average Volatility Index Nikkei 225 VI Opening Date.

Source: pinterest.com

Source: pinterest.com

TOKYO – Nikkei Inc. Last week prices fell below the lower limit of the 21-day Bollinger Bands. Morning and afternoon of the Tokyo Stock Exchange and find that the microstructure noise. Stock Price Index - Real Time Values. Nikkei Stock Average Volatility Index GJR-GARCH Volatility Analysis Whats on this page.

Source: mdpi.com

Source: mdpi.com

The greater the index values are the larger fluctuation investors expect in the market. To avoid the bias on the realized volatility from the non-trading hours issue we calculate realized volatility separately in the two trading sessions ie. Nikkei Stock Average Volatility Index Spline-GARCH Volatility Analysis Whats on this page. Nikkei Stock Average Volatility Index is calculated by using the traded price on Nikkei 225 option market and the indicator represents the volatility in the one month period expected by the investors. The current price of the Nikkei 225 Index as of November 19 2021 is 2974587.

Source: pinterest.com

Source: pinterest.com

The Nikkei Stock Average Volatility Index signals the expected volatility of the Nikkei 225 in one month period. Calculation method The Nikkei Stock Average Volatility Index are calculated by using prices of Nikkei 225 futures and Nikkei 225 options on the Osaka Exchange OSE. Bloomberg – The Nikkei 225 Stock Average touched a level above 30000 for the first time since April as a reshuffle of the blue. Nikkei 225 Futures Large Contracts.

Source: pinterest.com

Source: pinterest.com

NIKKEI 225s volatility is measured either by using standard deviation or beta. Standard deviation will reflect the average amount of how NIKKEI 225 stocks price will differ from the mean after some timeTo get its calculation you should first determine the mean price during the specified period then subtract that from each price point. TOKYO – Nikkei Inc. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. For the details regarding the calculation formula for the VI please refer to the Index Guidebook for the Nikkei Stock Average Volatility Index.

Source: pinterest.com

Source: pinterest.com

The greater the index values are the. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. Morning and afternoon of the Tokyo Stock Exchange and find that the microstructure noise. The current price of the Nikkei 225 Index as of November 19 2021 is 2974587. Nikkei 225 Touches 30000 as Reshuffle Extends Japan Stock Gains.

Source: researchgate.net

Source: researchgate.net

Interactive daily chart of Japans Nikkei 225 stock market index back to 1949. The 21-day SMA-based boring band is extremely wide demonstrating the volatility the market saw last month. The Nikkei Stock Average Volatility Index is calculated in accordance with the following procedure. Dow Jones Utility Average Index. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future.

Source: pinterest.com

Source: pinterest.com

NIKKEI 225s volatility is measured either by using standard deviation or beta. Stock Price Index - Real Time Values. The greater the index values are the larger fluctuation investors expect in the market. For the details regarding the calculation formula for the VI please refer to the Index Guidebook for the Nikkei Stock Average Volatility Index. NASDAQ 100 Index NASDAQ Calculation 1638098-19236.

Source: researchgate.net

Source: researchgate.net

Last week prices fell below the lower limit of the 21-day Bollinger Bands. Nikkei 225 up 009. We calculate realized volatility of the Nikkei Stock Average Nikkei225 Index on the Tokyo Stock Exchange and investigate the return dynamics. Bloomberg – The Nikkei 225 Stock Average touched a level above 30000 for the first time since April as a reshuffle of the blue. Dow Jones Utility Average Index.

Source: pinterest.com

Source: pinterest.com

Calculation method The Nikkei Stock Average Volatility Index are calculated by using prices of Nikkei 225 futures and Nikkei 225 options on the Osaka Exchange OSE. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. We calculate realized volatility of the Nikkei Stock Average Nikkei225 Index on the Tokyo Stock Exchange and investigate the return dynamics. Volatility analysis of Nikkei Stock Average Volatility Index using a AGARCH model. Nikkei 225 up 009.

Source: in.pinterest.com

Source: in.pinterest.com

Note Orders are only accepted and not matched for 5 minutes before the Itayose on close. Regulatory Measures etc Concerning Margin Trading. For the details regarding the calculation formula for the VI please refer to the Index Guidebook for the Nikkei Stock Average Volatility Index. Nikkei 225 VI Futures are futures contracts based on the Nikkei Stock Average Volatility Index Nikkei 225 VI which is an index calculated by Nikkei Inc estimating the degree of expected fluctuation in the Nikkei Stock Average. Total Stock Market Index.

Source: cmegroup.com

Source: cmegroup.com

Underlying index The Nikkei Stock Average Volatility Index signals the expected volatility of the Nikkei 225 in one month period. TOKYO – Nikkei Inc. Nikkei Stock Average Volatility Index Nikkei 225 VI Opening Date. Nikkei Volatility News. Bloomberg – The Nikkei 225 Stock Average touched a level above 30000 for the first time since April as a reshuffle of the blue.

Source: researchgate.net

Source: researchgate.net

Nikkei Stock Average Volatility Index is calculated by using the traded price on Nikkei 225 option market and the indicator represents the volatility in the one month period expected by the investors. Announced on Wednesday that it will change the benchmark interest rate used to calculate the Nikkei Stock Average Volatility Index. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. Volatility analysis of Nikkei Stock Average Volatility Index using a AGARCH model. Bloomberg – The Nikkei 225 Stock Average touched a level above 30000 for the first time since April as a reshuffle of the blue.

Source: investing.com

Source: investing.com

We calculate realized volatility of the Nikkei Stock Average Nikkei225 Index on the Tokyo Stock Exchange and investigate the return dynamics. Volatility Prediction for Tuesday October 26th 2021. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. For the details regarding the calculation formula for the VI please refer to the Index Guidebook for the Nikkei Stock Average Volatility Index. Japan stocks higher at close of trade.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nikkei stock average volatility index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 50+ Indigo paints market cap Popular

- 46++ International financial markets and instruments Coin

- 26++ The econometrics of financial markets List

- 50+ Best crypto exchange app ios Stock

- 40+ Bid ask List

- 46++ Spx market cap List

- 16++ Sell on etoro app Trading

- 20+ Coinmarketcap chiliz List

- 16++ Fractal market hypothesis Mining

- 15++ Financial derivatives market Trend