20++ Volatility meaning in stocks Mining

Home » Bitcoin » 20++ Volatility meaning in stocks MiningYour Volatility meaning in stocks bitcoin are ready. Volatility meaning in stocks are a exchange that is most popular and liked by everyone today. You can News the Volatility meaning in stocks files here. Get all free coin.

If you’re searching for volatility meaning in stocks images information connected with to the volatility meaning in stocks topic, you have visit the right blog. Our site always gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Volatility Meaning In Stocks. Volatility is the measure of how much a stocks price moves. Investors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock already in the portfolio or sell stock currently in the possession of the investor. It is commonly used as a measure of the risk of the security. Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of time.

Understanding Stock Market Volatility Rule 1 Investing From ruleoneinvesting.com

Understanding Stock Market Volatility Rule 1 Investing From ruleoneinvesting.com

If you used. It expresses the degree of risk associated with a securitys price fluctuations. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way. Volatility is a measure of the securitys stability and is usually calculated as the standard deviation derived from a continuously compounded return over a certain period of time. Volatility is how fast the price of an investment fluctuates over time. How volatility is measured will affect the value of the coefficient used.

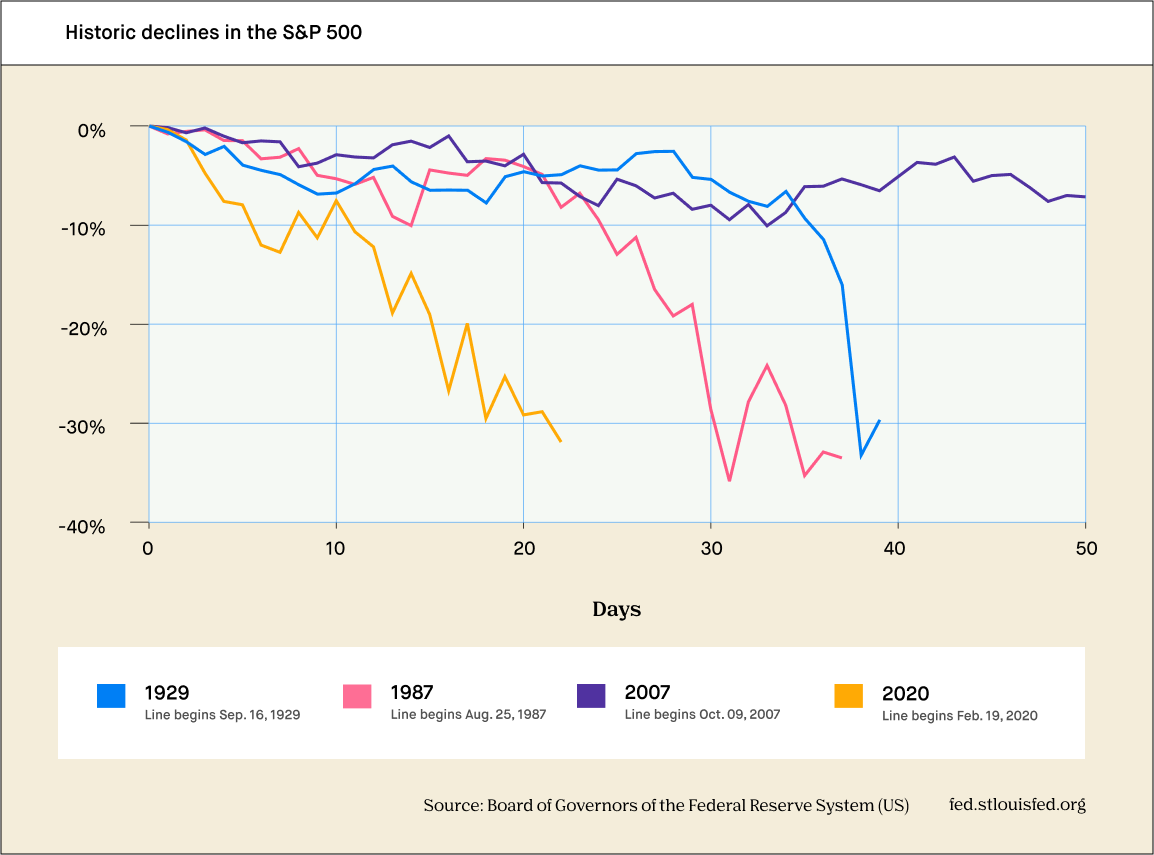

Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way.

Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way. If you used. A measurement of historic volatility looks at a securitys past market prices. There are stocks which cost 5 dollars and there are other stocks which cost 200 dollars. It measures how fast those movements are how often they occur and how big they are. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way.

Source: sciencedirect.com

Source: sciencedirect.com

Volatility is how fast the price of an investment fluctuates over time. It is commonly used as a measure of the risk of the security. Volatility is how fast the price of an investment fluctuates over time. Stock market volatility refers to the range of price movement of a stock over time. In simple terms VIX refers to a markets.

Source: investopedia.com

Source: investopedia.com

It measures how fast those movements are how often they occur and how big they are. If the price almost never changes it has low volatility. Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way. It measures how fast those movements are how often they occur and how big they are. A stocks volatility is equal to the amount that particular stock will separate from the original price at which it was traded.

Source: fidelity.com

Source: fidelity.com

A stock that maintains a relatively stable price has low volatility. If you used. Market volatility is defined as a statistical measure of a stocks or other assets deviations from a set benchmark or its own average performance. At its most basic stock volatility is the extent to which share prices increase and decrease. Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of time.

Source: lynalden.com

Source: lynalden.com

Historic volatility measures a time series of past market prices. There are stocks which cost 5 dollars and there are other stocks which cost 200 dollars. The concept of a Volatility Index was first developed by the CBOE Chicago Board Options Exchange in the early 1990s although the mathematics behind it goes back to the 1970s. If the price of a stock moves up and down rapidly over short time periods it has high volatility. Volatility as expressed as a percentage coefficient within option-pricing formulas arises from daily trading activities.

Source: fidelity.com

Source: fidelity.com

It expresses the degree of risk associated with a securitys price fluctuations. If the price of a stock moves up and down rapidly over short time periods it has high volatility. We calculate the daily volatility with up to 3 years of daily price data. It is essentially an analysis of the changes in the value of a security. Investors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock already in the portfolio or sell stock currently in the possession of the investor.

Source: investopedia.com

Source: investopedia.com

Volatility refers to amount of risk related to the amount person has invested on the stock. By using percentages you can directly compare their volatility more percent always means greater volatility. The concept of a Volatility Index was first developed by the CBOE Chicago Board Options Exchange in the early 1990s although the mathematics behind it goes back to the 1970s. A measurement of historic volatility looks at a securitys past market prices. If the price almost never changes it has low volatility.

Source: youtube.com

Source: youtube.com

Volatility is the measure of how much a stocks price moves. In finance volatility is a measurement of the fluctuations of the price of a security. Volatility is found by calculating the annualized standard deviation of daily change in price. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. When investing in a volatile security the chance.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

There are stocks which cost 5 dollars and there are other stocks which cost 200 dollars. It is a rate at which the price of a security increases or decreases for a given set of returns. Loosely translated that means how likely. Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of time. The concept of a Volatility Index was first developed by the CBOE Chicago Board Options Exchange in the early 1990s although the mathematics behind it goes back to the 1970s.

Source: capital.com

Source: capital.com

If the price almost never changes it has low volatility. Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. Volatility is the measure of how much a stocks price moves. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way.

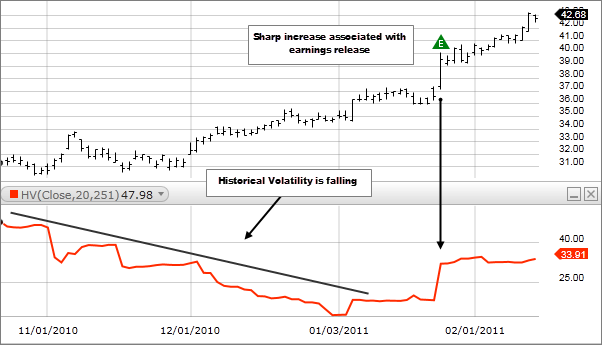

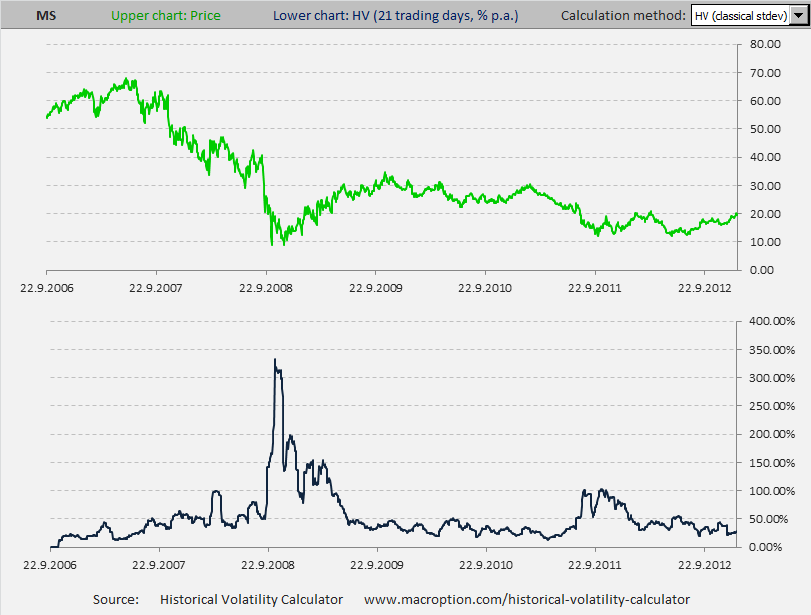

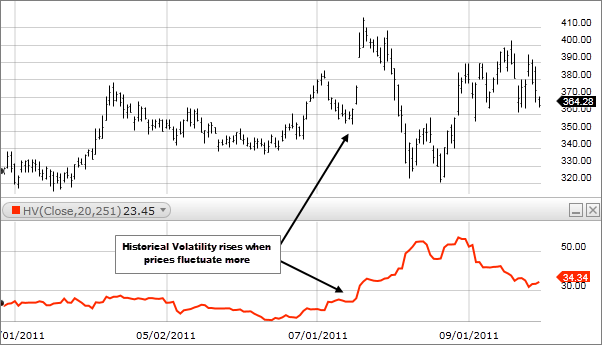

Source: macroption.com

Source: macroption.com

Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. If the price of a stock moves up and down rapidly over short time periods it has high volatility. When volatility is high the dispersion will be. If volatility is high for a stock that means it could be a risky bet because of wild price swings. Volatility refers to amount of risk related to the amount person has invested on the stock.

Source: fool.com

Source: fool.com

Market volatility is defined as a statistical measure of a stocks or other assets deviations from a set benchmark or its own average performance. A highly volatile stock is inherently riskier but that risk cuts both ways. Investors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock already in the portfolio or sell stock currently in the possession of the investor. When volatility is high the dispersion will be. It expresses the degree of risk associated with a securitys price fluctuations.

Source: investopedia.com

Source: investopedia.com

The concept of a Volatility Index was first developed by the CBOE Chicago Board Options Exchange in the early 1990s although the mathematics behind it goes back to the 1970s. Historic volatility measures a time series of past market prices. In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns. So what does stock volatility mean. Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks.

Source: fidelity.com

Source: fidelity.com

High volatility is associated with higher risk. So what does stock volatility mean. It can be measured against the ups and downs of the market Or it can be plotted statistically against the average price. In finance volatility is a measurement of the fluctuations of the price of a security. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way.

Source: study.com

Source: study.com

What is volatility. Volatility stands for the risk of change in the price of a security. What is volatility. If the price of a stock moves up and down rapidly over short time periods it has high volatility. Loosely translated that means how likely.

Source: investopedia.com

Source: investopedia.com

What is Volatility in the Stock Market. A stock that maintains a relatively stable price has low volatility. When volatility is high the dispersion will be. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. If it is.

Source: learn.robinhood.com

Source: learn.robinhood.com

In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns. Volatility is found by calculating the annualized standard deviation of daily change in price. So what does stock volatility mean. If the price almost never changes it has low volatility. It expresses the degree of risk associated with a securitys price fluctuations.

Source: educba.com

Source: educba.com

Historic volatility measures a time series of past market prices. We calculate the daily volatility with up to 3 years of daily price data. It can also be defined as a statistical measure of dispersion for particular securities and is. Stock market volatility refers to the range of price movement of a stock over time. What is Stock Volatility.

Source: lynalden.com

Source: lynalden.com

Loosely translated that means how likely. When investing in a volatile security the chance. Volatility refers to amount of risk related to the amount person has invested on the stock. If it is. Loosely translated that means how likely.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title volatility meaning in stocks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 20++ Bitmart coinmarketcap Trading

- 35++ T stock price today Trend

- 23+ Dow jones industrial stock market Trending

- 33+ Nyse path Stock

- 35+ Volatile investment Trading

- 37++ Basf market cap Trending

- 31+ Best digital currency trading app Mining

- 38+ Intraday stocks for today List

- 34++ Tellor coinmarketcap Trending

- 11+ Best digital currency to invest in right now Coin