44+ Etoro crypto tax List

Home » Trading » 44+ Etoro crypto tax ListYour Etoro crypto tax exchange are ready in this website. Etoro crypto tax are a bitcoin that is most popular and liked by everyone this time. You can News the Etoro crypto tax files here. Find and Download all free trading.

If you’re looking for etoro crypto tax images information linked to the etoro crypto tax keyword, you have pay a visit to the right site. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

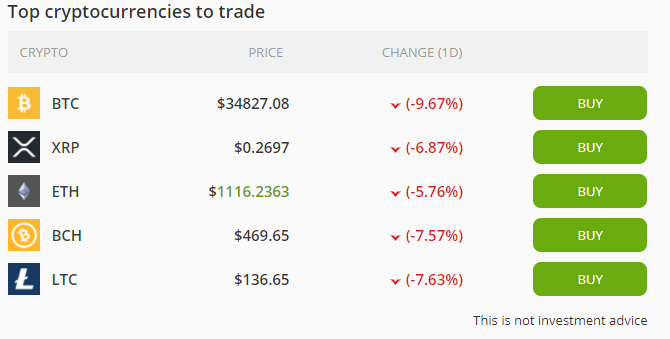

Etoro Crypto Tax. In Germany it is a flat rate of 25 solidarity surcharge 55 church tax 8 or 9 and affects most products on eToro. With cryptocurrency trading at eToro you should note that any selling exchanging or paying with cryptocurrency is defined as a disposal by the latest regulations from the HMRC Her Majestys Revenue Customs in the UK. Only for Etoro users. Heres what you should do.

Guide How To Report Crypto Taxes On Etoro Updated 2021 From coinpanda.io

Guide How To Report Crypto Taxes On Etoro Updated 2021 From coinpanda.io

This is not meant to be tax advice or financial advice of any kind. Non-leveraged BUY long crypto trades are secured with real assets. The BearTax platform has a number of useful features. How is crypto tax calculated in Australia. Automatically sync your eToroX account with CryptoTraderTax by entering your public wallet address. Clients of eToro Europe Ltd.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

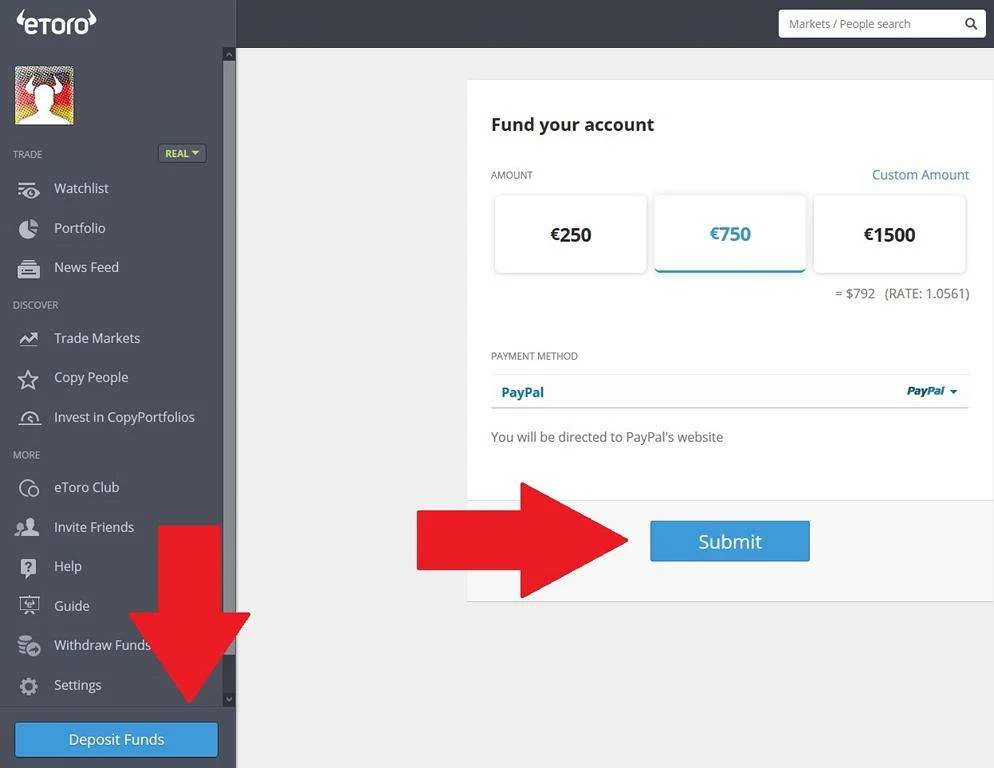

Here are some of the benefits of Accointing. Users will sign up to eToro open trade of 100 minimum and in 7 working days will receive an email from TokenTax regarding their subscription plan. Only accounts that have purchased at least 100 in cryptocurrency on eToro are eligible for this offer. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. Get our Premium package for free after trading your first 100 on eToro. So otherwise it is my understanding that it should be tax free after one year.

Or download the ACCOINTINGCOM app and connect here. Clients of eToro Europe Ltd. Whether youre a crypto beginner or a seasoned coiner accessing a world of crypto services has never been easier. Leveraged and SELL short crypto trades are CFDs. AND your total proceeds from all your sales of crypto to USD exceed 20000 during the previous calendar year.

Source: trusted-broker-reviews.com

Source: trusted-broker-reviews.com

Non-leveraged BUY long crypto trades are secured with real assets. You can generate your gains losses and income tax reports from your eToroX investing activity by connecting your account with CryptoTraderTax. Log into eToro account. What transactions are considered as taxable events and what are not. Generally speaking when you make a profit on eToro either via copying successful traders or by taking your own investment decisions you may be required to pay tax on the proceeds if you are based in the UK.

Source:

Source:

With cryptocurrency trading at eToro you should note that any selling exchanging or paying with cryptocurrency is defined as a disposal by the latest regulations from the HMRC Her Majestys Revenue Customs in the UK. Httpsbeartax BearTax is one of the simplest ways to calculate your crypto taxes. On the etoro Website it is stated that. At eToro we are always looking to ensure our platform is as user-friendly as possible from our copy trading service to providing seamless and easy transaction information for when it comes to getting your taxes in order. Clients of eToro Europe Ltd.

Source: comparebrokers.co

Source: comparebrokers.co

You can generate your gains losses and income tax reports from your eToroX investing activity by connecting your account with CryptoTraderTax. The first and usually the only step is to download all your data from eToro and upload them into Koinly. Here are some of the benefits of Accointing. This declares that you are not a US resident for tax purposes. Httpsbeartax BearTax is one of the simplest ways to calculate your crypto taxes.

Source: coinformant.com.au

Source: coinformant.com.au

EToro UK tax rules are complex and its not always easy to work out which tax rules will apply to you. Koinly can import both your CFD and. You can generate your gains losses and income tax reports from your eToro investing activity by connecting your account with CryptoTraderTax. Automatically sync your eToroX account with CryptoTraderTax by entering your public wallet address. Httpsbeartax BearTax is one of the simplest ways to calculate your crypto taxes.

Source: crypto-news-flash.com

Source: crypto-news-flash.com

Investments are subject to market risk including the possible loss of principal. HMRC DOES NOT CONSIDER THE BUYING AND SELLING OF CRYPTOASSETS TO BE THE SAME AS GAMBLING Only in exceptional circumstances would HMRC expect individuals to buy and. Koinly can import both your CFD and. You have made more than 200 crypto to USD trades Closed positions during the previous calendar year. Contact eToro customer support and ask for your Complete Trading History.

Source: trusted-broker-reviews.com

Source: trusted-broker-reviews.com

EToro does not have an API so you will need to download your transaction files from their web site and upload them to Koinly manually. In those states we will send you a 1099-K form if. Click on the different crypto-assets to review your buy and sell dates. AND your total proceeds from all your sales of crypto to USD exceed 20000 during the previous calendar year. All you need to do is export an Excel file from eToro that contains all your historical transactions and then upload the file to the Coinpanda platform.

Source: prweb.com

Source: prweb.com

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Heres what you should do. Tax treatment depends on your individual circumstances and may be subject to change in the future. The platform imports your transaction data using integrations with over 25 major exchanges to calculate your gains and provides export documents for you to file with your taxes. Contact eToro customer support and ask for your Complete Trading History.

Source: etoro.com

Source: etoro.com

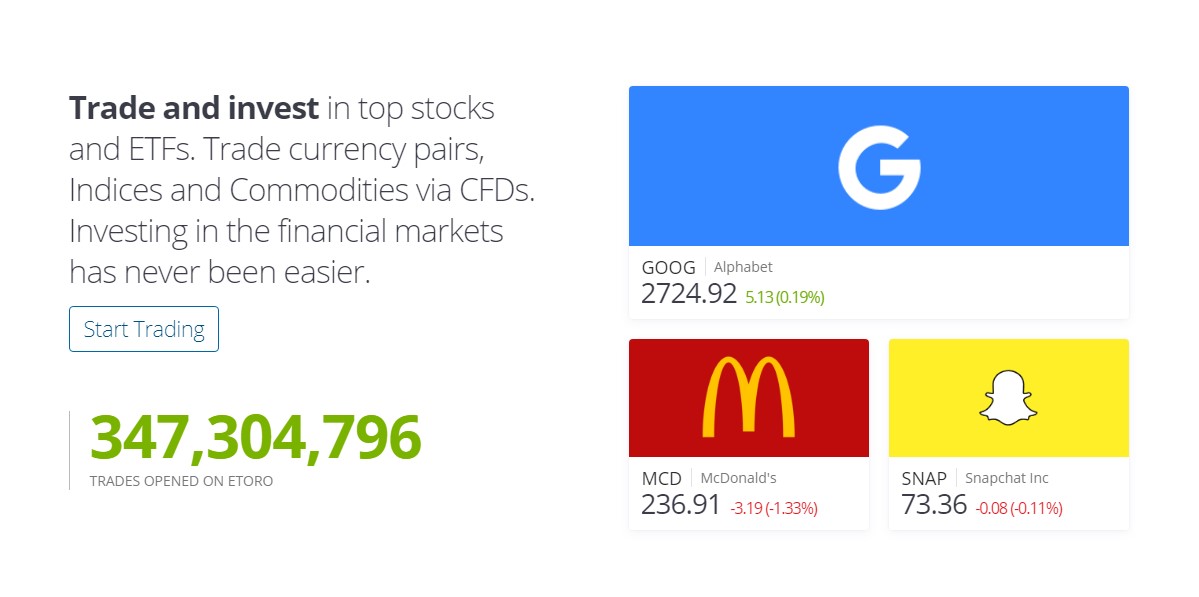

Httpsbeartax BearTax is one of the simplest ways to calculate your crypto taxes. EToro is the worlds leading social trading platform offering a wide array of tools to invest in the capital markets. Analyse your eToro historical performance by selecting your preferred time period as well as getting a look at total profits or losses. On the etoro Website it is stated that. You have made more than 200 crypto to USD trades Closed positions during the previous calendar year.

Source: investingoal.com

Source: investingoal.com

Hi Everyone in this video I want to talk about Cryptocurrency taxes. Coinpanda is one of very few crypto tax software solutions that can do tax calculations for trading on eToro correctly today. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. Log into eToro account. Select the History icon in upper left of the horizontal menu counter-clockwise arrow around a clock Click on the Settings icon in upper right and select Account Statement.

Source: tokentax.co

Source: tokentax.co

Tax plan details will be emailed to you from ZenLedger within 3-7 business days after you have completed your 100 purchase of cryptocurrency. Httpsbeartax BearTax is one of the simplest ways to calculate your crypto taxes. The above information we compiled from online tax forums. At eToro we are always looking to ensure our platform is as user-friendly as possible from our copy trading service to providing seamless and easy transaction information for when it comes to getting your taxes in order. Whether youre a crypto beginner or a seasoned coiner accessing a world of crypto services has never been easier.

Source: forex.academy

Source: forex.academy

Exclusive offer for eToro users. You can generate your gains losses and income tax reports from your eToroX investing activity by connecting your account with CryptoTraderTax. Get 10 off any tax plan for new users automatically when you signup from this link. Only accounts that have purchased at least 100 in cryptocurrency on eToro are eligible for this offer. Only for Etoro users.

Source: crypto-news-flash.com

Source: crypto-news-flash.com

Bank on eToros experience as a global fintech leader since the early days of Blockchain to provide you with a complete crypto trading solution. Httpsbeartax BearTax is one of the simplest ways to calculate your crypto taxes. Analyse your eToro historical performance by selecting your preferred time period as well as getting a look at total profits or losses. With cryptocurrency trading at eToro you should note that any selling exchanging or paying with cryptocurrency is defined as a disposal by the latest regulations from the HMRC Her Majestys Revenue Customs in the UK. Koinly can import both your CFD and.

Source: investingoal.com

Source: investingoal.com

The first and usually the only step is to download all your data from eToro and upload them into Koinly. The above information we compiled from online tax forums. After importing all your transactions from eToro go to your Overview Page so youll get a summary of your entire portfolio. Whether youre a crypto beginner or a seasoned coiner accessing a world of crypto services has never been easier. Users will sign up to eToro open trade of 100 minimum and in 7 working days will receive an email from TokenTax regarding their subscription plan.

Source: coinpanda.io

Source: coinpanda.io

There are a couple different ways to connect your account and import your data. Users will sign up to eToro open trade of 100 minimum and in 7 working days will receive an email from TokenTax regarding their subscription plan. All you need to do is export an Excel file from eToro that contains all your historical transactions and then upload the file to the Coinpanda platform. Bank on eToros experience as a global fintech leader since the early days of Blockchain to provide you with a complete crypto trading solution. How is crypto tax calculated in Australia.

Source: coinformant.com.au

Source: coinformant.com.au

This is not meant to be tax advice or financial advice of any kind. Only accounts that have purchased at least 100 in cryptocurrency on eToro are eligible for this offer. HMRC DOES NOT CONSIDER THE BUYING AND SELLING OF CRYPTOASSETS TO BE THE SAME AS GAMBLING Only in exceptional circumstances would HMRC expect individuals to buy and. The first and usually the only step is to download all your data from eToro and upload them into Koinly. EToro UK tax rules are complex and its not always easy to work out which tax rules will apply to you.

Source: coincentral.com

Source: coincentral.com

EToro does not provide financial or tax advice. The above information we compiled from online tax forums. This is not meant to be tax advice or financial advice of any kind. There are a couple different ways to connect your account and import your data. Only people who sign up from this page are eligible for a free 149 tax plan from ZenLedger.

Source: coinformant.com.au

Source: coinformant.com.au

Only for Etoro users. This is not meant to be tax advice or financial advice of any kind. Hi Everyone in this video I want to talk about Cryptocurrency taxes. Get 10 off any tax plan for new users automatically when you signup from this link. Users will sign up to eToro open trade of 100 minimum and in 7 working days will receive an email from TokenTax regarding their subscription plan.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title etoro crypto tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 20+ Angel broking market cap Best

- 30+ Dow average today Trading

- 25+ American stock exchange Trading

- 49++ Financial markets online Top

- 42++ S and p 500 index Top

- 23+ Black monday financial crisis Stock

- 45++ Polka dot crypto price Wallet

- 21+ The start of digital currency Coin

- 22+ Golem coinmarketcap Popular

- 42+ Nikkei volatility index Popular