22+ Buffett indicator by country Trending

Home » Bitcoin » 22+ Buffett indicator by country TrendingYour Buffett indicator by country bitcoin are available in this site. Buffett indicator by country are a exchange that is most popular and liked by everyone now. You can Find and Download the Buffett indicator by country files here. Get all free coin.

If you’re searching for buffett indicator by country pictures information connected with to the buffett indicator by country keyword, you have pay a visit to the ideal site. Our website always gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

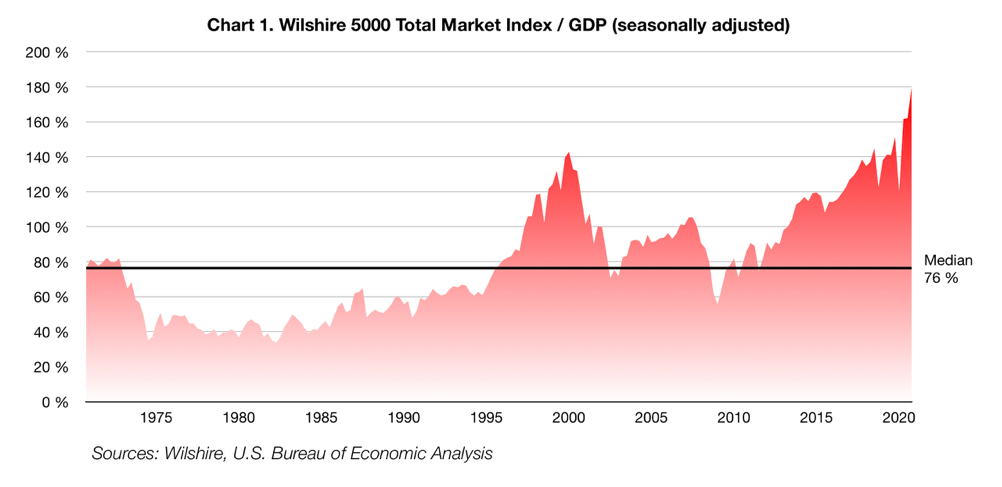

Buffett Indicator By Country. It means more sometimes than othersAnd both of the things that you mentioned get bandied around a lot. It used as a broad way of assessing whether the. It originated in a December 2001 interview with Carol Loomis where Warren Buffett discussed his favorite way to quantify stock valuation on a macro level. As pointed out by Warren Buffett the percentage of total market cap TMC relative to the US.

Pin On Biostats From pinterest.com

Pin On Biostats From pinterest.com

In the US the ratio is at its highest level since 2007. Every number has some degree of meaning. He had this to say. The following list sorts countries by the total market capitalization of all domestic companies listed in the country according to data from the World Bank. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. We use it as a broad way of assessing whether a countries stock market is over or undervalued compared to historical averages.

Using the FTSE All World index for market capitalizations and the International Monetary Fund data for GDP data we can calculate the Buffett Indicator for any country and all countries together.

This determination is made by dividing the countrys total stock market capitalisation by its GDP and multiplying by 100. As a general rule if the result is greater than 100 the market is said to be overvalued. This Warrens a Buffet Indicator. The current 73 is moderately high. That is why the ratio is widely used in the advanceddeveloped countries like the US UK Singapore Germany Sweden where more of business comes under the formal sector. Market falling sharply after the dotcom bubble burst this ratio may have some predictive value in signaling peaks in the market.

Source: pinterest.com

Source: pinterest.com

From December 2000 to October 2019 the average was 55. Market capitalization of listed domestic companies current US Stocks traded turnover ratio of domestic shares SP Global Equity Indices annual change Stocks traded total value current US Listed domestic companies total. What is the Buffett Indicator doing now. He had this to say. In the US the ratio is at its highest level since 2007.

Source: pinterest.com

Source: pinterest.com

GNP is probably the best single measure of where valuations stand at any given moment. Every number has some degree of meaning. Moreover GuruFocus introduces a new indicator TMCGDP Total Assets of Fed which acts similarly but gives an additional edition of market valuation. In the US the ratio is at its highest level since 2007. Buffett Indicator Stock Market Capitalization GDP.

Source: ar.pinterest.com

Source: ar.pinterest.com

It means more sometimes than othersAnd both of the things that you mentioned get bandied around a lot. Buffett fans often refer to the ratio as the Buffett indicatorThe Buffett indicator is calculated by dividing the total value of all stocks in the US. Market and by the gross domestic product. This determination is made by dividing the countrys total stock market capitalisation by its GDP and multiplying by 100. The Buffett Indicator or the market cap to GDP ratio tells us how expensive or cheap countries publicly traded stocks are at a given point in time.

Source: pinterest.com

Source: pinterest.com

The Buffett Indicator is a market valuation measure also known as the stock market capitalization to Gross Domestic Product ratio. As a general rule if the result is greater than 100 the market is said to be overvalued. He had this to say. It used as a broad way of assessing whether the. We use it as a broad way of assessing whether a countries stock market is over or undervalued compared to historical averages.

Source: pinterest.com

Source: pinterest.com

It means more sometimes than othersAnd both of the things that you mentioned get bandied around a lot. It originated in a December 2001 interview with Carol Loomis where Warren Buffett discussed his favorite way to quantify stock valuation on a macro level. Heres the Buffett Indicator in action for the US UK and. The Buffett Indicator is a market valuation measure also known as the stock market capitalization to Gross Domestic Product ratio. Market falling sharply after the dotcom bubble burst this ratio may have some predictive value in signaling peaks in the market.

Source: pinterest.com

Source: pinterest.com

We use it as a broad way of assessing whether a countries stock market is over or undervalued compared to historical averages. At the 2017 Berkshire Hathaway BRK-A BRK-B annual shareholders meeting Buffett fielded a question about the Buffett indicator as well as Robert Shillers legendary CAPE ratio. Buffett has since walked back those comments hesitating to endorse any single measure as either comprehensive or consistent over time but this ratio remains credited to his name. The Buffett Indicator is the ratio of total US stock market valuation to GDP. The Buffett Indicator suggests a below-average return in the next 12 months.

Source: irglobal.com

Source: irglobal.com

It used as a broad way of assessing whether the. The ratio Warren Buffett uses for market valuation TMCGNP is like a PS ratio. The current 73 is moderately high. The applicability of the buffett indicator is higher when the market cap reflects a much larger share of economic activity in the country. At the 2017 Berkshire Hathaway BRK-A BRK-B annual shareholders meeting Buffett fielded a question about the Buffett indicator as well as Robert Shillers legendary CAPE ratio.

Source: pinterest.com

Source: pinterest.com

The Buffett Indicator is a market valuation measure also known as the stock market capitalization to Gross Domestic Product ratio. As a general rule if the result is greater than 100 the market is said to be overvalued. The ratio is now at 160. So the Buffett indicator for the Indian market would be 88. In the US the ratio is at its highest level since 2007.

Source: in.pinterest.com

Source: in.pinterest.com

The Buffett Indicator is a ratio used by investors to gauge whether the market is undervalued fair valued or overvalued. At the 2017 Berkshire Hathaway BRK-A BRK-B annual shareholders meeting Buffett fielded a question about the Buffett indicator as well as Robert Shillers legendary CAPE ratio. It has become popular in recent years thanks to Warren Buffett. Market Cap to GDP is a long-term valuation indicator for stocks. With the US.

Famous investor Warren Buffet claims to use this indicator as. In this case the price is the total market cap of all stocks that are traded and sales is the total gross national product of the country. Back in 2001 he remarked in a Fortune Magazine interview that it is probably the best single measure of where valuations stand at any given moment. The Buffett Indicator is the ratio of total US stock market valuation to GDP. As a general rule if the result is greater than 100 the market is said to be overvalued.

Source: pinterest.com

Source: pinterest.com

The Buffett Indicator is a market valuation measure also known as the stock market capitalization to Gross Domestic Product ratio. Stocks traded total value of GDP. As a general rule if the result is greater than 100 the market is said to be overvalued. Every number has some degree of meaning. He had this to say.

Source: pinterest.com

Source: pinterest.com

The ratio Warren Buffett uses for market valuation TMCGNP is like a PS ratio. The Buffett Indicator or the market cap to GDP ratio tells us how expensive or cheap countries publicly traded stocks are at a given point in time. You take the stock market capitalisation of a countrys entire stock market and divide it by that countrys Gross Domestic Product GDP. Buffett has since walked back those comments hesitating to endorse any single measure as either comprehensive or consistent over time but this ratio remains credited to his name. The indicators we use are still the percentages of the total market caps of these countries over their own GDPs and the modified indicator TMC GDP Total Assets of Central Bank ratio.

Source: pinterest.com

Source: pinterest.com

The Buffett Indicator suggests a below-average return in the next 12 months. At the 2017 Berkshire Hathaway BRK-A BRK-B annual shareholders meeting Buffett fielded a question about the Buffett indicator as well as Robert Shillers legendary CAPE ratio. This Warrens a Buffet Indicator. Every number has some degree of meaning. The Buffett Indicator is Flashing Amber.

Source: id.pinterest.com

Source: id.pinterest.com

At the 2017 Berkshire Hathaway BRK-A BRK-B annual shareholders meeting Buffett fielded a question about the Buffett indicator as well as Robert Shillers legendary CAPE ratio. Named after Warren Buffett who called the ratio the best single measure of where valuations stand at any given moment. He had this to say. Buffett Indicator Stock Market Capitalization GDP. Market capitalization of listed domestic companies current US Stocks traded turnover ratio of domestic shares SP Global Equity Indices annual change Stocks traded total value current US Listed domestic companies total.

Source: pinterest.com

Source: pinterest.com

It originated in a December 2001 interview with Carol Loomis where Warren Buffett discussed his favorite way to quantify stock valuation on a macro level. The Buffett Indicator suggests a below-average return in the next one year. He had this to say. The Buffett Indicator is Flashing Amber. Every number has some degree of meaning.

Source: wpguynews.com

Source: wpguynews.com

Every number has some degree of meaning. It used as a broad way of assessing whether the. Has traded in this range or above in 34 of months. Market Cap to GDP is a long-term valuation indicator for stocks. Market capitalization commonly called market cap is the market value of a publicly traded company s outstanding shares.

Source: blog.is-wm.com

Source: blog.is-wm.com

It means more sometimes than othersAnd both of the things that you mentioned get bandied around a lot. How To Use The. Market capitalization of listed domestic companies current US Stocks traded turnover ratio of domestic shares SP Global Equity Indices annual change Stocks traded total value current US Listed domestic companies total. In the US the ratio is at its highest level since 2007. At the 2017 Berkshire Hathaway BRK-A BRK-B annual shareholders meeting Buffett fielded a question about the Buffett indicator as well as Robert Shillers legendary CAPE ratio.

Source: becomeabetterinvestor.net

Source: becomeabetterinvestor.net

The applicability of the buffett indicator is higher when the market cap reflects a much larger share of economic activity in the country. The Buffett Indicator is a ratio used by investors to gauge whether the market is undervalued fair valued or overvalued. For those catching up the Buffett Indicator is the value of a countrys publicly traded stocks divided by its gross national product and different people have different ways of accounting for. The ratio Warren Buffett uses for market valuation TMCGNP is like a PS ratio. It originated in a December 2001 interview with Carol Loomis where Warren Buffett discussed his favorite way to quantify stock valuation on a macro level.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title buffett indicator by country by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 20++ Bitmart coinmarketcap Trading

- 35++ T stock price today Trend

- 23+ Dow jones industrial stock market Trending

- 33+ Nyse path Stock

- 35+ Volatile investment Trading

- 37++ Basf market cap Trending

- 31+ Best digital currency trading app Mining

- 38+ Intraday stocks for today List

- 34++ Tellor coinmarketcap Trending

- 11+ Best digital currency to invest in right now Coin