28++ Market community implied volatility Popular

Home » Mining » 28++ Market community implied volatility PopularYour Market community implied volatility trading are available. Market community implied volatility are a trading that is most popular and liked by everyone now. You can Download the Market community implied volatility files here. Find and Download all royalty-free news.

If you’re searching for market community implied volatility pictures information linked to the market community implied volatility keyword, you have visit the right blog. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Market Community Implied Volatility. What is implied volatility. The two most common types of. The measure reflects the markets view on the likelihood of movements in prices for the underlying having the tendency to increase when prices decline and thus reflect the riskier picture. Thus the model is able to capture the stochastic movements of a full term structure of implied volatilities.

The two most common types of. What Does Implied Volatility Measure. Suppose you quote bidask prices vols around the prices given by your implied vol surface. Implied volatility data is information about the markets prediction of certain securitys value. Implied volatility is calculated by taking the price of a stock on the market and putting it in an equation that takes into account the time till the option expires as well as other conditions of the marketplace. What is implied volatility.

By using market price of the option as a known variable in the BS formula underlying volatility can be back calculated and the volatility calculated this way is known as implied volatility.

It acts as a good reference point for understanding whether the IV is higherlower as compared to the historical volatility. As you can probably deduce a stock with a high Implied Volatility is expected to have large swings in price while a. According to the CFA institute implied volatility is a measure of the expected risk with regards to the underlying for an option. Implied volatility is the estimated volatility of an asset underlying an option and is derived from an options price. The past is history. While reading How does implied volatility affect option pricing by Investopedia it states the following in key takeaways.

Source: pinterest.com

Source: pinterest.com

A non-option financial instrument that has embedded optionality such as an interest rate cap can also have an implied. Implied volatility does not forecast the direction in which the price change will progress. When options markets experience a downtrend implied volatility generally increases. Analysts take into account numerous factors to project the likely movements in securities prices. What Does Implied Volatility Measure.

Source: pinterest.com

Source: pinterest.com

It acts as a good reference point for understanding whether the IV is higherlower as compared to the historical volatility. An example of this is if the security has high. Implied volatility data is information about the markets prediction of certain securitys value. Implied volatility represents market expectation of the volatility and it is often used to. The two most common types of.

Source: thebluecollarinvestor.com

Source: thebluecollarinvestor.com

The past is history. In theory one may interpret option-implied volatility as the aggregate view on how volatile the underlying security will be between a given day and the option expiry and hence should be as good a predictor as any. A non-option financial instrument that has embedded optionality such as an interest rate cap can also have an implied. While reading How does implied volatility affect option pricing by Investopedia it states the following in key takeaways. Implied volatility is a tool that all market participants need to embrace as it is a real-time indicator of market sentiment.

Source: pinterest.com

Source: pinterest.com

Implied volatility represents market expectation of the volatility and it is often used to. Thus the model is able to capture the stochastic movements of a full term structure of implied volatilities. In theory one may interpret option-implied volatility as the aggregate view on how volatile the underlying security will be between a given day and the option expiry and hence should be as good a predictor as any. The present is all that matters for traders and investors History depends on interpretation. As you can probably deduce a stock with a high Implied Volatility is expected to have large swings in price while a.

Source: pinterest.com

Source: pinterest.com

In order to manage inventory and deal with asymmetric information risks it is necessary to adjust you bidask quotes as you are hitlifted. What is implied volatility. Implied volatility is calculated by taking the price of a stock on the market and putting it in an equation that takes into account the time till the option expires as well as other conditions of the marketplace. Traders buy options callput. One of the reasons is that the market activity in OTM options is greater than in in-the-money ITM options because they have lower delta and are thus cheaper to hedge and offer higher leverage.

By using market price of the option as a known variable in the BS formula underlying volatility can be back calculated and the volatility calculated this way is known as implied volatility. In order to manage inventory and deal with asymmetric information risks it is necessary to adjust you bidask quotes as you are hitlifted. Implied volatility indices are constructed from out-of-the-money OTM call and put option premia. The measure reflects the markets view on the likelihood of movements in prices for the underlying having the tendency to increase when prices decline and thus reflect the riskier picture. Vis-a-vis the implied volatility as explained above historical volatility is the actual computed volatility of the stocksecurityasset over the past year.

Source: id.pinterest.com

Source: id.pinterest.com

The past is history. Implied volatility does not forecast the direction in which the price change will progress. The two most common types of. Implied volatility is calculated by taking the price of a stock on the market and putting it in an equation that takes into account the time till the option expires as well as other conditions of the marketplace. In theory one may interpret option-implied volatility as the aggregate view on how volatile the underlying security will be between a given day and the option expiry and hence should be as good a predictor as any.

Source: pinterest.com

Source: pinterest.com

What is implied volatility. Implied volatility is a critical metric in the determination of prices of options contracts. Accompanied by an implied volatility number which is a model-based estimate of future volatility as implied by option prices. According to the CFA institute implied volatility is a measure of the expected risk with regards to the underlying for an option. It is expressed in percentages.

The conditions are derived that have to be. One of the reasons is that the market activity in OTM options is greater than in in-the-money ITM options because they have lower delta and are thus cheaper to hedge and offer higher leverage. Implied volatility is a critical metric in the determination of prices of options contracts. The two most common types of. Vis-a-vis the implied volatility as explained above historical volatility is the actual computed volatility of the stocksecurityasset over the past year.

Source: pinterest.com

Source: pinterest.com

Options with elevated implied volatility are an indication that investors are anticipating the underlying equity to experience higher than normal price swings relative to its historical range. Suppose you quote bidask prices vols around the prices given by your implied vol surface. By using market price of the option as a known variable in the BS formula underlying volatility can be back calculated and the volatility calculated this way is known as implied volatility. The present is all that matters for traders and investors History depends on interpretation. In order to manage inventory and deal with asymmetric information risks it is necessary to adjust you bidask quotes as you are hitlifted.

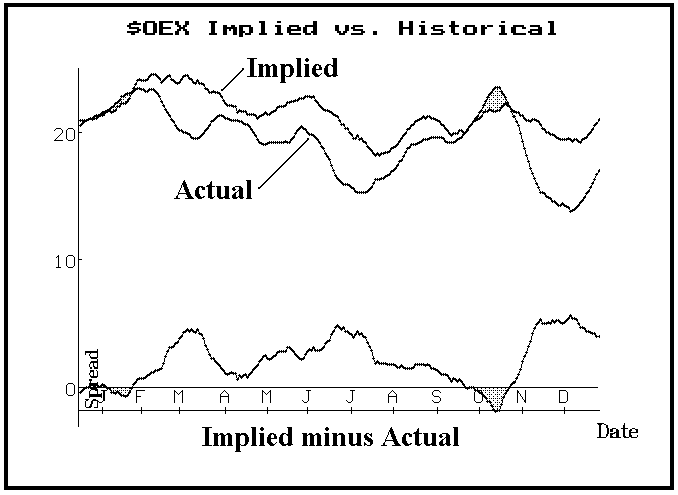

Source: optionstrategist.com

Source: optionstrategist.com

Options with elevated implied volatility are an indication that investors are anticipating the underlying equity to experience higher than normal price swings relative to its historical range. Implied volatility represents market expectation of the volatility and it is often used to. Implied volatility falls when the options market shows an upward trend. Implied volatility indices are constructed from out-of-the-money OTM call and put option premia. The past is history.

Source: pinterest.com

Source: pinterest.com

Accompanied by an implied volatility number which is a model-based estimate of future volatility as implied by option prices. Vis-a-vis the implied volatility as explained above historical volatility is the actual computed volatility of the stocksecurityasset over the past year. Implied volatility does not forecast the direction in which the price change will progress. The conditions are derived that have to be. Accompanied by an implied volatility number which is a model-based estimate of future volatility as implied by option prices.

Source: pinterest.com

Source: pinterest.com

While reading How does implied volatility affect option pricing by Investopedia it states the following in key takeaways. It is expressed in percentages. Implied volatility represents market expectation of the volatility and it is often used to. The two most common types of. In layman terms Implied Volatility is the market opinion of the potential movement or range of a stock over the following 12-month period.

Source: tradingview.com

Source: tradingview.com

In theory one may interpret option-implied volatility as the aggregate view on how volatile the underlying security will be between a given day and the option expiry and hence should be as good a predictor as any. It acts as a good reference point for understanding whether the IV is higherlower as compared to the historical volatility. In order to manage inventory and deal with asymmetric information risks it is necessary to adjust you bidask quotes as you are hitlifted. According to the CFA institute implied volatility is a measure of the expected risk with regards to the underlying for an option. An example of this is if the security has high.

Source: pinterest.com

Source: pinterest.com

Implied volatility measures the probability that a certain stock will change in price. One of the reasons is that the market activity in OTM options is greater than in in-the-money ITM options because they have lower delta and are thus cheaper to hedge and offer higher leverage. While reading How does implied volatility affect option pricing by Investopedia it states the following in key takeaways. The conditions are derived that have to be. Accompanied by an implied volatility number which is a model-based estimate of future volatility as implied by option prices.

Source: ig.com

Source: ig.com

Traders buy options callput. By comparing implied volatility to historical averages investors find insights into which equities may be facing higher or lower future volatility in the future. The past is history. An example of this is if the security has high. One of the reasons is that the market activity in OTM options is greater than in in-the-money ITM options because they have lower delta and are thus cheaper to hedge and offer higher leverage.

Source: pinterest.com

Source: pinterest.com

Implied volatility is a critical metric in the determination of prices of options contracts. However implied volatility does not clarify in which direction prices will move. The idea builds on my previous Implied Move script which helps visualize the distribution of prices that the market is pricing in via optionsimplied volatility. In layman terms Implied Volatility is the market opinion of the potential movement or range of a stock over the following 12-month period. The past is history.

Source: id.pinterest.com

Source: id.pinterest.com

Options with elevated implied volatility are an indication that investors are anticipating the underlying equity to experience higher than normal price swings relative to its historical range. One of the reasons is that the market activity in OTM options is greater than in in-the-money ITM options because they have lower delta and are thus cheaper to hedge and offer higher leverage. In layman terms Implied Volatility is the market opinion of the potential movement or range of a stock over the following 12-month period. Implied volatility is one of the important parameters and a vital component of the Black-Scholes model which is an option pricing model that shall give the options market price or market value. It is expressed in percentages.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title market community implied volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 32++ Sp 500 minimum volatility index Top

- 43+ Adx coinmarketcap News

- 10+ Bmo market cap Trending

- 10+ Investment opportunity Trend

- 35++ Fantom market cap Mining

- 29+ Tqqq premarket Top

- 26+ Dao coinmarketcap Bitcoin

- 34+ Us commodity market Mining

- 49++ New currencies on coinbase Top

- 23+ Coinmarketcap cashaa Mining