44++ Vix below 20 List

Home » Mining » 44++ Vix below 20 ListYour Vix below 20 exchange are ready. Vix below 20 are a mining that is most popular and liked by everyone now. You can Find and Download the Vix below 20 files here. Find and Download all royalty-free exchange.

If you’re looking for vix below 20 images information related to the vix below 20 topic, you have come to the ideal blog. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

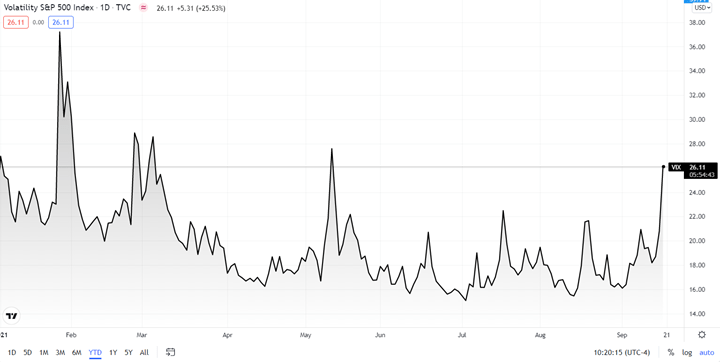

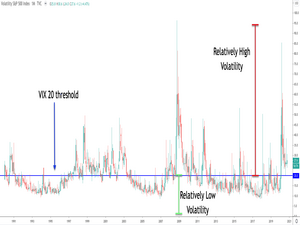

Vix Below 20. Answer 1 of 3. The question will resolve on the first date that the closing price of VIX is below 200 as per the CBOEs daily updated csv file or if unavailable any other report from CBOE. Whenever the VIX dips below 20 the stock market marks a medium-term top. How to Trade the VIX VIX index has paved the way for using volatility as a tradable asset although through.

Vix Etfs Rally As Volatility Levels Spike Seeking Alpha From seekingalpha.com

Vix Etfs Rally As Volatility Levels Spike Seeking Alpha From seekingalpha.com

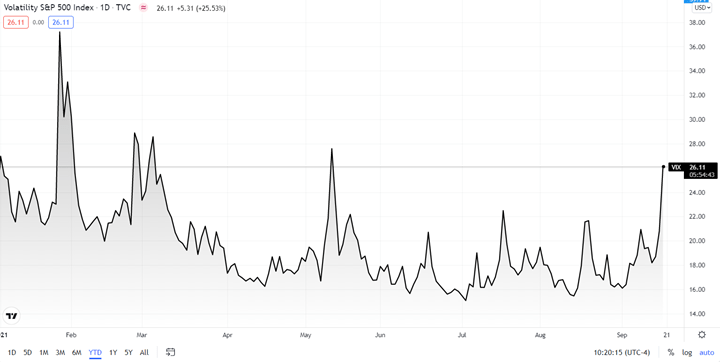

The VIX is a highly touted index on CNBC and in financial circles but what is it and what does it represent. On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded. Despite the VIX being under 20 the way options trade now versus a year ago has fundamentally changed. A low VIX under 20 is good for buying - everyone is aligned in expectations and the market is stable. The question will resolve on the first date that the closing price of VIX is below 200 as per the CBOEs daily updated csv file or if unavailable any other report from CBOE. For over a year the VIX has not ended a week below the 20 mark.

However when the VIX does rise it tends to do so very quickly.

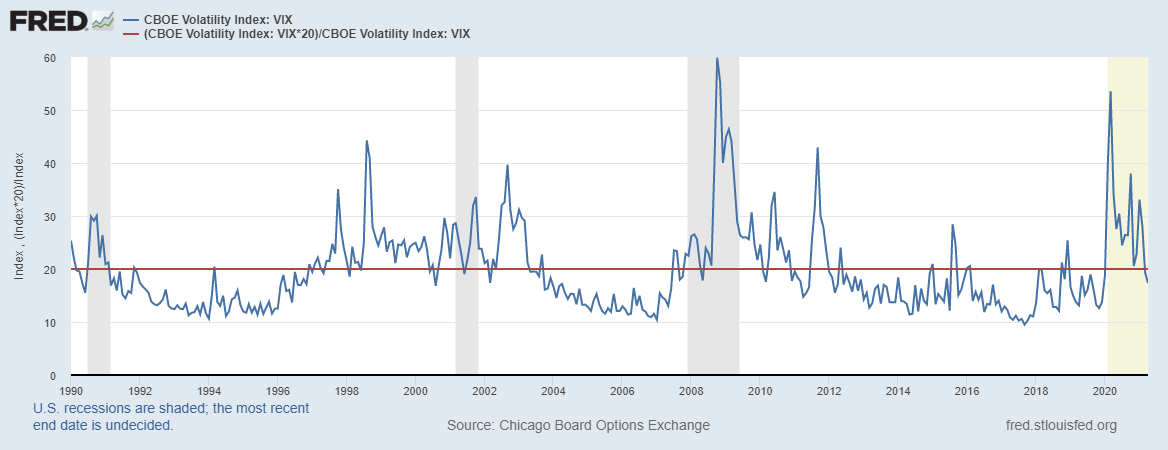

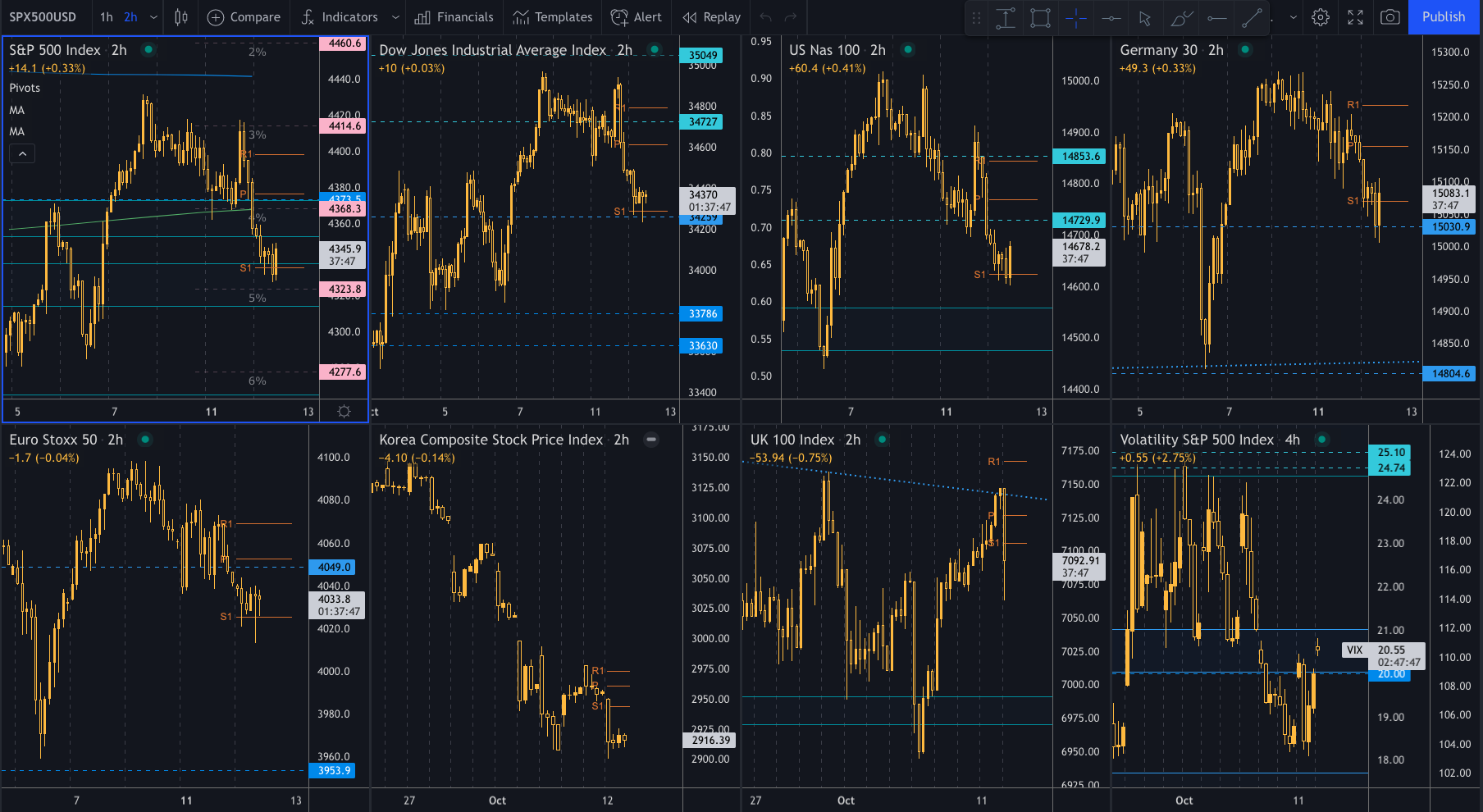

21 2020 when coronavirus-related fears were beginning to grip investorsThe SP 500 Index slumped more than 11 in the final week of February. Answer 1 of 3. Whenever the VIX begins to register readings above 20 then it is a sign of a higher risk market environment. As the chart below shows the VIX trades above the level of 20 during the periods of US recessions and the. And cheap isnt really that. The Cboe Volatility Index known as Wall Streets fear gauge ended below 20 forthe first time in nearly a year on Friday.

Source: fool.com

Source: fool.com

For over a year the VIX has not ended a week below the 20 mark. A full series of VIX prices since its 2002 inception is available here. The CBOE Volatility Index pulled back below the 20 level yesterday as equity indexes closed mixed but little-changed. This is rather significant as it implies that the fear and. The Cboe Volatility Index settled below 20 Friday for the first time since the pandemic rout took hold a year ago.

Source: investopedia.com

Source: investopedia.com

The VIX fell 128 points to end at 1997. The VIX CBOE Index is currently trading below 20 which is a very important level. The volatility measure peaked on March 18 at 8547 and has tum. A VIX level of 20 would consider a borderline in case the VIX went below that line it usually meant market traders increased their appetite for riskier assets so as a general observation we would like to increase risk in case the VIX drops below 20 which in 2020 happened very little as a fact it happened the minimum number of times in the. Its the price of SPX options out about 30 days in expiry both puts and calls.

Source: seekingalpha.com

Source: seekingalpha.com

Intraday price movements will not count towards resolution. The VIX fell 128 points to end at 1997. The CBOE Volatility Index pulled back below the 20 level yesterday as equity indexes closed mixed but little-changed. During the last two bear markets the 16-17 level on the VIX has been the floor. And cheap isnt really that.

Source: quanttrader.com

Source: quanttrader.com

The VIX has been a great shibboleth for testing whether stocks will rise or fall and a quick barometer on the risk tone. When the market moves fast usually down it rises fast and. You may hear it called the Fear Index but that too is a misnomer and not an. On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded. The VIX fell 128 points to end at 1997.

Source: seekingalpha.com

Source: seekingalpha.com

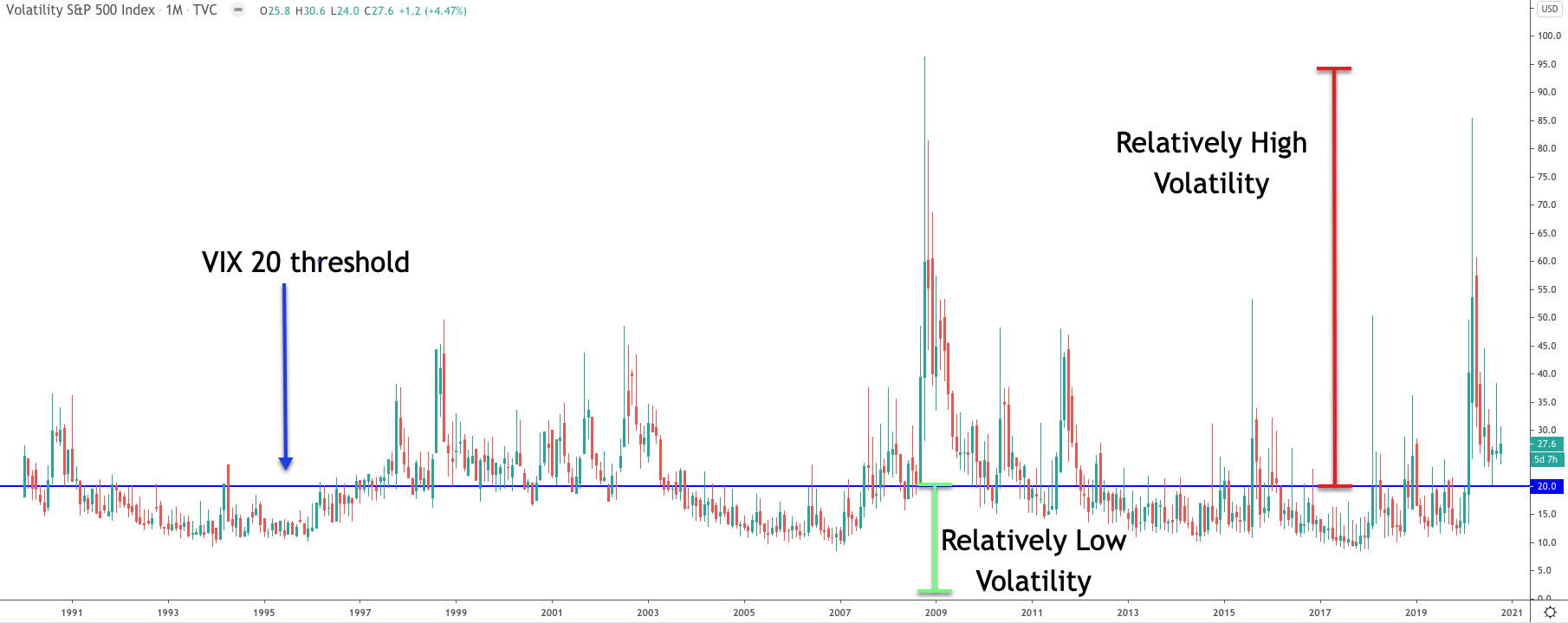

The CBOE Volatility Index pulled back below the 20 level yesterday as equity indexes closed mixed but little-changed. A VIX level of 20 would consider a borderline in case the VIX went below that line it usually meant market traders increased their appetite for riskier assets so as a general observation we would like to increase risk in case the VIX drops below 20 which in 2020 happened very little as a fact it happened the minimum number of times in the. On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded. The volatility measure peaked on March 18 at 8547 and has tum. SP 500 Volatility Index VIX Weve used a weekly VIX chart here to illustrate the significance in the recent reduction in volatility.

Source: forexlive.com

Source: forexlive.com

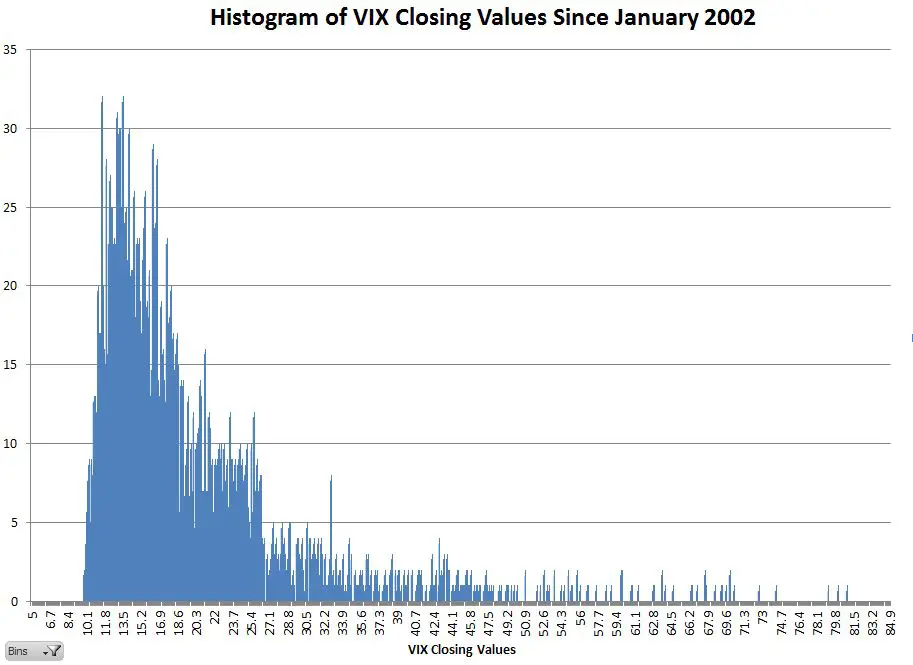

21 2020 when coronavirus-related fears were beginning to grip investorsThe SP 500 Index slumped more than 11 in the final week of February. The VIX is a measure of that expected volatility When the VIX is high and falling Wall Street is climbing that wall of worry. In fact 61 of the VIX closes have been below 20 since 1990. The CBOE Volatility Index pulled back below the 20 level yesterday as equity indexes closed mixed but little-changed. The VIX median back to 1993 is 1826 so if nothing else Id use that as the cheap point.

Source: investopedia.com

Source: investopedia.com

In fact 61 of the VIX closes have been below 20 since 1990. Despite the VIX being under 20 the way options trade now versus a year ago has fundamentally changed. Answer 1 of 3. When there is heightened anxiety in the market the VIX price reading can spike quickly higher as market participants are more inclined to buy insurance. Whenever the VIX begins to register readings above 20 then it is a sign of a higher risk market environment.

Source: forextraininggroup.com

Source: forextraininggroup.com

Below is a monthly analysis of the VIX this century with the SP 500 performance shown beeneath it. On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded. The VIX fell 128 points to end at 1997. You may hear it called the Fear Index but that too is a misnomer and not an. The Cboe Volatility Index known as Wall Streets fear gauge ended below 20 forthe first time in nearly a year on Friday.

A full series of VIX prices since its 2002 inception is available here. You may hear it called the Fear Index but that too is a misnomer and not an. The VIX as its better known closed at 1997 the lowest since Feb. Intraday price movements will not count towards resolution. As Global Head of Trading Structuring and Quant RD I was responsible for 2050 billion dollars of daily trading across 1617 trading desks - comprising head count of 50 traders reporting into me Across listedOTC products including Spot FwdsFutures Options Ex.

Source: sixfigureinvesting.com

Source: sixfigureinvesting.com

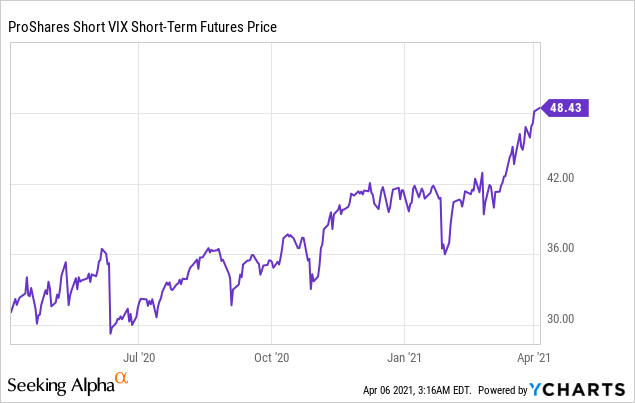

Despite the VIX being under 20 the way options trade now versus a year ago has fundamentally changed. VIX values below 20 generally correspond to stable stress-free periods in the markets. And cheap isnt really that. The VIX fell 128 points to end at 1997. A high VIX over 30 is bad from a risk averse perspective - expectations are all over the place and the market is unstable.

Source: alsimple.com

Source: alsimple.com

Now for two weeks in a row not only did we see a close of the VIX below 20 it has closed at the lowest level in over 12 months. The VIX has been a great shibboleth for testing whether stocks will rise or fall and a quick barometer on the risk tone. From the chart above its pretty clear that when the VIX moves above 20 you must remain cautious as many times this signals bear market action for an extended period. The Cboe Volatility Index settled below 20 Friday for the first time since the pandemic rout took hold a year ago. Last week was slow by recent standards and option volume on Friday was 43 MILLION contracts.

Source: tradinggods.net

Source: tradinggods.net

Below you will find the long term chart of the VIX based on monthly timeframe. A VIX level of 20 would consider a borderline in case the VIX went below that line it usually meant market traders increased their appetite for riskier assets so as a general observation we would like to increase risk in case the VIX drops below 20 which in 2020 happened very little as a fact it happened the minimum number of times in the. Answer 1 of 3. The VIX as its better known closed at 1997 the lowest since Feb. The VIX is not the nose of the dog its the tail.

The VIX as its better known closed at 1997 the lowest since Feb. The VIX CBOE Index is currently trading below 20 which is a very important level. The question will resolve on the first date that the closing price of VIX is below 200 as per the CBOEs daily updated csv file or if unavailable any other report from CBOE. As the chart below shows the VIX trades above the level of 20 during the periods of US recessions and the. Despite the VIX being under 20 the way options trade now versus a year ago has fundamentally changed.

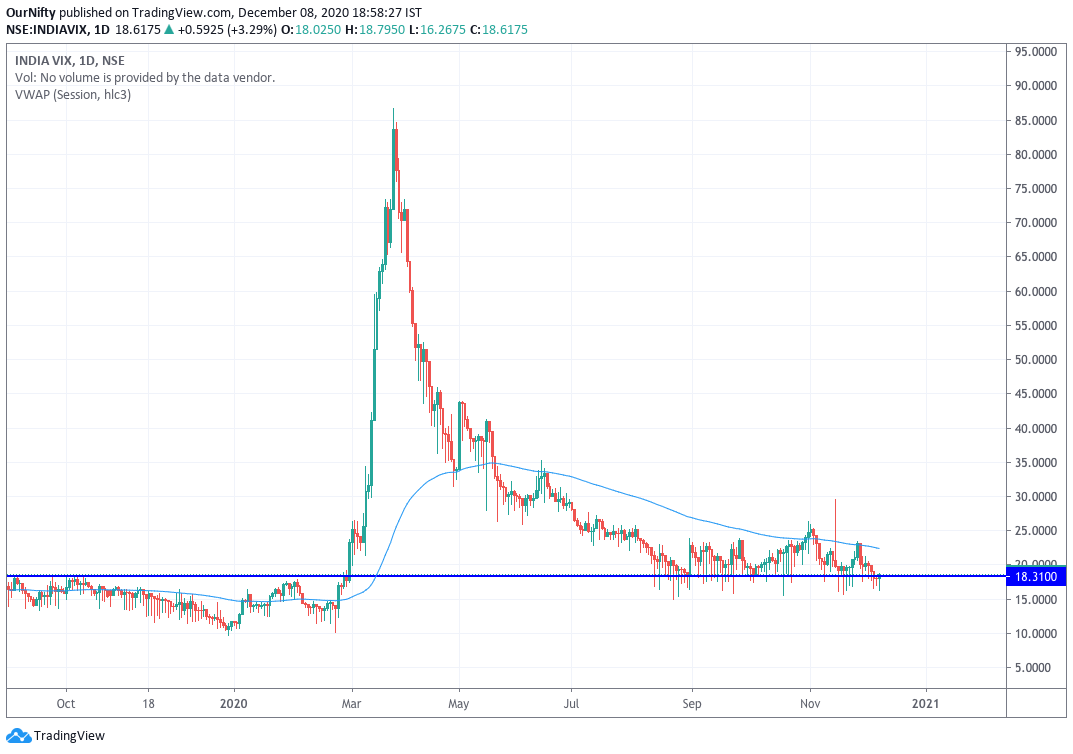

Source: ournifty.com

Source: ournifty.com

The VIX as its better known closed at 1997 the lowest since Feb. This is rather significant as it implies that the fear and. The CBOE Volatility Index pulled back below the 20 level yesterday as equity indexes closed mixed but little-changed. When the market moves fast usually down it rises fast and. On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded.

Source: ig.com

Source: ig.com

The question will resolve on the first date that the closing price of VIX is below 200 as per the CBOEs daily updated csv file or if unavailable any other report from CBOE. The VIX has been a great shibboleth for testing whether stocks will rise or fall and a quick barometer on the risk tone. Its the price of SPX options out about 30 days in expiry both puts and calls. The VIX is a measure of that expected volatility When the VIX is high and falling Wall Street is climbing that wall of worry. The volatility measure peaked on March 18 at 8547 and has tum.

Source: seekingalpha.com

Source: seekingalpha.com

The VIX as its better known closed at 1997 the lowest since Feb. Another important point worth mentioning is that the VIX Index is often said to be mean-reverting which means that when the VIX surges to significantly high levels above 25 or 30 or falls to low levels below 15. You see individual equity option volume has exploded. It had not closedbelow 20. The VIX as its better known closed at 1997 the lowest since Feb.

Source: forextraininggroup.com

Source: forextraininggroup.com

When the market moves fast usually down it rises fast and. On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded. For over a year the VIX has not ended a week below the 20 mark. The VIX is a measure of that expected volatility When the VIX is high and falling Wall Street is climbing that wall of worry. The VIX as its better known closed at 1997 the lowest since Feb.

Source: marquetteassociates.com

Source: marquetteassociates.com

Intraday price movements will not count towards resolution. The VIX is a measure of that expected volatility When the VIX is high and falling Wall Street is climbing that wall of worry. When there is heightened anxiety in the market the VIX price reading can spike quickly higher as market participants are more inclined to buy insurance. The VIX has been a great shibboleth for testing whether stocks will rise or fall and a quick barometer on the risk tone. When the market moves fast usually down it rises fast and.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vix below 20 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 32++ Sp 500 minimum volatility index Top

- 43+ Adx coinmarketcap News

- 10+ Bmo market cap Trending

- 10+ Investment opportunity Trend

- 35++ Fantom market cap Mining

- 29+ Tqqq premarket Top

- 26+ Dao coinmarketcap Bitcoin

- 34+ Us commodity market Mining

- 49++ New currencies on coinbase Top

- 23+ Coinmarketcap cashaa Mining