30++ Volatile market example Coin

Home » News » 30++ Volatile market example CoinYour Volatile market example trading are ready. Volatile market example are a coin that is most popular and liked by everyone today. You can News the Volatile market example files here. Get all royalty-free mining.

If you’re searching for volatile market example pictures information linked to the volatile market example topic, you have pay a visit to the ideal site. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

Volatile Market Example. In one of the most volatile markets in decades active fund managers underperformed again. One prominent factor that may affect volatility is the news. For example an implied volatility of 20 of Amazon stock trading at 2000 per share represents a one standard deviation range of 400 over the next year. But on the flip side buying at the wrong time can spell disaster.

How To Measure Volatility In Forex Babypips Com From babypips.com

How To Measure Volatility In Forex Babypips Com From babypips.com

Companies with a high beta over a value of 1 generally have a higher implied volatility while those under 1 do not. Some analysts make a living trying to explain volatility and its effect on the market. For example a security with a volatility of 50 is considered very high risk because it has the potential to increase or decrease by up to half its value. Key news announcements may expose the Client to additional risks including the risk that the Client may not get the price him or her requests. Highly volatile markets are generally unstable and prone to making sharp upward and downward moves. In volatile markets prices move quickly.

Some analysts make a living trying to explain volatility and its effect on the market.

An assets volatility is a key factor when pricing options contracts. Volatility is the likelihood of a market making major short-term price movements at any given time. Highly volatile markets are generally unstable and prone to making sharp upward and downward moves. How to use options for taking advantage of volatile markets. An assets volatility is a key factor when pricing. A market with a great deal of price instability.

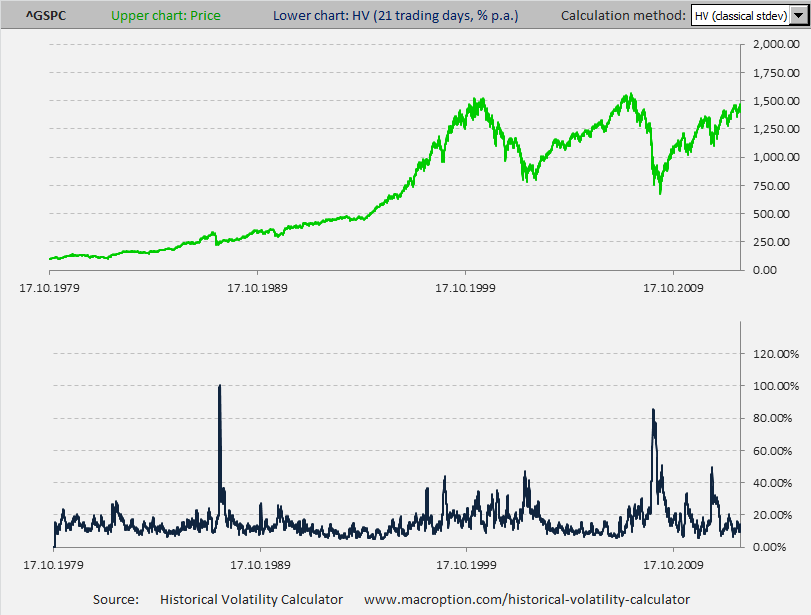

Source: macroption.com

Source: macroption.com

An assets volatility is a key factor when pricing. Pipeline firm deposited millions into fund for police to protect Line 3 project. Maryland man pleads. In the securities markets volatility is often associated with big swings in either direction. Highly volatile markets are generally unstable and prone to making sharp upward and downward moves.

Source: investopedia.com

Source: investopedia.com

In other words this implies AMZN stock prices will range between 1600 and 2400 over the next year. For example if you normally trade 100 stock shares or 10 options contracts maybe go with 75 shares or 7 contracts. When markets are volatile this means that prices are changing fast in a short period of time. Some analysts make a living trying to explain volatility and its effect on the market. In other words this implies AMZN stock prices will range between 1600 and 2400 over the next year.

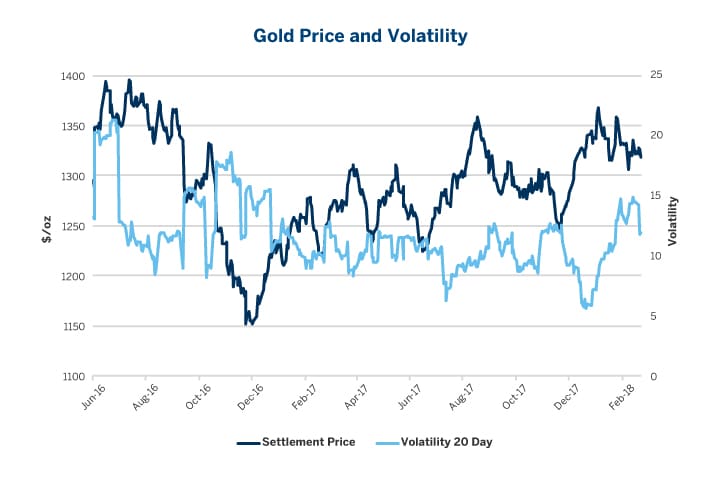

Source: cmegroup.com

Source: cmegroup.com

Buying a put option gives right not obligation to the. Unsurprisingly this highly volatile stock presented a huge opportunity for gains. The most volatile stocks have a higher beta. When the VIX is on the rise the SP 500 index typically falls. In one of the most volatile markets in decades active fund managers underperformed again.

Source: optimusfutures.com

Source: optimusfutures.com

High volatility in the stock market usually means dramatic fluctuations measured in an overall market index such as the SP 500. For example a security with a volatility of 50 is considered very high risk because it has the potential to increase or decrease by up to half its value. The most volatile stocks have a higher beta. In the securities markets volatility is often associated with big swings in either direction. Key news announcements may expose the Client to additional risks including the risk that the Client may not get the price him or her requests.

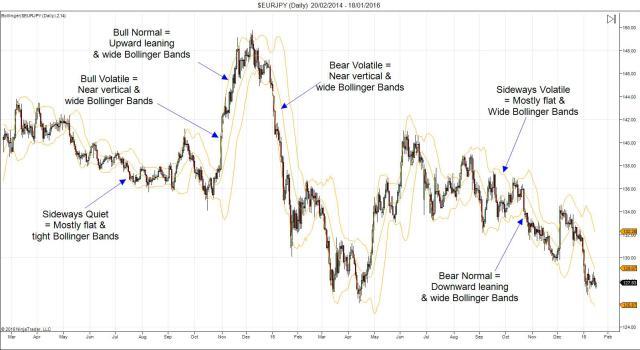

Source: fxstreet.com

Source: fxstreet.com

Volatile markets are highly risky. But one of the most tried-and-true stocks and options strategies for volatile markets is to reduce position sizing. An assets volatility is a key factor when pricing options contracts. For example an implied volatility of 20 of Amazon stock trading at 2000 per share represents a one standard deviation range of 400 over the next year. Highly volatile markets are generally unstable and prone to making sharp upward and downward moves.

Source: babypips.com

Source: babypips.com

This lines up with what history shows. This lines up with what history shows. How to use options for taking advantage of volatile markets. 2012 Farlex Inc. But one of the most tried-and-true stocks and options strategies for volatile markets is to reduce position sizing.

Source: lynalden.com

Source: lynalden.com

This article will explain the benefits of trading in a volatile market as well as some important tips for investors to get maximum profit in the volatile market. When the VIX is on the rise the SP 500 index typically falls. For example JPMorgan Chase tried to quantify the effects of President Donald Trumps tweets on the market. Typically a stock will rise or fall in correlation with its market. How to use options for taking advantage of volatile markets.

Source: babypips.com

Source: babypips.com

Theres a few ways to compensate for that when adding new positions. Volatile markets are highly risky. The most volatile stocks have a higher beta. For example when the stock market rises and falls more than one percent over a sustained period of time it is called a volatile market. In other words this implies AMZN stock prices will range between 1600 and 2400 over the next year.

Source: investopedia.com

Source: investopedia.com

When the VIX is on the rise the SP 500 index typically falls. Things like index funds the SP 500 and NASDAQ are all examples of larger markets made up of several individual stocks. Volatility is the likelihood of a market making major short-term price movements at any given time. This article will explain the benefits of trading in a volatile market as well as some important tips for investors to get maximum profit in the volatile market. For example JPMorgan Chase tried to quantify the effects of President Donald Trumps tweets on the market.

Source: mytradingskills.com

Source: mytradingskills.com

But one of the most tried-and-true stocks and options strategies for volatile markets is to reduce position sizing. Buying a put option gives right not obligation to the. High volatility in the stock market usually means dramatic fluctuations measured in an overall market index such as the SP 500. This lines up with what history shows. Things like index funds the SP 500 and NASDAQ are all examples of larger markets made up of several individual stocks.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

Unsurprisingly this highly volatile stock presented a huge opportunity for gains. Many people wonder how to use volatility in trading. How to use options for taking advantage of volatile markets. In volatile markets prices move quickly. Price volatility and the movement of price position to market changes are compared to determine the relative risk of any given stock.

Source: tradingsim.com

Source: tradingsim.com

Companies with a high beta over a value of 1 generally have a higher implied volatility while those under 1 do not. Volatility is a measure of price-change during a specified amount of time. An assets volatility is a key factor when pricing options contracts. For example if a stock has high volatility in bearish market then the investor can buy put option and make a profit. 2012 Farlex Inc.

Source: investopedia.com

Source: investopedia.com

2012 Farlex Inc. Unsurprisingly this highly volatile stock presented a huge opportunity for gains. Highly volatile markets are generally unstable and prone to making sharp upward and downward moves. Volatility is the likelihood of a market making major short-term price movements at any given time. Pipeline firm deposited millions into fund for police to protect Line 3 project.

Source: zerodha.com

Source: zerodha.com

Most highly volatile assets typically come with greater risk but also greater chance of profit. Price volatility and the movement of price position to market changes are compared to determine the relative risk of any given stock. Pipeline firm deposited millions into fund for police to protect Line 3 project. For example if a stock has high volatility in bearish market then the investor can buy put option and make a profit. For example when the stock market rises and falls more than one percent over a sustained period of time it is called a volatile market.

Source: fxssi.com

Source: fxssi.com

Whats important to remember though is what else history reveals. But one of the most tried-and-true stocks and options strategies for volatile markets is to reduce position sizing. Whats important to remember though is what else history reveals. An assets volatility is a key factor when pricing options contracts. Volatility is a measure of price-change during a specified amount of time.

Source: youtube.com

Source: youtube.com

For example an implied volatility of 20 of Amazon stock trading at 2000 per share represents a one standard deviation range of 400 over the next year. Volatile markets are highly risky. Volatility is the likelihood of a market making major short-term price movements at any given time. Highly volatile markets are generally unstable and prone to making sharp upward and downward moves. For example if a stock has high volatility in bearish market then the investor can buy put option and make a profit.

Source: investopedia.com

Source: investopedia.com

For example an implied volatility of 20 of Amazon stock trading at 2000 per share represents a one standard deviation range of 400 over the next year. For example the results of an election may motivate volatility as investors anticipate potential changes in taxes trade agreements or federal spending. Most highly volatile assets typically come with greater risk but also greater chance of profit. Many people wonder how to use volatility in trading. But one of the most tried-and-true stocks and options strategies for volatile markets is to reduce position sizing.

Source: investopedia.com

Source: investopedia.com

An assets volatility is a key factor when pricing. Volatility is a measure of price-change during a specified amount of time. But on the flip side buying at the wrong time can spell disaster. In other words this implies AMZN stock prices will range between 1600 and 2400 over the next year. Highly volatile markets are generally unstable and prone to making sharp upward and downward moves.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title volatile market example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 35++ Todays volatility index Trend

- 14++ Royal dutch shell market cap Wallet

- 26+ Travala coinmarketcap List

- 24++ Dow jones market today Mining

- 31+ Bombardier market cap Stock

- 22+ Best performing digital currency Trading

- 37+ Toyota market cap in usd Trending

- 29++ Apple inc market cap Bitcoin

- 19+ Cbn and cryptocurrency Trend

- 31++ 1 trillion market cap Best