40+ Instruments of new issue market Trending

Home » Mining » 40+ Instruments of new issue market TrendingYour Instruments of new issue market coin are ready in this website. Instruments of new issue market are a trading that is most popular and liked by everyone this time. You can Find and Download the Instruments of new issue market files here. News all free wallet.

If you’re searching for instruments of new issue market pictures information connected with to the instruments of new issue market topic, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Instruments Of New Issue Market. After a prospectus is issued the public subscribes to shares debentures etc. Directing the various agencies involved in the public issue. The stock issuing company also. There are various methods of floating new issues in the primary market.

Diy Modified Steinberger Spirit Guitar Piezo Center Pu Guitar Luthier Guitar Guitar Design From pinterest.com

Diy Modified Steinberger Spirit Guitar Piezo Center Pu Guitar Luthier Guitar Guitar Design From pinterest.com

Registrars to the Issue 4. Primary markets create long term instruments through which corporate entities raise funds from the capital market. But under the law a part of the new public issue must be offered to the general public. A primary market is a place where companies bring a new issue of shares for being subscribed by the general public for raising funds to fulfil their long-term capital requirement like expanding the existing business or purchasing new entity. New primary issuance of fixed income instruments new bond issuance or new issue follows a process that is presented below at a high level. After a prospectus is issued the public subscribes to shares debentures etc.

The financial arrangements for the purpose include considerations of promoters equity liquidity ratio debt-equity ratio and requirement of foreign exchange.

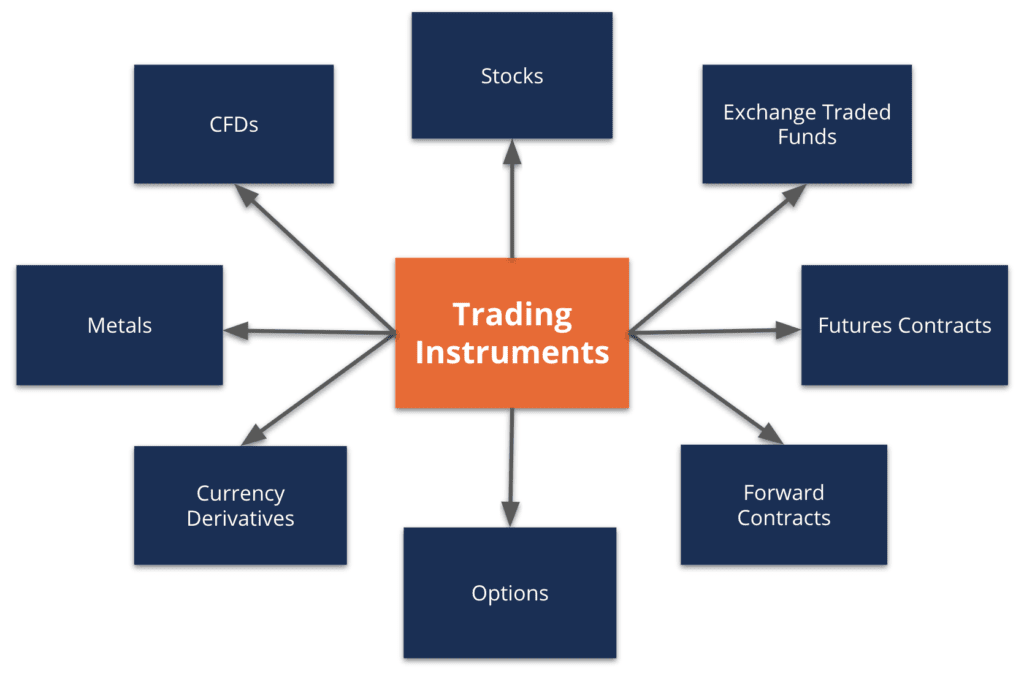

A capital market is a place that allows the trading of funding instruments such as shares debentures debt instruments bonds ETFs etc. The important intermediariesplayers in the new issue market are. Markets during a new issue period. There are a variety of fees or costs that a company incurs when issuing new securities into the market on behalf of their company. It plays an important role in mobilizing the funds from the savers and transferring them to the borrowers. Offer through prospectus is the most popular method of raising funds by public companies in the primary market.

Source: pinterest.com

Source: pinterest.com

FUNCTIONS OF NEW ISSUE MARKET The main function of new issue market is to facilitate transfer resources from savers to the users. The primary market is the part of the capital market that deals with the issuance and sale of equity-backed securities to investors directly by the issuer. Banker to the Issue 6. It is called After Issue Market. Mandate for the new issue and unwound at or in close proximity to the time of pricing of the.

Source: ar.pinterest.com

Source: ar.pinterest.com

In India key financial instruments that are traded in the stock market include shares mutual funds derivatives and bonds. After a prospectus is issued the public subscribes to shares debentures etc. The average size of public issues however increased from Rs272 crore in 2006-07 to Rs703 crore in 2007-08. A primary market or the so-called new issue market is where securities such as shares and bonds are being created and traded for the first time without using any intermediary such as an exchange in. Primary markets create long term instruments through which corporate entities raise funds from the capital market.

Source: pinterest.com

Source: pinterest.com

Since issuers of money market instruments have a high credit rating and the returns are fixed beforehand the risk of losing your invested capital is minuscule. Clerical fees Costs of issuing and reacquiring equity instruments There are clerks responsible for preparing the forms that must be filled out and filed when new securities are. Offer through prospectus is the most popular method of raising funds by public companies in the primary market. Since issuers of money market instruments have a high credit rating and the returns are fixed beforehand the risk of losing your invested capital is minuscule. Primary markets create long term instruments through which corporate entities raise funds from the capital market.

Source: id.pinterest.com

Source: id.pinterest.com

It is the work that is before the issue is actually floated into the market. The stock issuing company also. The main function of new issue market can be divided into three service functions. The remainder of the article focuses on elaborating on the basics of these. The financial market is the melting pot for millions of investors across the world to come together and trade a gamut of financial instruments.

Source: pinterest.com

Source: pinterest.com

For them there is no problem of sale of stock to the public. It is a source for raising funds for individuals firms and governments. The important intermediariesplayers in the new issue market are. It is called After Issue Market. Banker to the Issue 6.

Source: pinterest.com

Source: pinterest.com

Out of 119 issues 82 issues were initial public offerings IPOs accounting for 477 per cent of total resource mobilisation. The remainder of the article focuses on elaborating on the basics of these. In India key financial instruments that are traded in the stock market include shares mutual funds derivatives and bonds. It is the work that is before the issue is actually floated into the market. The financial arrangements for the purpose include considerations of promoters equity liquidity ratio debt-equity ratio and requirement of foreign exchange.

Source: pinterest.com

Source: pinterest.com

A primary market is a place where companies bring a new issue of shares for being subscribed by the general public for raising funds to fulfil their long-term capital requirement like expanding the existing business or purchasing new entity. The primary market is concerned with the floatation of new issues of shares or bonds. Banker to the Issue 6. It is a place where already issued or existing shares are traded. Clerical fees Costs of issuing and reacquiring equity instruments There are clerks responsible for preparing the forms that must be filled out and filed when new securities are.

Source: id.pinterest.com

Source: id.pinterest.com

The important intermediariesplayers in the new issue market are. A primary market or the so-called new issue market is where securities such as shares and bonds are being created and traded for the first time without using any intermediary such as an exchange in. Primary markets create long term instruments through which corporate entities raise funds from the capital market. It is a way of issuing fresh shares in the market. The Stock market provides financing by sharing the ownership of a company through stocks issuing and trading.

Source: pinterest.com

Source: pinterest.com

A major component of the primary market is the IPO. Mandate for the new issue and unwound at or in close proximity to the time of pricing of the. It is a place where already issued or existing shares are traded. In India key financial instruments that are traded in the stock market include shares mutual funds derivatives and bonds. In the recent years a number of new instruments such as PCDs FCDs PSBs and CCPs etc.

Source: pinterest.com

Source: pinterest.com

Out of 119 issues 82 issues were initial public offerings IPOs accounting for 477 per cent of total resource mobilisation. Market Scheme Treasury Bill Market Money Market Instruments Commercial Papers Certificate of Deposit CD Inter-bank Participation Certificate Repo Instruments Structure of Indian Money. The primary market is the part of the capital market that deals with the issuance and sale of equity-backed securities to investors directly by the issuer. The term-lending institutions the LIC the UTI and several other financial institutions usually underwrite new issues as direct investments for their own portfolios. The Stock market provides financing by sharing the ownership of a company through stocks issuing and trading.

Source: pinterest.com

Source: pinterest.com

It is a source for raising funds for individuals firms and governments. It is also called New Issue Market. The amount received from the issue of shares goes to the company for their business expansion purposes. It is a place where already issued or existing shares are traded. The stock issuing company also.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The important intermediariesplayers in the new issue market are. Merchant Bankers Managers to the Issue. It plays an important role in mobilizing the funds from the savers and transferring them to the borrowers. A primary market or the so-called new issue market is where securities such as shares and bonds are being created and traded for the first time without using any intermediary such as an exchange in. Clerical fees Costs of issuing and reacquiring equity instruments There are clerks responsible for preparing the forms that must be filled out and filed when new securities are.

Source: pinterest.com

Source: pinterest.com

Registrars to the Issue 4. Clerical fees Costs of issuing and reacquiring equity instruments There are clerks responsible for preparing the forms that must be filled out and filed when new securities are. Market Scheme Treasury Bill Market Money Market Instruments Commercial Papers Certificate of Deposit CD Inter-bank Participation Certificate Repo Instruments Structure of Indian Money. A capital market is a place that allows the trading of funding instruments such as shares debentures debt instruments bonds ETFs etc. The primary market is the part of the capital market that deals with the issuance and sale of equity-backed securities to investors directly by the issuer.

Source: pinterest.com

Source: pinterest.com

The remainder of the article focuses on elaborating on the basics of these. There are a variety of fees or costs that a company incurs when issuing new securities into the market on behalf of their company. Further details of the new bond issuance process. The term-lending institutions the LIC the UTI and several other financial institutions usually underwrite new issues as direct investments for their own portfolios. Merchant Bankers Managers to the Issue.

Source: pinterest.com

Source: pinterest.com

Investors buy securities that were never traded before. The amount received from the issue of shares goes to the company for their business expansion purposes. The financial arrangements for the purpose include considerations of promoters equity liquidity ratio debt-equity ratio and requirement of foreign exchange. A major component of the primary market is the IPO. The main function of new issue market can be divided into three service functions.

Source: pinterest.com

Source: pinterest.com

In the recent years a number of new instruments such as PCDs FCDs PSBs and CCPs etc. Mandate for the new issue and unwound at or in close proximity to the time of pricing of the. The securities scam during 1991 caused a temporary setback to the growing new issue market in India. The stock issuing company also. Organising new issue offers involves a detailed assessment of project viability among other factors.

Source: pinterest.com

Source: pinterest.com

A primary market or the so-called new issue market is where securities such as shares and bonds are being created and traded for the first time without using any intermediary such as an exchange in. All public issues during 2007-08 were in the form of equity barring three which were in the form of debt. Out of 119 issues 82 issues were initial public offerings IPOs accounting for 477 per cent of total resource mobilisation. In India key financial instruments that are traded in the stock market include shares mutual funds derivatives and bonds. It is also known as the New Issue Market.

Source: pinterest.com

Source: pinterest.com

It is a source for raising funds for individuals firms and governments. The amount received from the issue of shares goes to the company for their business expansion purposes. Offer through prospectus is the most popular method of raising funds by public companies in the primary market. Merchant Bankers Managers to the Issue 2. Parties involved in the new issue Drafting the prospectus Preparing the budget of expenses related to the issue Suggesting the appropriate timings of the public issue Assisting in marketing the public issue successfully Advising the company in the appointment of registrars to the issue underwriters brokers etc.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title instruments of new issue market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 32++ Sp 500 minimum volatility index Top

- 43+ Adx coinmarketcap News

- 10+ Bmo market cap Trending

- 10+ Investment opportunity Trend

- 35++ Fantom market cap Mining

- 29+ Tqqq premarket Top

- 26+ Dao coinmarketcap Bitcoin

- 34+ Us commodity market Mining

- 49++ New currencies on coinbase Top

- 23+ Coinmarketcap cashaa Mining