27++ Sp 500 historical volatility Trend

Home » Mining » 27++ Sp 500 historical volatility TrendYour Sp 500 historical volatility news are available. Sp 500 historical volatility are a exchange that is most popular and liked by everyone this time. You can Download the Sp 500 historical volatility files here. Find and Download all royalty-free wallet.

If you’re searching for sp 500 historical volatility pictures information connected with to the sp 500 historical volatility keyword, you have come to the right blog. Our site always gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

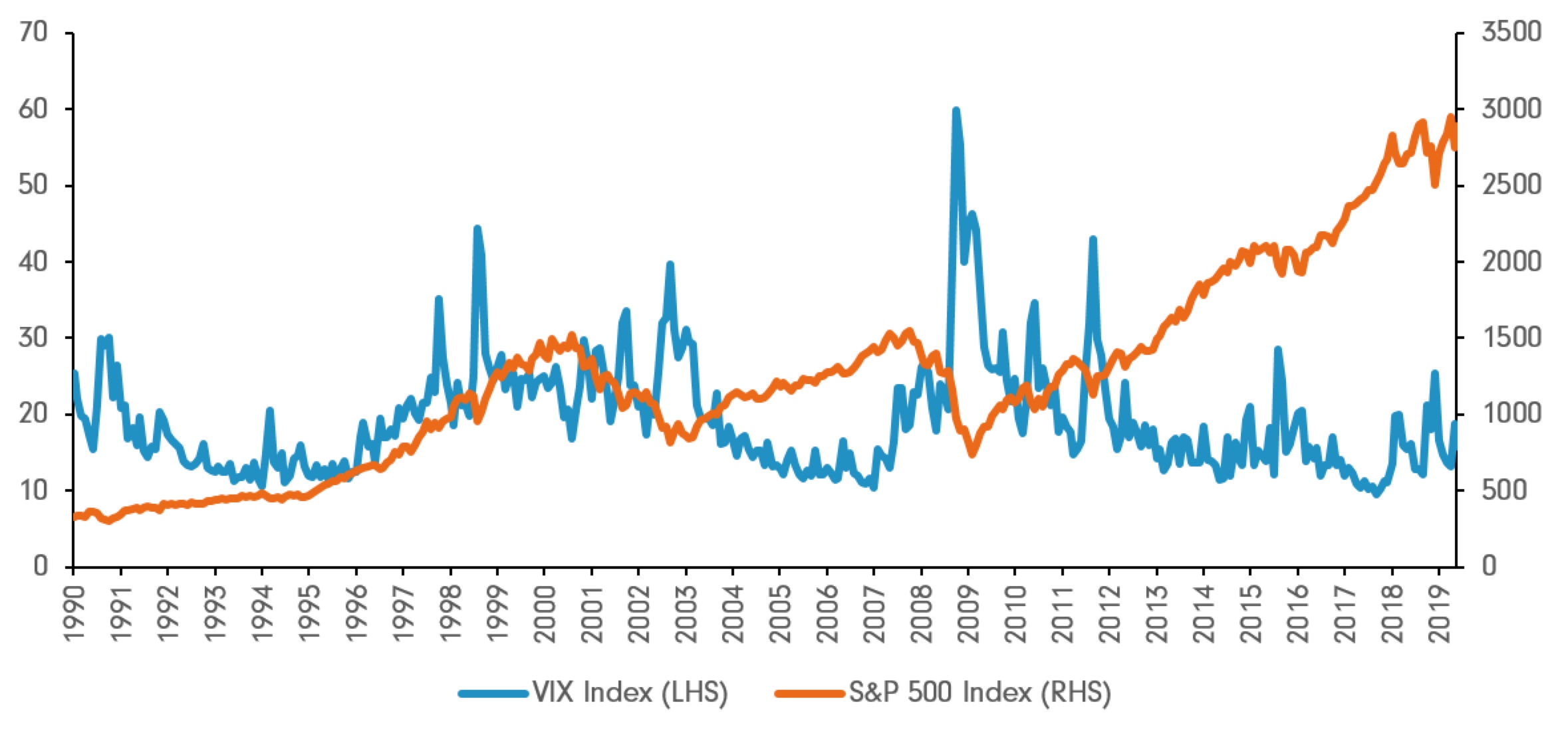

Sp 500 Historical Volatility. SP 500 12-Month Realized Volatility Index. 18 1972 and Dec. Interactive historical chart showing the daily level of the CBOE VIX Volatility Index back to 1990. 356756 563 016.

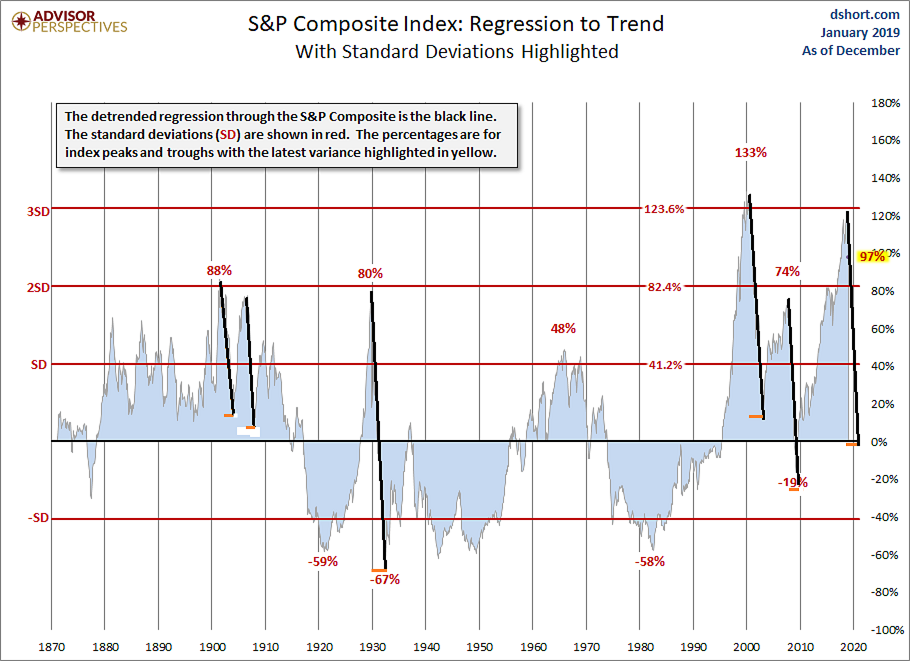

A 120 Year History Suggests The S P 500 Could Drop To 1630 By Year End 2020 Seeking Alpha From seekingalpha.com

A 120 Year History Suggests The S P 500 Could Drop To 1630 By Year End 2020 Seeking Alpha From seekingalpha.com

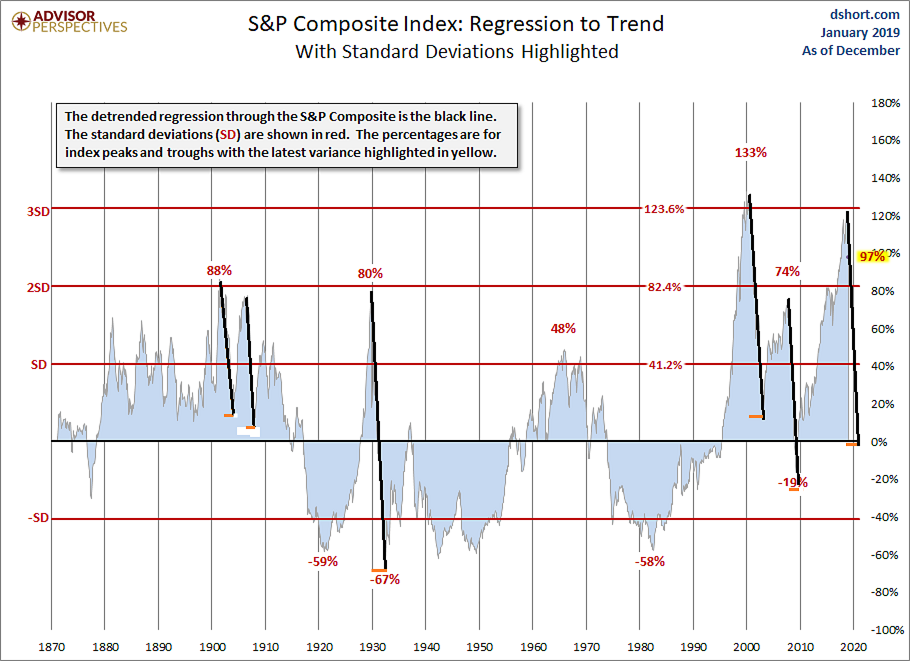

Historical volatility or HV is a statistical indicator that measures the distribution of returns for a specific security or market index Market Index Market index is a portfolio of securities that represent a section of the stock market deriving its value from the values of its underlying securities over a specified period. At the foot of the table youll find the. Overlay and compare different stocks and volatility metrics using the interactive features. Realized volatility measures the variations in the price of a security over a given period. From there the SP 500 fell another 27 in about five weeks which saw short-term volatility rocket to 97. Volatility can be measured using the standard deviation which signals how tightly the price of a stock is grouped around the mean or moving average MA.

46899 69 015.

The concept of rolling periods just means that the value. 1791 032 182. Overlay and compare different stocks and volatility metrics using the interactive features. SP 500 Index Volatility. Calculating a stocks volatility To calculate volatility well need historical prices for the given stock. Risk-adjusted returns based on the ratio of annualized returns to annualized volatility.

The current price of the SP 500 as of October 28 2021 is 459642. As I write this the SP 500. During that time the widely-watched VIX index exploded from 36 to 80. The VIX index measures the expectation of stock market volatility over the next 30 days implied by SP 500 index options. 1917 126 704.

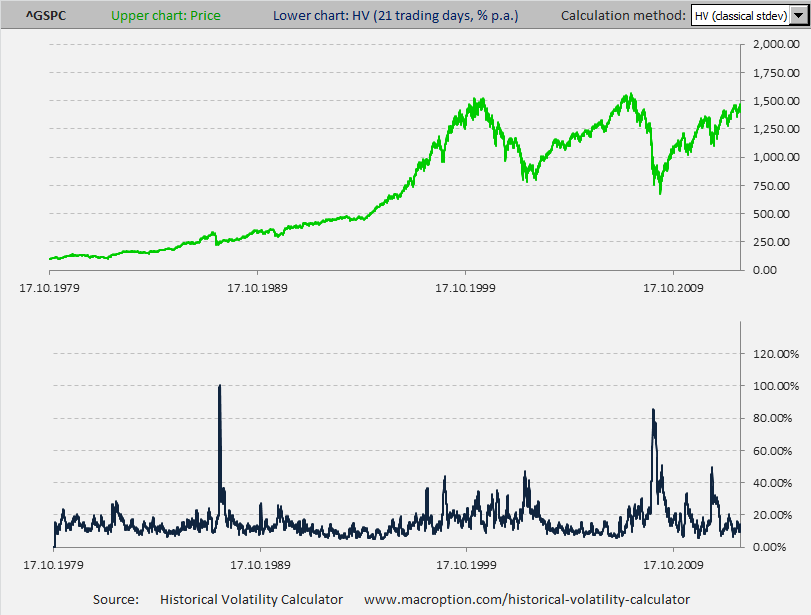

Source: macroption.com

Source: macroption.com

Calculating a stocks volatility To calculate volatility well need historical prices for the given stock. 1295 USD -041 1 Day. In Figure 1 we plot the volatility of the SP 500 Index from July 1962 to October 2014. From there the SP 500 fell another 27 in about five weeks which saw short-term volatility rocket to 97. 10-Day 20-Day 30-Day 60-Day.

Source: researchgate.net

Source: researchgate.net

35 is considered not very volatile. Risk-adjusted returns based on the ratio of annualized returns to annualized volatility. On each trading day we sold the at-the-money straddle in the standard expiration cycle with 25-35 days to expiration. As the chart shows recent volatility has been near the bottom of a 50-year range. From there the SP 500 fell another 27 in about five weeks which saw short-term volatility rocket to 97.

Source: investing.com

Source: investing.com

During that time the widely-watched VIX index exploded from 36 to 80. View volatility charts for SPDR SP 500 ETF Trust SPY including implied volatility and realized volatility. Risk-adjusted returns based on the ratio of annualized returns to annualized volatility. The 20-day historic volatility for the underlying asset. During that time the widely-watched VIX index exploded from 36 to 80.

1791 032 182. Get historical data for the SP 500 Low Volatility Index SP500LVOL on Yahoo Finance. Historical volatility or HV is a statistical indicator that measures the distribution of returns for a specific security or market index Market Index Market index is a portfolio of securities that represent a section of the stock market deriving its value from the values of its underlying securities over a specified period. Interactive historical chart showing the daily level of the CBOE VIX Volatility Index back to 1990. This index seeks to reflect the 12-Month realized volatility in the daily levels of the SP 500.

Source: dailyfx.com

Source: dailyfx.com

Access historical data for CBOE Volatility Index free of charge. 1295 USD -041 1 Day. The past volatility of the security over the selected time frame calculated using the closing price on each trading day. 160574 637 040. The VIX index measures the expectation of stock market volatility over the next 30 days implied by SP 500 index options.

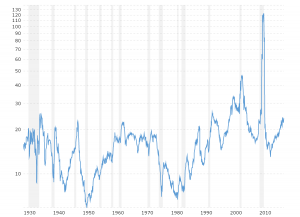

Overlay and compare different stocks and volatility metrics using the interactive features. This low is all the more striking because in the immediate aftermath of the Global Financial Crisis volatility was higher than at any time since at least 1960 and in all likelihood since the 1930s depression. The past volatility of the security over the selected time frame calculated using the closing price on each trading day. Interactive chart showing the annual percentage change of the SP 500 index back to 1927. Realized volatility measures the variations in the price of a security over a given period.

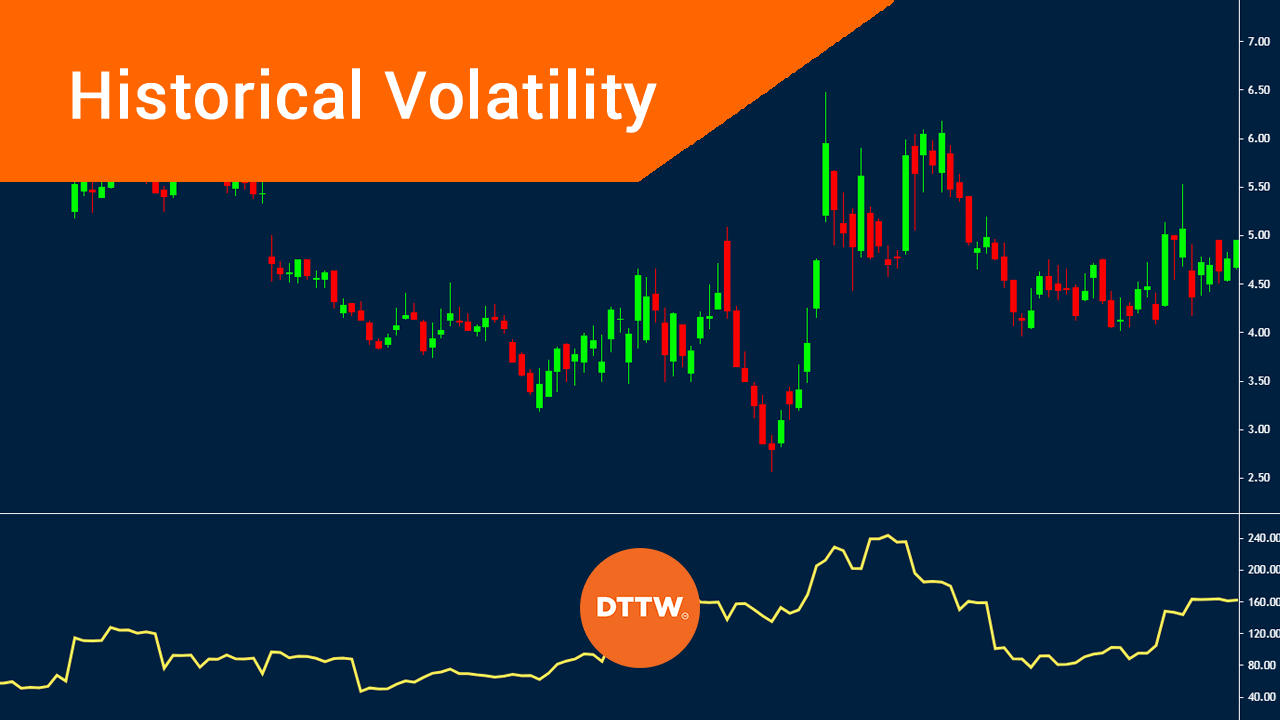

Source: daytradetheworld.com

Source: daytradetheworld.com

1295 USD -041 1 Day. The concept of rolling periods just means that the value. I hope this helps. This low is all the more striking because in the immediate aftermath of the Global Financial Crisis volatility was higher than at any time since at least 1960 and in all likelihood since the 1930s depression. You will find the closing price open high low change and percentage change for the selected range of dates.

Source: fidelity.com.hk

Source: fidelity.com.hk

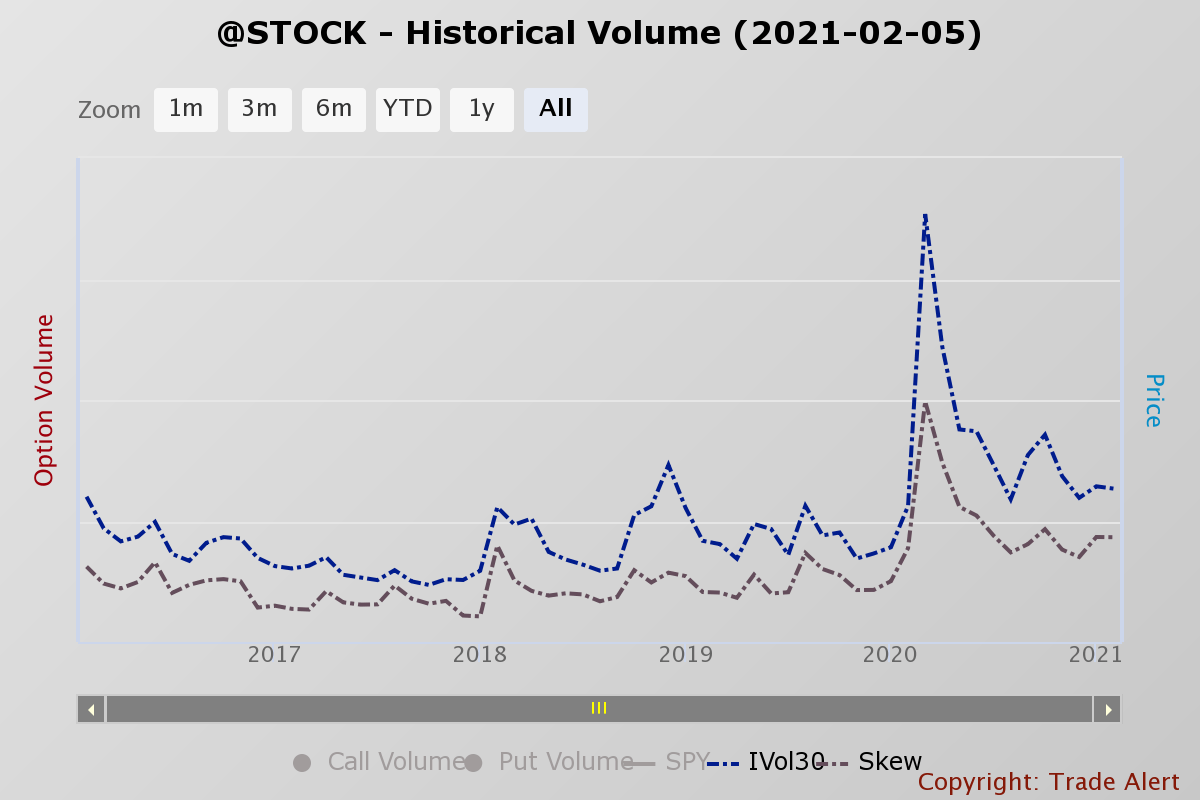

SP 500 Historical Annual Returns. SP Dow Jones Indices LLC. On each trading day we sold the at-the-money straddle in the standard expiration cycle with 25-35 days to expiration. View volatility charts for SPDR SP 500 ETF Trust SPY including implied volatility and realized volatility. The VIX index measures the expectation of stock market volatility over the next 30 days implied by SP 500 index options.

Source: school.stockcharts.com

Source: school.stockcharts.com

View volatility charts for SPDR SP 500 ETF Trust SPY including implied volatility and realized volatility. Overlay and compare different stocks and volatility metrics using the interactive features. SP 500 12-Month Realized Volatility Index. You will find the closing price open high low change and percentage change for the selected range of dates. Tracking SP 500 Volatility Today we will examine an updated SPX volatility study in addition to reviewing how many days this year have seen daily moves exceeding 2 given the pick-up in.

Source: seekingalpha.com

Source: seekingalpha.com

10-Day 20-Day 30-Day 60-Day. The current VIX index level as of November 22 2021 is 1917. Calculating a stocks volatility To calculate volatility well need historical prices for the given stock. Overlay and compare different stocks and volatility metrics using the interactive features. You will find the closing price open high low change and percentage change for the selected range of dates.

Source: dailyfx.com

Source: dailyfx.com

SP Dow Jones Indices LLC. SP 500 12-Month Realized Volatility Index. The VIX index measures the expectation of stock market volatility over the next 30 days implied by SP 500 index options. Exhibit 1 shows the risk-adjusted returns for the SP 500 Low Volatility Index and the SP 500 in each decade since 1972. 356756 563 016.

Source: equityclock.com

Source: equityclock.com

Historic volatility is the standard deviation of the price returns over a given number of sessions multiplied by a factor 260 days to produce an annualized volatility level. Rolling Volatility 1950 to Present Lets look at seven decades of volatilityto put volatility into perspective. SPDR SP 500 ETF SPY had 10-Day Historical Volatility Close-to-Close of 00560 for 2021-11-19. 1917 126 704. 102 rows Get historical data for the CBOE Volatility Index VIX on Yahoo Finance.

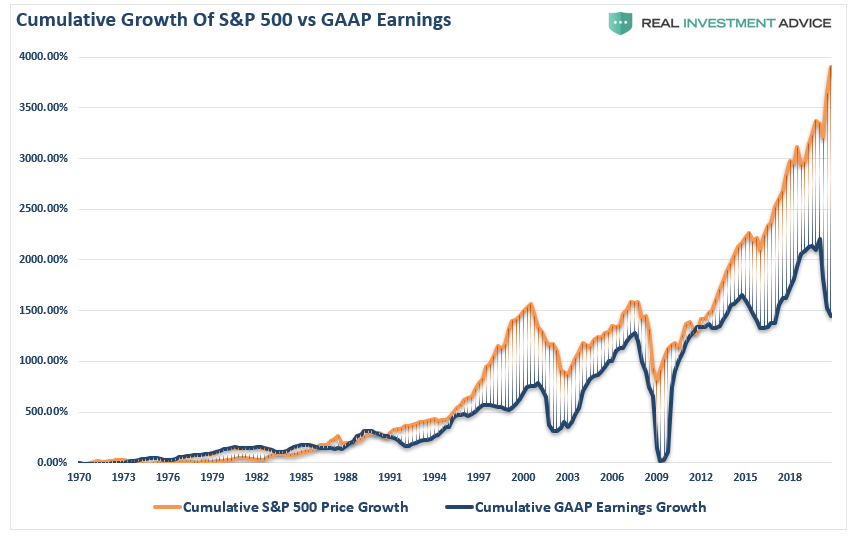

Source: seekingalpha.com

Source: seekingalpha.com

The average volatility of the SP 500 annualized standard deviation at 181. Overlay and compare different stocks and volatility metrics using the interactive features. SP 500 12-Month Realized Volatility Index. From 2007 to present we compared SP 500s one-month implied volatility the VIX Index to the SP 500s one-month 20-day historical volatility HV. In this example well use the SP 500s pricing data from August 2015.

Source: macrotrends.net

Source: macrotrends.net

In depth view into CBOE SP 500 Volatility Index including performance historical levels from 1990 charts and stats. Tracking SP 500 Volatility Today we will examine an updated SPX volatility study in addition to reviewing how many days this year have seen daily moves exceeding 2 given the pick-up in. Rolling Volatility 1950 to Present Lets look at seven decades of volatilityto put volatility into perspective. This low is all the more striking because in the immediate aftermath of the Global Financial Crisis volatility was higher than at any time since at least 1960 and in all likelihood since the 1930s depression. View volatility charts for SPDR SP 500 ETF Trust SPY including implied volatility and realized volatility.

Source: macrotrends.net

Source: macrotrends.net

View and download daily weekly or monthly data to help your investment decisions. Exhibit 1 shows the risk-adjusted returns for the SP 500 Low Volatility Index and the SP 500 in each decade since 1972. From there the SP 500 fell another 27 in about five weeks which saw short-term volatility rocket to 97. Historical Volatility Close-to-Close. During that time the widely-watched VIX index exploded from 36 to 80.

Source: dailyfx.com

Source: dailyfx.com

The terms are used interchangeably. Exhibit 1 shows the risk-adjusted returns for the SP 500 Low Volatility Index and the SP 500 in each decade since 1972. The historical volatility of a security or other financial instrument in a given period is. During that time the widely-watched VIX index exploded from 36 to 80. Overlay and compare different stocks and volatility metrics using the interactive features.

Source: seekingalpha.com

Source: seekingalpha.com

Performance is calculated as the change from the last trading day of each year from the last trading day of the previous year. SP 500 12-Month Realized Volatility Index. This low is all the more striking because in the immediate aftermath of the Global Financial Crisis volatility was higher than at any time since at least 1960 and in all likelihood since the 1930s depression. Calculating a stocks volatility To calculate volatility well need historical prices for the given stock. During that time the widely-watched VIX index exploded from 36 to 80.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sp 500 historical volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 32++ Sp 500 minimum volatility index Top

- 43+ Adx coinmarketcap News

- 10+ Bmo market cap Trending

- 10+ Investment opportunity Trend

- 35++ Fantom market cap Mining

- 29+ Tqqq premarket Top

- 26+ Dao coinmarketcap Bitcoin

- 34+ Us commodity market Mining

- 49++ New currencies on coinbase Top

- 23+ Coinmarketcap cashaa Mining