28+ High volatility stocks meaning Coin

Home » Mining » 28+ High volatility stocks meaning CoinYour High volatility stocks meaning news are obtainable. High volatility stocks meaning are a exchange that is most popular and liked by everyone this time. You can Get the High volatility stocks meaning files here. Download all free mining.

If you’re searching for high volatility stocks meaning pictures information related to the high volatility stocks meaning interest, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

High Volatility Stocks Meaning. In the stock market volatility stands for the risk of change in the price of a security. Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows. In the stock market context rapid price fluctuation in either direction is considered as volatility. First what is a high volatility stock.

Understanding Stock Market Volatility Rule 1 Investing From ruleoneinvesting.com

Understanding Stock Market Volatility Rule 1 Investing From ruleoneinvesting.com

Traders with an investment mindset will often talk about volatility like its a bad thing. In the stock market context rapid price fluctuation in either direction is considered as volatility. A high beta index is a basket of stocks that exhibits greater volatility than a broad market index such as the SP 500 Index. Our favorite strategy is the iron condor followed by short strangles and straddles. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. In most cases a surge or dive of 1 in market indexes classifies it as a volatile market.

The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day.

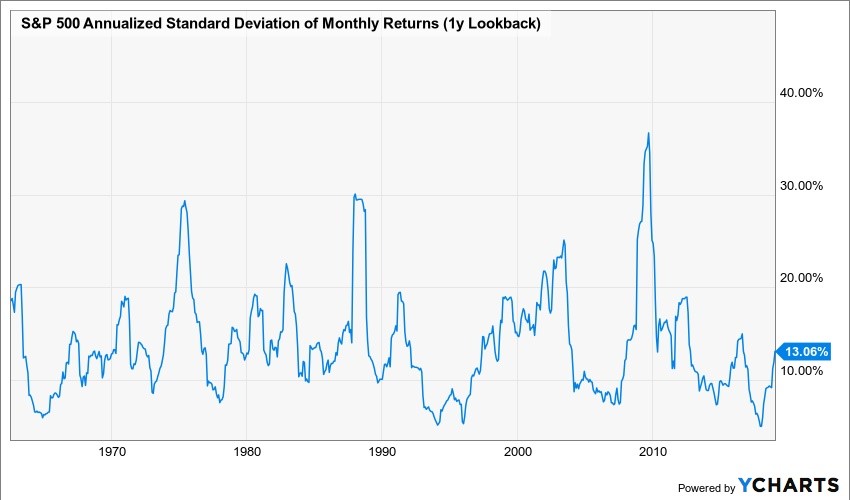

Day traders and swing traders often rely on a volatility-based strategy that aims. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods. A high beta index is a basket of stocks that exhibits greater volatility than a broad market index such as the SP 500 Index. High volatility is quite risky as it giv. A volatile stock simply means it moves. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day.

Source: fosterandmotley.com

Source: fosterandmotley.com

This means that the price of the security can change dramatically over a short time. A more stable stock will have a lower standard deviation. Stocks that move in any direction fruitfully can be deemed as high volatility stocks. If the prices of a security fluctuate slowly in a longer time span it is termed to have low volatility. While there is more risk associated with high-volatility stocks there is also greater potential reward.

Source: investopedia.com

Source: investopedia.com

High volatility stocks mean stocks that are showing big up and down moves or one-sided big moves daily during trading hours. High volatility is associated with higher risk. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. Trading volatile stocks is a two-sided sword the potential is exceptionally high but it also means that the risk is high. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods.

High volatility stocks meaning. A volatile stock simply means it moves. In most cases a surge or dive of 1 in market indexes classifies it as a volatile market. Here we are going to list down the Top 50 High Volatile Stocks NSE. Short calls and puts have their place and can be very effective but should only be run by more experienced option traders.

Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows. In most cases a surge or dive of 1 in market indexes classifies it as a volatile market. Such organisations usually produce goods and services having industry-first features and hence are highly demanded in the market. While there is more risk associated with high-volatility stocks there is also greater potential reward. Those who focus on options trading should also consider that volatility increases the premium that has to be paid for the option traded.

Source: lynalden.com

Source: lynalden.com

When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the. High volatility stocks mean stocks that are showing big up and down moves or one-sided big moves daily during trading hours. High volatility is quite risky as it giv. In the stock market volatility stands for the risk of change in the price of a security. High volatility is associated with higher risk.

Source: investopedia.com

Source: investopedia.com

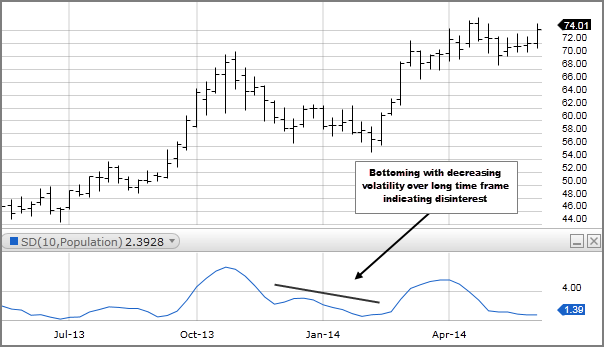

Volatility in the price of a stock or index is the measure of rangeextent into which the price is expected to fluctuate. Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows. If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility. If the prices of a security fluctuate slowly in a longer time span it is termed to have low volatility. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day.

Source: fidelity.com

Source: fidelity.com

Short calls and puts have their place and can be very effective but should only be run by more experienced option traders. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. A high volatility indicates big wild fluctuations whereas a low volatility means a narrow range bound stock price. In most cases a surge or dive of 1 in market indexes classifies it as a volatile market. A stock that maintains a relatively stable price has low volatility.

Source: investopedia.com

Source: investopedia.com

In simple words it is a rate at which stock price increases or decreases over time. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. Volatility stands for the risk of change in the price of a security. Stocks that move in any direction fruitfully can be deemed as high volatility stocks. High volatility means prices change frequently and dramatically in either direction.

Source: fool.com

Source: fool.com

In the stock market volatility stands for the risk of change in the price of a security. If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility. High volatility means prices change frequently and dramatically in either direction. A more stable stock will have a lower standard deviation. Whether they move within a 5 range continuously move up or down they can.

Source: dailyfx.com

Source: dailyfx.com

In simple words it is a rate at which stock price increases or decreases over time. Our favorite strategy is the iron condor followed by short strangles and straddles. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. In simple words it is a rate at which stock price increases or decreases over time. High volatility is associated with higher risk.

Source: youtube.com

Source: youtube.com

While there is more risk associated with high-volatility stocks there is also greater potential reward. Volatile stocks can boost your performance. A high volatility indicates big wild fluctuations whereas a low volatility means a narrow range bound stock price. What is volatility. A highly volatile stock may be spread out over a large range of values so this means that the price of the security can dramatically increase or decrease at any given short amount of time.

Source: school.stockcharts.com

Source: school.stockcharts.com

In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet. Short calls and puts have their place and can be very effective but should only be run by more experienced option traders. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet. A high-volatility stock has a higher deviation on average than other stocks. Trading volatile stocks is a two-sided sword the potential is exceptionally high but it also means that the risk is high.

Source: investopedia.com

Source: investopedia.com

Stocks may see unusually-high price volatility when important new information affecting the stocks valuation is made known to the public but the market is uncertain how that news will affect. Day traders and swing traders often rely on a volatility-based strategy that aims. Trading volatile stocks is a two-sided sword the potential is exceptionally high but it also means that the risk is high. Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows. A high-volatility stock has a higher deviation on average than other stocks.

Source: fidelity.com

Source: fidelity.com

Stocks may see unusually-high price volatility when important new information affecting the stocks valuation is made known to the public but the market is uncertain how that news will affect. In simple words it is a rate at which stock price increases or decreases over time. Here we are going to list down the Top 50 High Volatile Stocks NSE. Those who focus on options trading should also consider that volatility increases the premium that has to be paid for the option traded. While a highly volatile stock may be a more anxiety-producing choice for this kind of strategy a small amount of volatility can actually mean greater profits.

The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis considered highly volatile. The SP 500 High Beta Index is the most well-known of these indexes. A high beta index is a basket of stocks that exhibits greater volatility than a broad market index such as the SP 500 Index. A more stable stock will have a lower standard deviation.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

This means that the price of the security can change dramatically over a short time. When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the. In most cases a surge or dive of 1 in market indexes classifies it as a volatile market. Stocks may see unusually-high price volatility when important new information affecting the stocks valuation is made known to the public but the market is uncertain how that news will affect. You could then surmise that lower volatility stocks tend to be steadier over time considering that the value of security as measured statistically by the standard deviation does not fluctuate as dramatically as.

Source: timothysykes.com

Source: timothysykes.com

High volatility means prices change frequently and dramatically in either direction. It is a stock that has substantial price changes in a given period. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods. A volatile stock simply means it moves. Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows.

Source: capital.com

Source: capital.com

A high beta index is a basket of stocks that exhibits greater volatility than a broad market index such as the SP 500 Index. Volatile stocks can boost your performance. The SP 500 High Beta Index is the most well-known of these indexes. In simple words it is a rate at which stock price increases or decreases over time. A high beta index is a basket of stocks that exhibits greater volatility than a broad market index such as the SP 500 Index.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title high volatility stocks meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 32++ Sp 500 minimum volatility index Top

- 43+ Adx coinmarketcap News

- 10+ Bmo market cap Trending

- 10+ Investment opportunity Trend

- 35++ Fantom market cap Mining

- 29+ Tqqq premarket Top

- 26+ Dao coinmarketcap Bitcoin

- 34+ Us commodity market Mining

- 49++ New currencies on coinbase Top

- 23+ Coinmarketcap cashaa Mining