50++ Commodity volatility index Mining

Home » Bitcoin » 50++ Commodity volatility index MiningYour Commodity volatility index exchange are available. Commodity volatility index are a trading that is most popular and liked by everyone now. You can News the Commodity volatility index files here. Download all royalty-free mining.

If you’re searching for commodity volatility index pictures information related to the commodity volatility index keyword, you have visit the right blog. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

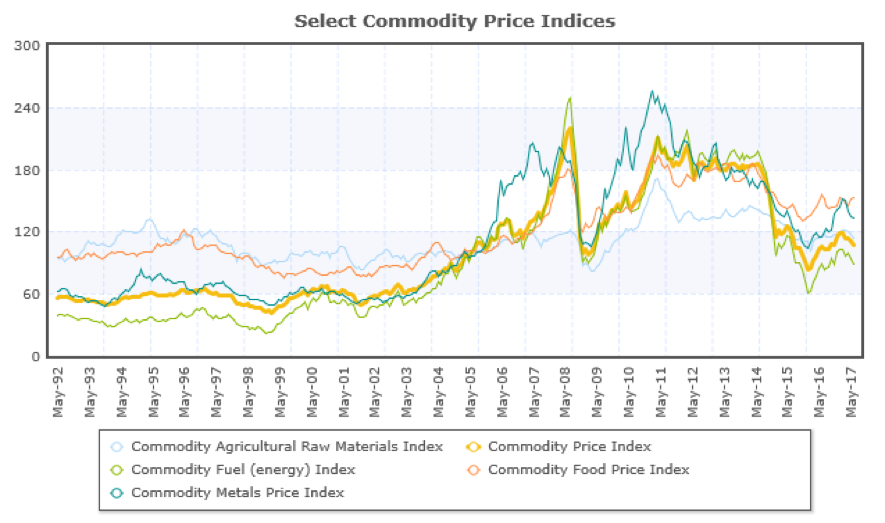

Commodity Volatility Index. Gold Volatility Index momentum was last calculated at 500100 indicating positive momentum. GSCI Commodity Index - data forecasts historical chart - was last updated on November of 2021. CBOEs volatility index spillover volatility transmission commodity markets JEL Classification. The quarterly historical volatility of the dollar indexdating back to 1988has ranged between 437 to 15 but the norm is a volatility reading below the 10 level.

What Is The Vix Volatility Index And How Do You Trade It From ig.com

What Is The Vix Volatility Index And How Do You Trade It From ig.com

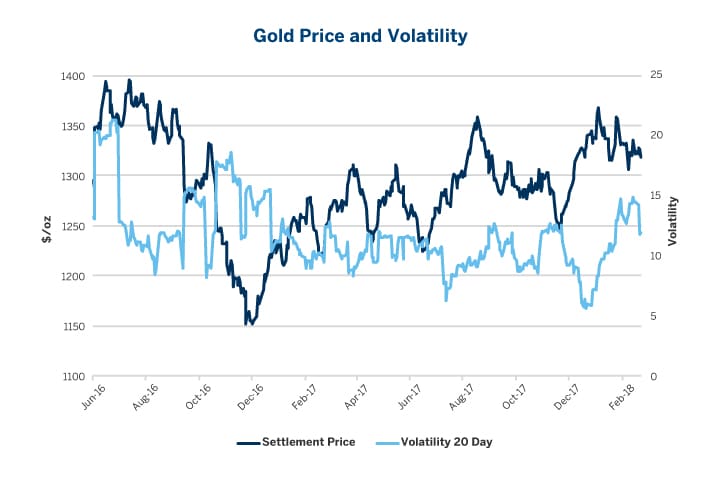

Volatility in oil and gold may offer more opportunity than risk Sep. Looking forward we estimate it to trade at 303194 in 12 months time. Its possible to report daily weekly monthly or yearly volatility. Saefong This commodity escaped the first half of 2020 drop in the energy sector. Agritel Volatility Index was designed as a new measurement tool dedicated to professionals in the food industry and the financial sector in order to better anticipate changes in option prices on agricultural commodities. Gold Volatility Index momentum was last calculated at 500100 indicating positive momentum.

GSCI Commodity Index - data forecasts historical chart - was last updated on November of 2021.

Volatility in oil and gold may offer more opportunity than risk Sep. Agritel Volatility Index is. Historically CRB Commodity Index reached an all time high of 47017 in July of 2008. Home World Markets Commodities Gold Volatility Index GVZ. The Cboe Volatility Index is based on real-time prices of options on the SP 500 Index and is designed to reflect investors consensus view of future 30-day expected stock market volatility. The commodity focused implied volatility indexes are put together by CBOE and are built based on the implied volatility of options on instruments.

Source: economist.com

Source: economist.com

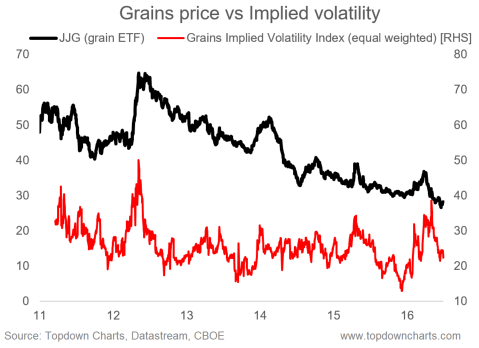

The study by Clem 1985 shows the dynamic and the static indices for the 156 commodity groupings studied for the full 9 years period 1975-1984. Up To 90 Profit Split. Moreover we make use of a country-specific commodity-price index that depends on the composition of a particular countrys commodity export- and import-baskets and investigate the impacts on growth of commodity terms of trade level and volatility. Commodities are categorized based on stage of processing group. The CME Group Volatility Index CVOL delivers the first ever cross-asset class family of implied volatility indexes based on simple variance.

Source: sciencedirect.com

Source: sciencedirect.com

Ad Trade Up To 200000 FTMO Account. Moreover we make use of a country-specific commodity-price index that depends on the composition of a particular countrys commodity export- and import-baskets and investigate the impacts on growth of commodity terms of trade level and volatility. The commodity focused implied volatility indexes are put together by CBOE and are built based on the implied volatility of options on instruments. Up To 90 Profit Split. Thus it could be interpreted that the investor in commodities market were sensitive to other markets.

Source: wikiwand.com

Source: wikiwand.com

First CVOL offerings to include 10-Year Treasury Note and G5 FX currency pair indexes. Up To 90 Profit Split. Agritel Volatility Index was designed as a new measurement tool dedicated to professionals in the food industry and the financial sector in order to better anticipate changes in option prices on agricultural commodities. Commodities Commodity volatility tends to be the highest of the asset classes described in this article. GSCI Commodity Index - data forecasts historical chart - was last updated on November of 2021.

Source: school.stockcharts.com

Source: school.stockcharts.com

Volatility Indices that measure market volatility including performance for Cboe VIX Euro VIX Gold VIX Crude VIX Nasdaq 100 VIX SP 500 VIX. Gold Volatility Index closed up by 149 to 1501 on 23 January 2021 and -99 on a weekly basis. The commodity focused implied volatility indexes are put together by CBOE and are built based on the implied volatility of options on instruments. This can be calculated using variance and standard deviation with standard deviation being the square root of variance. The tool for measuring the market price risk in.

The VIX Index is used as a barometer for market uncertainty providing market participants and observers with a measure of constant 30-day expected volatility of the broad US. Ad Trade Up To 200000 FTMO Account. The Chicago Board of Options Exchanges implied volatility index VIX historically appeared 8269 at the highest level on March 16 2020 while it was about 80 in 2008. The commodity focused implied volatility indexes are put together by CBOE and are built based on the implied volatility of options on instruments. Its possible to report daily weekly monthly or yearly volatility.

Source: rba.gov.au

Source: rba.gov.au

This can be calculated using variance and standard deviation with standard deviation being the square root of variance. Moreover we make use of a country-specific commodity-price index that depends on the composition of a particular countrys commodity export- and import-baskets and investigate the impacts on growth of commodity terms of trade level and volatility. This can be calculated using variance and standard deviation with standard deviation being the square root of variance. Using our proprietary simple variance methodology that assigns equal weighting to strikes across the entire implied volatility curve the CVOL Index produces a more representative measure of. We cover the losses.

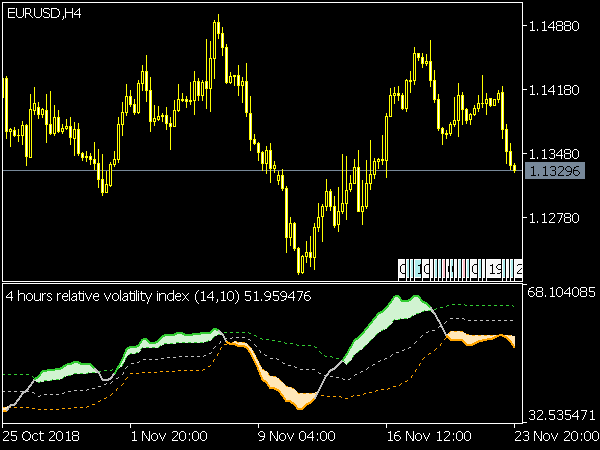

Source: forex.in.rs

Source: forex.in.rs

Volatility Indices that measure market volatility including performance for Cboe VIX Euro VIX Gold VIX Crude VIX Nasdaq 100 VIX SP 500 VIX. ET by Myra P. The VIX Index is used as a barometer for market uncertainty providing market participants and observers with a measure of constant 30-day expected volatility of the broad US. Commodities Commodity volatility tends to be the highest of the asset classes described in this article. First CVOL offerings to include 10-Year Treasury Note and G5 FX currency pair indexes.

Source: cmegroup.com

Source: cmegroup.com

Volatility in oil and gold may offer more opportunity than risk Sep. Commodities are categorized based on stage of processing group. Gold Volatility Index closed up by 149 to 1501 on 23 January 2021 and -99 on a weekly basis. The VIX Index is used as a barometer for market uncertainty providing market participants and observers with a measure of constant 30-day expected volatility of the broad US. CRB Index increased 7153 points or 4012 since the beginning of 2021 according to trading on a contract for difference CFD that tracks the benchmark market for this commodity.

Source: seekingalpha.com

Source: seekingalpha.com

The quarterly historical volatility of the dollar indexdating back to 1988has ranged between 437 to 15 but the norm is a volatility reading below the 10 level. The quarterly historical volatility of the dollar indexdating back to 1988has ranged between 437 to 15 but the norm is a volatility reading below the 10 level. Commodities Commodity volatility tends to be the highest of the asset classes described in this article. These revolutionary volatility products can offer investors effective ways to help manage risk leverage volatility and diversify a portfolio. Up To 90 Profit Split.

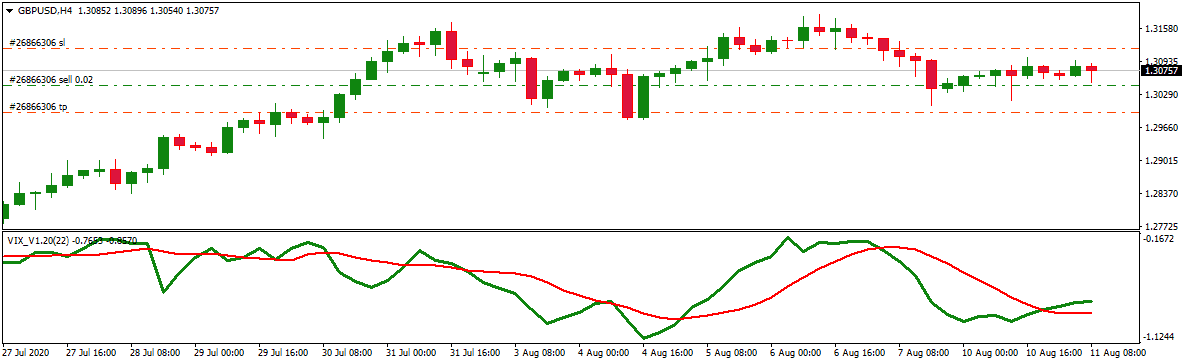

Source: best-metatrader-indicators.com

Source: best-metatrader-indicators.com

CRB Index increased 7153 points or 4012 since the beginning of 2021 according to trading on a contract for difference CFD that tracks the benchmark market for this commodity. Moreover we make use of a country-specific commodity-price index that depends on the composition of a particular countrys commodity export- and import-baskets and investigate the impacts on growth of commodity terms of trade level and volatility. Saefong This commodity escaped the first half of 2020 drop in the energy sector. The VIX is the 30-day annualized implied volatility of the SP 500 Index Options. Ad Trade Up To 200000 FTMO Account.

Source: blacksummitfg.com

Source: blacksummitfg.com

We cover the losses. Traders bid up the price of these put options which manifest as an increase in the implied. Thus it could be interpreted that the investor in commodities market were sensitive to other markets. The Cboe Volatility Index is based on real-time prices of options on the SP 500 Index and is designed to reflect investors consensus view of future 30-day expected stock market volatility. Commodities Commodity volatility tends to be the highest of the asset classes described in this article.

Source: transportgeography.org

Source: transportgeography.org

Volatility in oil and gold may offer more opportunity than risk Sep. Commodities are categorized based on stage of processing group. 17 2020 PRNewswire – CME Group the worlds leading and most diverse derivatives marketplace today announced it began daily publication of a suite of new implied volatility benchmark indexes based on its innovative proprietary CME Group Volatility Index CVOLâ methodology. First CVOL offerings to include 10-Year Treasury Note and G5 FX currency pair indexes. Up To 90 Profit Split.

Source: forexrobotfreemt4.blogspot.com

Source: forexrobotfreemt4.blogspot.com

1 we observe that the volatility of the broad commodity index and of oil market is significantly higher compared to gold for the whole sample. Moreover we make use of a country-specific commodity-price index that depends on the composition of a particular countrys commodity export- and import-baskets and investigate the impacts on growth of commodity terms of trade level and volatility. Commodities Commodity volatility tends to be the highest of the asset classes described in this article. 10 2020 at 103 pm. First CVOL offerings to include 10-Year Treasury Note and G5 FX currency pair indexes.

Source: rba.gov.au

Source: rba.gov.au

Commodities Commodity volatility tends to be the highest of the asset classes described in this article. Ad Trade Up To 200000 FTMO Account. The commodity focused implied volatility indexes are put together by CBOE and are built based on the implied volatility of options on instruments. The VIX Index is often referred to as the markets fear gauge. We cover the losses.

Source: ig.com

Source: ig.com

Home World Markets Commodities Gold Volatility Index GVZ. Looking forward we estimate it to trade at 303194 in 12 months time. Up To 90 Profit Split. The VIX is the 30-day annualized implied volatility of the SP 500 Index Options. Commodities Commodity volatility tends to be the highest of the asset classes described in this article.

Source: researchgate.net

Source: researchgate.net

This can be calculated using variance and standard deviation with standard deviation being the square root of variance. The tool for measuring the market price risk in. These revolutionary volatility products can offer investors effective ways to help manage risk leverage volatility and diversify a portfolio. CBOEs volatility index spillover volatility transmission commodity markets JEL Classification. Ad Trade Up To 200000 FTMO Account.

Source: seekingalpha.com

Source: seekingalpha.com

Commodities are categorized based on stage of processing group. The quarterly historical volatility of the dollar indexdating back to 1988has ranged between 437 to 15 but the norm is a volatility reading below the 10 level. Commodities are categorized based on stage of processing group. The VIX Index is not directly tradable but the VIX methodology provides a script for replicating volatility exposure with a portfolio of SPX options a. 10 2020 at 103 pm.

Source: treasury.gov.au

Source: treasury.gov.au

Saefong This commodity escaped the first half of 2020 drop in the energy sector. For the two sub periods 1979-1981 and 1982-1984 only the dynamic indices are shown. The quarterly historical volatility of the dollar indexdating back to 1988has ranged between 437 to 15 but the norm is a volatility reading below the 10 level. Up To 90 Profit Split. A similar tool to the volatility indicator is the VIX and VXN indexes that measure the implied volatility of CBOE index options.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commodity volatility index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 20++ Bitmart coinmarketcap Trading

- 35++ T stock price today Trend

- 23+ Dow jones industrial stock market Trending

- 33+ Nyse path Stock

- 35+ Volatile investment Trading

- 37++ Basf market cap Trending

- 31+ Best digital currency trading app Mining

- 38+ Intraday stocks for today List

- 34++ Tellor coinmarketcap Trending

- 11+ Best digital currency to invest in right now Coin