50++ Free float market capitalisation Top

Home » Trading » 50++ Free float market capitalisation TopYour Free float market capitalisation mining are available in this site. Free float market capitalisation are a coin that is most popular and liked by everyone this time. You can Find and Download the Free float market capitalisation files here. Download all free mining.

If you’re searching for free float market capitalisation images information related to the free float market capitalisation keyword, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

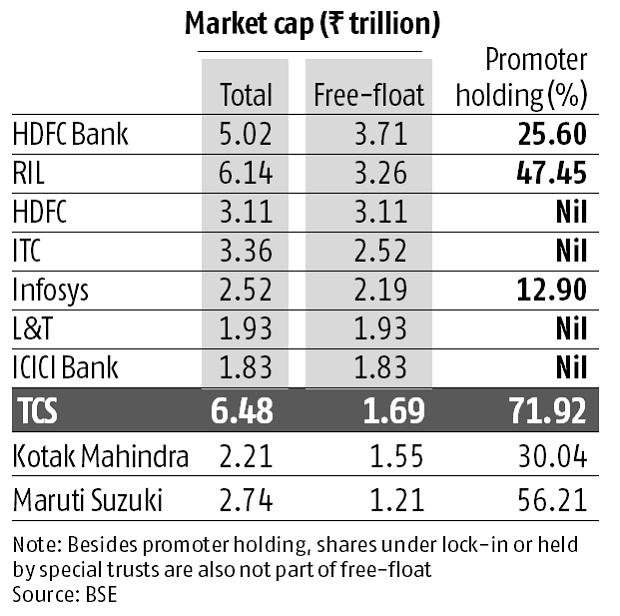

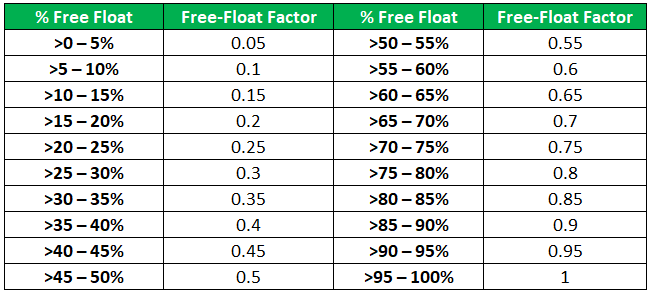

Free Float Market Capitalisation. Capped Free Float Adjusted Market Capitalization Weighted Quality Factored. Saat ini BEI masih menggunakan dua metode yaitu full market capitalization method dan capped adjusted free float market capitalization methodRencananya BEI akan mengubah metode penghitungan menjadi capped adjusted free float market capitalization weighted average method. These excluded shares are the free float sharesFor example if a company has issued 10 lakh shares of face value Rs 10 but of these four lakh shares is owned by the promoter then the free float market capitalisation is Rs 60 lakh. The free float percentage also known as float percentage of total shares outstanding simply shows the percentage of shares outstanding that trade freely.

What Is Free Float Market Capitalization Formula Calculation Live Example In English Youtube From youtube.com

What Is Free Float Market Capitalization Formula Calculation Live Example In English Youtube From youtube.com

This value is the sum of the free-float market cap sizes of all its listed entities. However we exclude shares held by private partie. It is important to note that the free float MCap is inversely proportional to the volatility of the shares in the market. See whenever a company wants to be listed in the stock market that company does not list all its shares that is it does not list 100 shares it can list all the shares but it depends on the company how much of the percentage shares that company want to list. This holding does not include those held by the government royalty or company insiders. These excluded shares are the free float sharesFor example if a company has issued 10 lakh shares of face value Rs 10 but of these four lakh shares is owned by the promoter then the free float market capitalisation is Rs 60 lakh.

The free-float technique is seen as a better way to calculate market capitalization as it provides a more accurate reflection of market movements and.

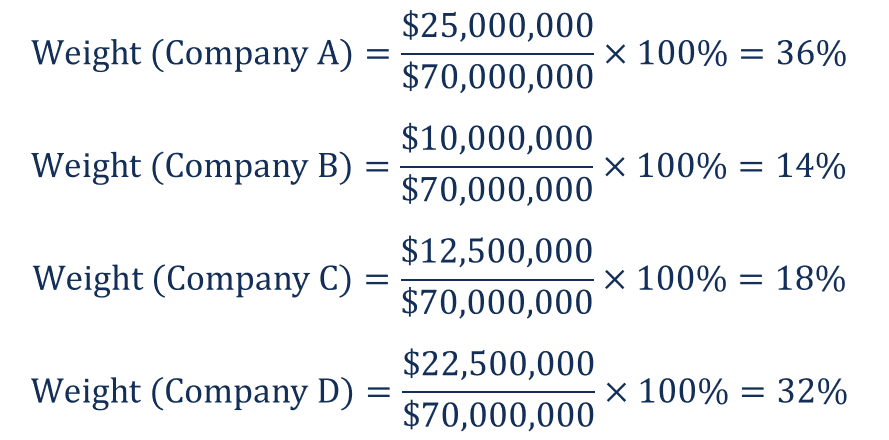

Capped Free Float Adjusted Market Capitalization Weighted. In the preceding example the free float percentage would be 90 450000 500000. Free float market capitalization is the current market value of the general public portion of the outstanding shares. However we exclude shares held by private partie. The term refers to that proportion of total shares which are actually available for trading in stock market. This value is the sum of the free-float market cap sizes of all its listed entities.

Source: youtube.com

Source: youtube.com

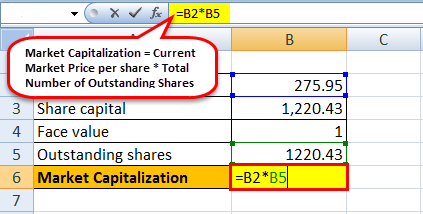

The free-float technique is seen as a better way to calculate market capitalization as it provides a more accurate reflection of market movements and. When calculating a companys total market capitalization all of its shares are multiplied by the stock price including those that are publicly traded as well as those held by promoters the government or other private parties. Understand the free-float method. The free-float market capitalization approach is calculated by taking the cost of equity and multiplying it by the number of easily accessible shares on the market. Implications of the Free Float Market Capitalisation.

Source: business-standard.com

Source: business-standard.com

The free float percentage also known as float percentage of total shares outstanding simply shows the percentage of shares outstanding that trade freely. Free-float market capitalization takes into consideration only those equity shares issued by the company that are readily available for trading in the market and DVR shares are not considered in the calculation of free-float market capitalization. In free float market capitalisation the value of the company is calculated by excluding shares held by the promoters. In the preceding example the free float percentage would be 90 450000 500000. The SP 500 is one example of a free.

Source: getmoneyrich.com

Source: getmoneyrich.com

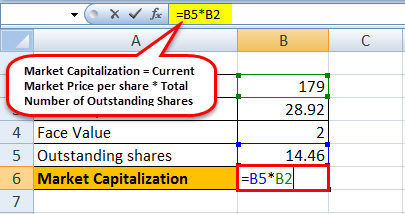

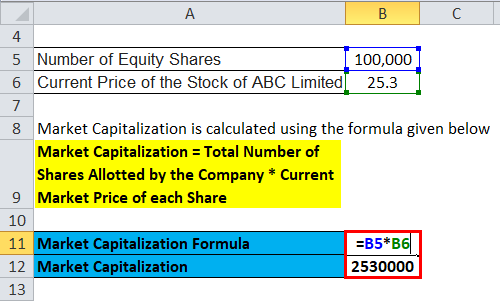

Implications of the Free Float Market Capitalisation. Free-float market capitalization is the value of the product of the current market price of the shares and the total number of shares that are readily accessible in the market for trading. Applying Free Float to Market Capitalization. Capped Free Float Adjusted Market Capitalization Weighted. Answer 1 of 18.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Answer 1 of 18. Applying Free Float to Market Capitalization. These shares do not include the shares which are of a locked-in type and which are closed for trading. In free-float market capitalization the value of the company is calculated by excluding shares held by the promoters. Free-float market capitalization takes into consideration only those equity shares issued by the company that are readily available for trading in the market and DVR shares are not considered in the calculation of free-float market capitalization.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

ACC has a free float market cap of Rs 12683 crores while the full market cap is around Rs. This holding does not include those held by the government royalty or company insiders. The market value of shares of a company that are available for trading is called free-float market capitalization. Capped Free Float Adjusted Market Capitalization Weighted Quality Factored. Capped Free Float Adjusted Market Capitalization Weighted.

Source: eaglesinvestors.com

Source: eaglesinvestors.com

The free-float market capitalization approach is calculated by taking the cost of equity and multiplying it by the number of easily accessible shares on the market. The market value of shares of a company that are available for trading is called free-float market capitalization. These shares do not include the shares which are of a locked-in type and which are closed for trading. Capped Free Float Adjusted Market Capitalization Weighted Quality Factored. This value is the sum of the free-float market cap sizes of all its listed entities.

Source: study.com

Source: study.com

Understand the free-float method. The Free Float Market Capitalization allows investors to differentiate companies with the smaller free-float size and those with medium and large. The free-float technique is seen as a better way to calculate market capitalization as it provides a more accurate reflection of market movements and. In free float market capitalisation the value of the company is calculated by excluding shares held by the promoters. In free-float market capitalization the value of the company is calculated by excluding shares held by the promoters.

Source: tradingsim.com

Source: tradingsim.com

The goal to calculate Free Float is to distinguish between strategic control shareholders whose holdings depend on concerns such as maintaining control rather than. Now let us understand the difference between full market cap and free float capitalization of ACC. IDX High Dividend 20. It is important to note that the free float MCap is inversely proportional to the volatility of the shares in the market. This capital can then be used to expand and develop the business as well as increase the companys profits.

Source: educba.com

Source: educba.com

When calculating a companys total market capitalization all of its shares are multiplied by the stock price including those that are publicly traded as well as those held by promoters the government or other private parties. For example to determine market capitalization in equity markets data providers and participants exclude company and executive team owned shares as well as shares owned by. Companies with a lower free float factor would mean that it is easier for traders to influence the price. It is important to note that the free float MCap is inversely proportional to the volatility of the shares in the market. The Free Float Market Capitalization allows investors to differentiate companies with the smaller free-float size and those with medium and large.

Source: qontigo.com

Source: qontigo.com

Metode ini digunakan karena dianggap lebih mampu menggambarkan kondisi perusahaan di lapangan. Typically investors expect a market size measurement to reflect the total value of assets that are available in the market. Companies with a lower free float factor would mean that it is easier for traders to influence the price. The free float of Company A is 450000 shares 500000 50000. Free floating allows companies to gain access to new capital sources by enabling public investors to put their money into the business.

Source: investopedia.com

Source: investopedia.com

In free-float market capitalization the value of the company is calculated by excluding shares held by the promoters. Many indexes use the floating stock of a company as the basis for market cap calculation. Free float market capitalization is a term used in stock market. This holding does not include those held by the government royalty or company insiders. The free float percentage also known as float percentage of total shares outstanding simply shows the percentage of shares outstanding that trade freely.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

These excluded shares are the free float sharesFor example if a company has issued 10 lakh shares of face value Rs 10 but of these four lakh shares is owned by the promoter then the free float market capitalisation is Rs 60 lakh. Free-float market capitalization takes into consideration only those equity shares issued by the company that are readily available for trading in the market and DVR shares are not considered in the calculation of free-float market capitalization. What is free float market capitalisation. Many indexes use the floating stock of a company as the basis for market cap calculation. However we exclude shares held by private partie.

Source: educba.com

Source: educba.com

The goal to calculate Free Float is to distinguish between strategic control shareholders whose holdings depend on concerns such as maintaining control rather than. Free float market capitalization is a term used in stock market. The free-float market capitalization approach is calculated by taking the cost of equity and multiplying it by the number of easily accessible shares on the market. It is important to note that the free float MCap is inversely proportional to the volatility of the shares in the market. Free-float market capitalization is the value of the product of the current market price of the shares and the total number of shares that are readily accessible in the market for trading.

Source: getmoneyrich.com

Source: getmoneyrich.com

The free-float market capitalization approach is calculated by taking the cost of equity and multiplying it by the number of easily accessible shares on the market. It means that out of total issued shares if promoters holdings government holdings and other locked in shares are excluded then remaining shares represent free float market capitalization. The free float percentage also known as float percentage of total shares outstanding simply shows the percentage of shares outstanding that trade freely. In free-float market capitalization the value of the company is calculated by excluding shares held by the promoters. The free-float technique is seen as a better way to calculate market capitalization as it provides a more accurate reflection of market movements and.

Source: efinancemanagement.com

Source: efinancemanagement.com

It means that out of total issued shares if promoters holdings government holdings and other locked in shares are excluded then remaining shares represent free float market capitalization. Saat ini BEI masih menggunakan dua metode yaitu full market capitalization method dan capped adjusted free float market capitalization methodRencananya BEI akan mengubah metode penghitungan menjadi capped adjusted free float market capitalization weighted average method. This value is the sum of the free-float market cap sizes of all its listed entities. In one of its most important applications Indian bourses National Stock Exchange and Bombay Stock Exchange use the free-float market capitalisation to calculate index value. The goal to calculate Free Float is to distinguish between strategic control shareholders whose holdings depend on concerns such as maintaining control rather than.

The goal to calculate Free Float is to distinguish between strategic control shareholders whose holdings depend on concerns such as maintaining control rather than. These excluded shares are the free float shares. Free float market capitalization is a term used in stock market. In free float market capitalisation the value of the company is calculated by excluding shares held by the promoters. Meaning of Float Market Capitalization.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Applying Free Float to Market Capitalization. Free-float market capitalization takes into consideration only those equity shares issued by the company that are readily available for trading in the market and DVR shares are not considered in the calculation of free-float market capitalization. It is important to note that the free float MCap is inversely proportional to the volatility of the shares in the market. This capital can then be used to expand and develop the business as well as increase the companys profits. Understand the free-float method.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

See whenever a company wants to be listed in the stock market that company does not list all its shares that is it does not list 100 shares it can list all the shares but it depends on the company how much of the percentage shares that company want to list. The SP 500 is one example of a free. The market value of shares of a company that are available for trading is called free-float market capitalization. Free float market capitalization is a term used in stock market. What is free float market capitalisation.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title free float market capitalisation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 20+ Angel broking market cap Best

- 30+ Dow average today Trading

- 25+ American stock exchange Trading

- 49++ Financial markets online Top

- 42++ S and p 500 index Top

- 23+ Black monday financial crisis Stock

- 45++ Polka dot crypto price Wallet

- 21+ The start of digital currency Coin

- 22+ Golem coinmarketcap Popular

- 42+ Nikkei volatility index Popular