28+ Msci emerging markets minimum volatility index Trading

Home » News » 28+ Msci emerging markets minimum volatility index TradingYour Msci emerging markets minimum volatility index news are obtainable. Msci emerging markets minimum volatility index are a bitcoin that is most popular and liked by everyone now. You can Find and Download the Msci emerging markets minimum volatility index files here. Get all free exchange.

If you’re looking for msci emerging markets minimum volatility index images information related to the msci emerging markets minimum volatility index keyword, you have visit the right blog. Our website always gives you hints for viewing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

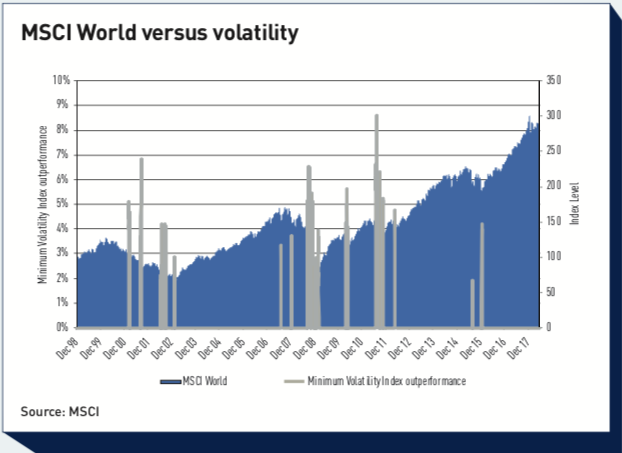

Msci Emerging Markets Minimum Volatility Index. IShares Edge MSCI EM Minimum Volatility UCITS ETF. Fees as stated in the prospectus Expense Ratio. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. MSCI EMERGING MARKETS MINIMUM VOLATILITY EUR INDEX The MSCI Emerging Markets Minimum Volatility EUR Index aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid-cap equities across 23 Emerging Markets EM countries.

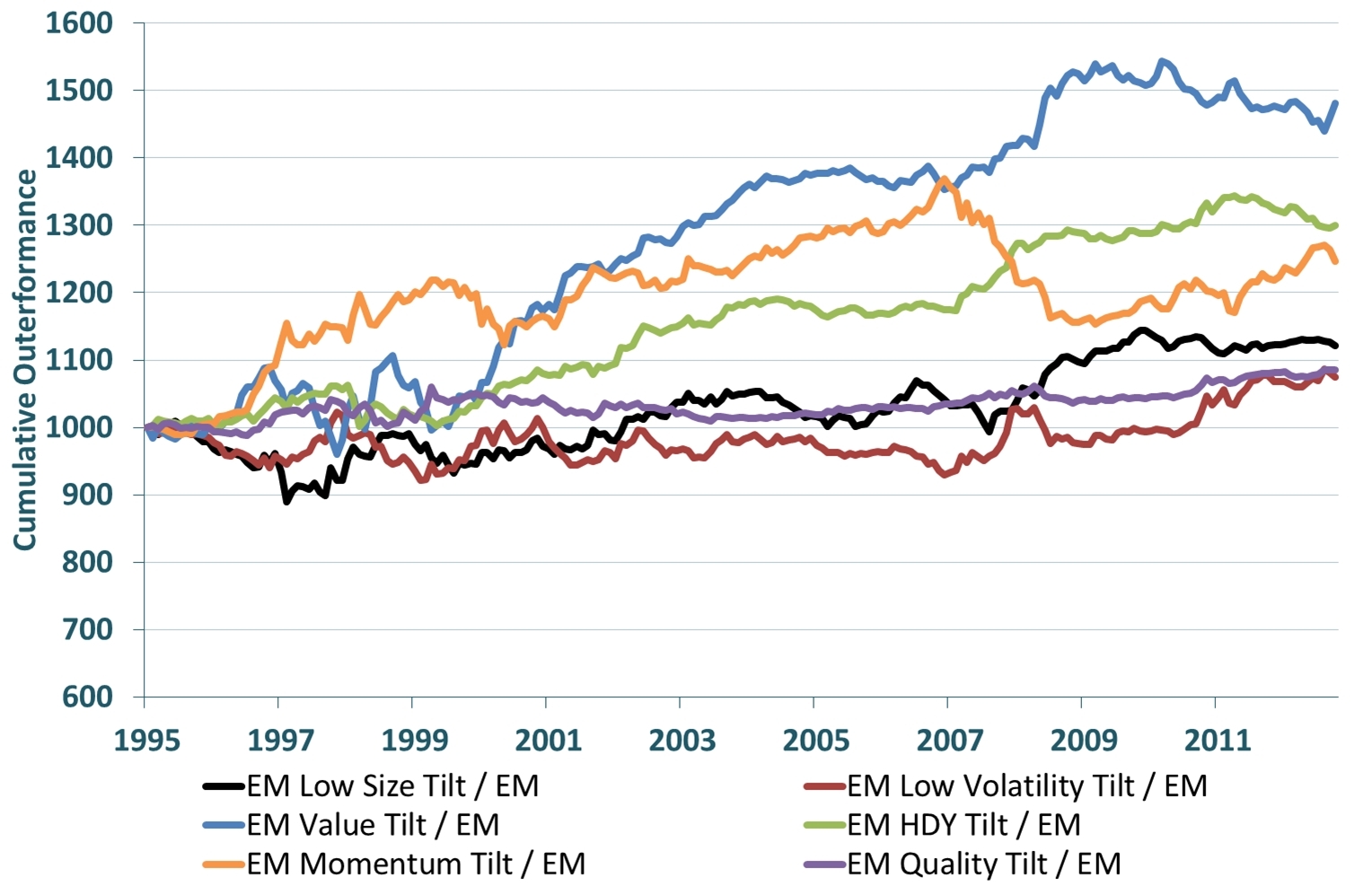

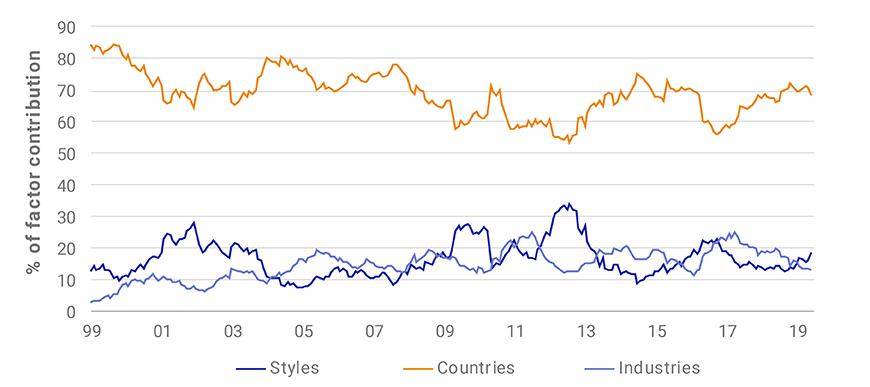

IShares Edge MSCI EM Minimum Volatility UCITS ETF. The MSCI Minimum Volatility Indexes are part of the MSCI Factor Indexes which represent the return of factors common stock characteristics that have historically earned a persistent premium over long periods of time. The MSCI Minimum Volatility Indexes are designed to serve as transparent benchmarks for minimum. The value of your investment and the income. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. The index measures the performance of equity securities in global emerging markets that have lower volatility relative to the equity securities included in.

IShares Edge MSCI EM Minimum Volatility UCITS ETF.

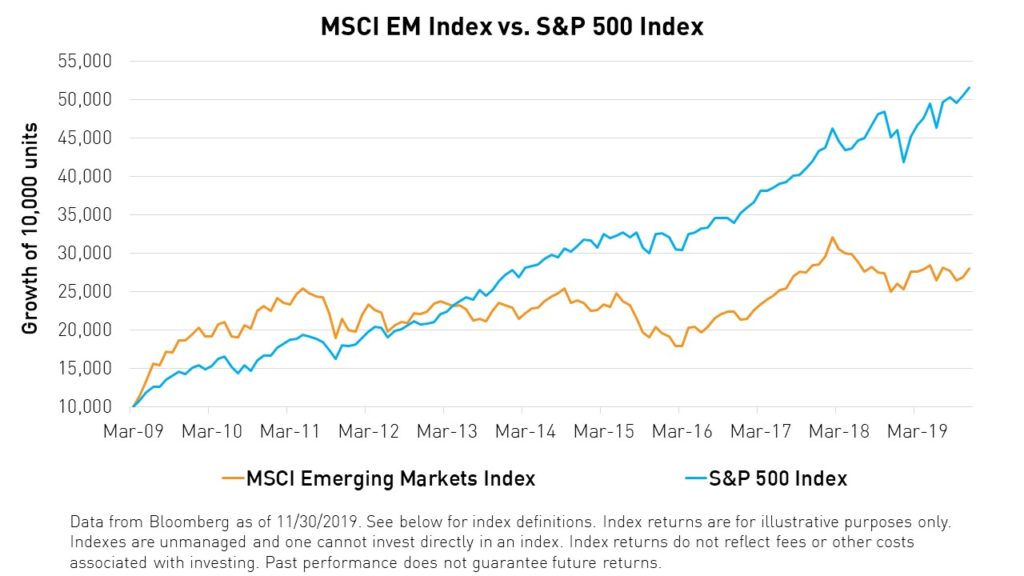

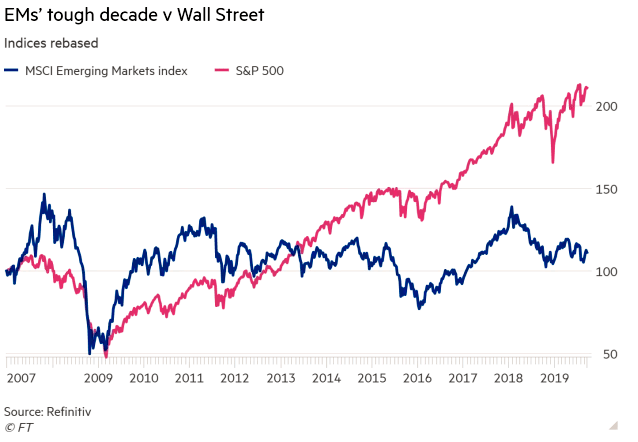

The table below includes fund flow data for all US. MSCI Emerging Markets Minimum Volatility Index 127 333 630 1122 758 831 546 MSCI Emerging Markets Investable Market Index -057 164 246 1016 1195 1115 578 All returns. Fees as stated in the prospectus Expense Ratio. IShares Edge MSCI EM Minimum Volatility UCITS ETF. IShares Edge MSCI EM Minimum Volatility UCITS ETF. It seeks to track the performance of the MSCI Emerging Markets Minimum Volatility USD Index by using representative sampling technique.

Source: investors-corner.bnpparibas-am.com

Source: investors-corner.bnpparibas-am.com

NAV as of Nov 22 2021 6345. The underlying index is the MSCI EM Minimum Volatility Net Total Return Index denominated in USD. IShares Edge MSCI EM Minimum Volatility UCITS ETF. IShares Edge MSCI EM Minimum Volatility UCITS ETF. IShares MSCI Emerging Markets Min Vol Factor ETF.

Source: pinterest.com

Source: pinterest.com

IShares Edge MSCI EM Minimum Volatility UCITS ETF EMMV. The MSCI Minimum Volatility Indexes are designed to serve as transparent benchmarks for minimum. The value of your investment and the income. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. The MSCI Minimum Volatility Index is constructed using the most recent release of the Barra Open Optimizer in combination with the relevant Barra Equity Model.

Source: ig.com

Source: ig.com

1 Day NAV Change as of 20Aug2021 -020 -060 NAV Total Return as of 19Aug2021 YTD. The iShares MSCI Emerging Markets Min Vol Factor ETF seeks to track the investment results of an index composed of emerging market equities that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. It seeks to track the performance of the MSCI Emerging Markets Minimum Volatility USD Index by using representative sampling technique. The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. MSCI Emerging Markets Minimum Volatility Index 127 333 630 1122 758 831 546 MSCI Emerging Markets Investable Market Index -057 164 246 1016 1195 1115 578 All returns.

The MSCI Minimum Volatility Indexes are part of the MSCI Factor Indexes which represent the return of factors common stock characteristics that have historically earned a persistent premium over long periods of time. IShares Edge MSCI EM Minimum Volatility UCITS ETF. IShares Edge MSCI EM Minimum Volatility UCITS ETF. IShares MSCI Emerging Markets Min Vol Factor ETF. The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets.

Source: businesswire.com

Source: businesswire.com

MSCI Emerging Markets Minimum Volatility Index 127 333 630 1122 758 831 546 MSCI Emerging Markets Investable Market Index -057 164 246 1016 1195 1115 578 All returns. It uses an optimizer to select and weight stocks from the MSCI Emerging Markets Index in a. 1 Day NAV Change as of Nov 19 2021 -008 -024 NAV Total Return as of Nov 18 2021 YTD. The MSCI Emerging Markets Minimum Volatility Net Total Return Index Futures are cash settled upon expiration. The fund tracks the MSCI Emerging Markets Minimum Volatility Index.

The fund tracks the MSCI Emerging Markets Minimum Volatility Index. The MSCI Minimum Volatility Indexes are designed to serve as transparent benchmarks for minimum. USD Accumulating NAV as of 20Aug2021 USD 3301. The iShares MSCI Emerging Markets Min Vol Factor ETF seeks to track the investment results of an index composed of emerging market equities that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets.

Source: ig.com

Source: ig.com

MSCI Emerging Markets Minimum Volatility Index 127 333 630 1122 758 831 546 MSCI Emerging Markets Investable Market Index -057 164 246 1016 1195 1115 578 All returns. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. Fees as stated in the prospectus Expense Ratio. The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. MSCI EMERGING MARKETS MINIMUM VOLATILITY EUR INDEX The MSCI Emerging Markets Minimum Volatility EUR Index aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid-cap equities across 23 Emerging Markets EM countries.

Source: kraneshares.com

Source: kraneshares.com

The MSCI Minimum Volatility Indexes are part of the MSCI Factor Indexes which represent the return of factors common stock characteristics that have historically earned a persistent premium over long periods of time. IShares Edge MSCI EM Minimum Volatility UCITS ETF. MSCI minimum volatility indexes. The iShares MSCI Emerging Markets Minimum Volatility Index ETF seeks to provide long-term capital growth by replicating to the extent possible the performance of the MSCI Emerging Markets Minimum Volatility Index USD net of expenses. NAV as of Nov 22 2021 6345.

Source: ipe.com

Source: ipe.com

1 Day NAV Change as of Nov 22 2021 -059 -092 NAV Total Return as of Nov 19 2021 YTD. Emerging markets exposure with lower volatility characteristics INVESTMENT OBJECTIVE The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. The fund tracks the MSCI Emerging Markets Minimum Volatility Index. The index measures the performance of equity securities in global emerging markets that have lower volatility relative to the equity securities included in.

Source: msci.com

Source: msci.com

The MSCI Minimum Volatility Index is constructed using the most recent release of the Barra Open Optimizer in combination with the relevant Barra Equity Model. XMM A complete iShares MSCI Minimum Volatility Emerging Markets Index ETF Units exchange traded fund overview by MarketWatch. IShares Edge MSCI EM Minimum Volatility UCITS ETF. MSCI Emerging Markets Minimum Volatility Index 127 333 630 1122 758 831 546 MSCI Emerging Markets Investable Market Index -057 164 246 1016 1195 1115 578 All returns. ETFs Tracking The MSCI Emerging Markets Minimum Volatility Index ETF Fund Flow.

Source: blog.techcharts.net

Source: blog.techcharts.net

The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. The underlying index is the MSCI EM Minimum Volatility Net Total Return Index denominated in USD. The iShares MSCI Emerging Markets Minimum Volatility Index ETF seeks to provide long-term capital growth by replicating to the extent possible the performance of the MSCI Emerging Markets Minimum Volatility Index USD net of expenses. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. IShares MSCI Emerging Markets Min Vol Factor ETF.

Source: man.com

Source: man.com

The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. The index measures the performance of equity securities in global emerging markets that have lower volatility relative to the equity securities included in. 1 Day NAV Change as of Nov 22 2021 -059 -092 NAV Total Return as of Nov 19 2021 YTD. The MSCI Minimum Volatility Index is constructed using the most recent release of the Barra Open Optimizer in combination with the relevant Barra Equity Model. The iShares MSCI Emerging Markets Min Vol Factor ETF seeks to track the investment results of an index composed of emerging market equities that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets.

Source: isabelnet.com

Source: isabelnet.com

Benchmark MSCI Emerging Markets Minimum Volatility Index ISIN IE00B8KGV557 Total Expense Ratio 040 Distribution Type None Domicile Ireland Methodology Optimised Product Structure Physical Rebalance Frequency Semi-Annual UCITS Yes ISA Eligibility Yes SIPP Available Yes UK DistributorReporting Status NoYes Use of Income Accumulating. 1 Day NAV Change as of 20Aug2021 -020 -060 NAV Total Return as of 19Aug2021 YTD. The MSCI Minimum Volatility Indexes are designed to serve as transparent benchmarks for minimum. The value of your investment and the income. IShares Edge MSCI EM Minimum Volatility UCITS ETF.

Source: etftrends.com

Source: etftrends.com

View the latest ETF prices and news for better ETF investing. The MSCI Minimum Volatility Index is constructed using the most recent release of the Barra Open Optimizer in combination with the relevant Barra Equity Model. XMM A complete iShares MSCI Minimum Volatility Emerging Markets Index ETF Units exchange traded fund overview by MarketWatch. IShares Edge MSCI EM Minimum Volatility UCITS ETF EMMV. 1 Day NAV Change as of Nov 22 2021 -059 -092 NAV Total Return as of Nov 19 2021 YTD.

Source: researchgate.net

Source: researchgate.net

The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. IShares Edge MSCI EM Minimum Volatility UCITS ETF. The iShares MSCI Emerging Markets Min Vol Factor ETF seeks to track the investment results of an index composed of emerging market equities that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. 1 Day NAV Change as of Nov 22 2021 -059 -092 NAV Total Return as of Nov 19 2021 YTD. The index is calculated by optimizing the MSCI ACWI Index its parent index in USD for the lowest absolute.

Source: globalxetfs.co.jp

Source: globalxetfs.co.jp

It seeks to track the performance of the MSCI Emerging Markets Minimum Volatility USD Index by using representative sampling technique. MSCI EMERGING MARKETS MINIMUM VOLATILITY EUR INDEX The MSCI Emerging Markets Minimum Volatility EUR Index aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid-cap equities across 23 Emerging Markets EM countries. It seeks to track the performance of the MSCI Emerging Markets Minimum Volatility USD Index by using representative sampling technique. The table below includes fund flow data for all US. Fees as stated in the prospectus Expense Ratio.

Benchmark MSCI Emerging Markets Minimum Volatility Index ISIN IE00B8KGV557 Total Expense Ratio 040 Distribution Type None Domicile Ireland Methodology Optimised Product Structure Physical Rebalance Frequency Semi-Annual UCITS Yes ISA Eligibility Yes SIPP Available Yes UK DistributorReporting Status NoYes Use of Income Accumulating. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. MSCI Emerging Markets Minimum Volatility Index 127 333 630 1122 758 831 546 MSCI Emerging Markets Investable Market Index -057 164 246 1016 1195 1115 578 All returns. The iShares MSCI Emerging Markets Min Vol Factor ETF seeks to track the investment results of an index composed of emerging market equities that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. XMM A complete iShares MSCI Minimum Volatility Emerging Markets Index ETF Units exchange traded fund overview by MarketWatch.

The iShares MSCI Emerging Markets Minimum Volatility Index ETF seeks to provide long-term capital growth by replicating to the extent possible the performance of the MSCI Emerging Markets Minimum Volatility Index USD net of expenses. IShares Edge MSCI EM Minimum Volatility UCITS ETF. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. The index measures the performance of equity securities in global emerging markets that have lower volatility relative to the equity securities included in. The iShares MSCI Emerging Markets Minimum Volatility Index ETF seeks to provide long-term capital growth by replicating to the extent possible the performance of the MSCI Emerging Markets Minimum Volatility Index USD net of expenses.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title msci emerging markets minimum volatility index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 35++ Todays volatility index Trend

- 14++ Royal dutch shell market cap Wallet

- 26+ Travala coinmarketcap List

- 24++ Dow jones market today Mining

- 31+ Bombardier market cap Stock

- 22+ Best performing digital currency Trading

- 37+ Toyota market cap in usd Trending

- 29++ Apple inc market cap Bitcoin

- 19+ Cbn and cryptocurrency Trend

- 31++ 1 trillion market cap Best