41++ Bond market volatility index Best

Home » Trading » 41++ Bond market volatility index BestYour Bond market volatility index wallet are available in this site. Bond market volatility index are a news that is most popular and liked by everyone now. You can News the Bond market volatility index files here. News all royalty-free exchange.

If you’re searching for bond market volatility index images information linked to the bond market volatility index topic, you have visit the right blog. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Bond Market Volatility Index. The 10-year Treasury note yield TMUBMUSD10Y 1594 stands at. ICE BOFAML US. The Merrill Option Volatility Expectations Index MOVE index a yield curve weighted index of the normalized implied volatility on 1-month Treasury options does reflect market estimate of future Treasury bond yield volatility but it isnt tradable. Futures trading on the 10-year US.

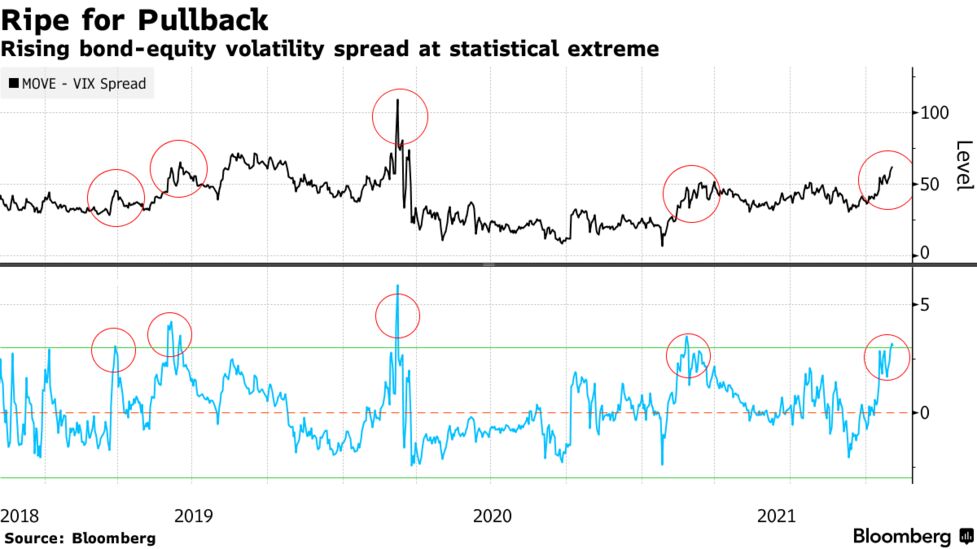

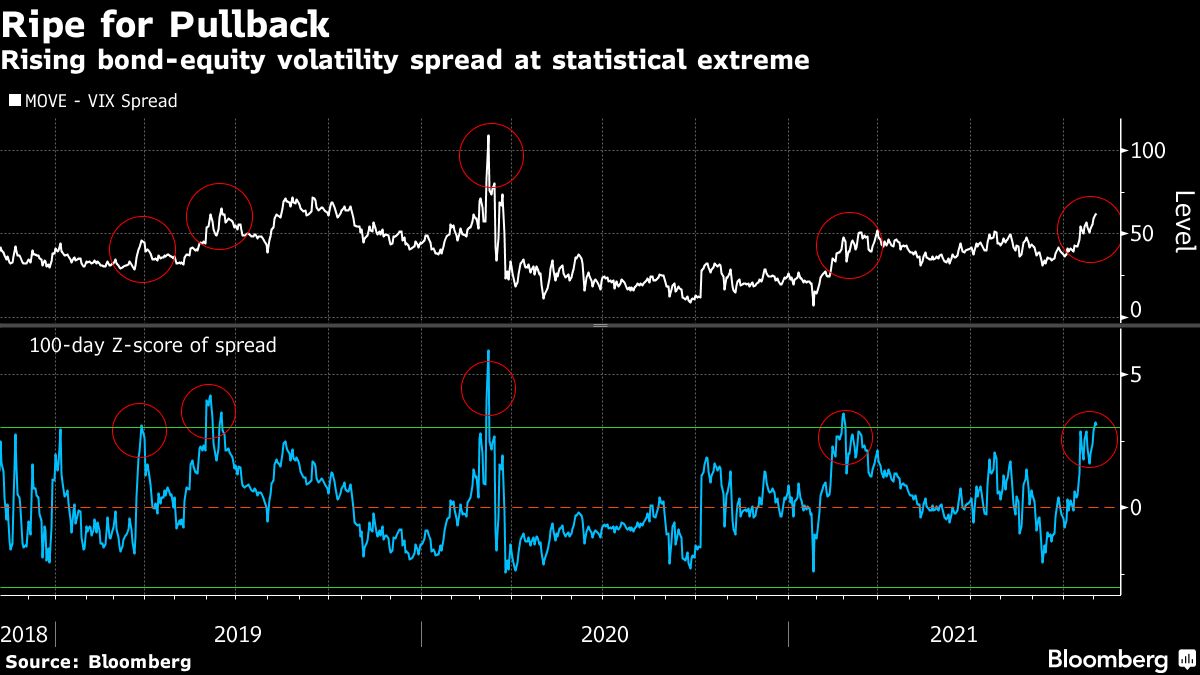

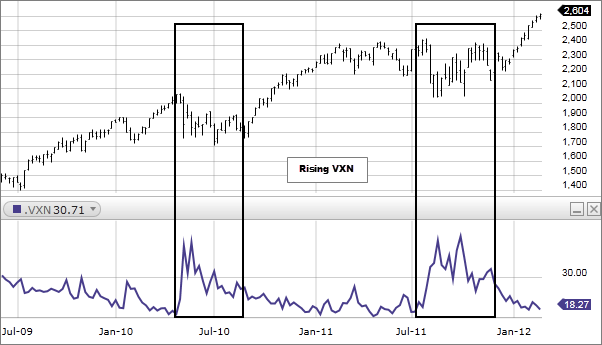

Us Bond Tumult Risks Triggering Stock Market Volatility Analysts Warn Financial Times From ft.com

Us Bond Tumult Risks Triggering Stock Market Volatility Analysts Warn Financial Times From ft.com

Seeks to track an index that measures the performance of inflation-protected public obligations of the US. Volatility Prediction for Monday November 22nd 2021. Kunal Mehta and Fatima Ait Moulay fixed income investment product specialists examine how the tracking errors of fixed income index funds can react to heightened market volatility. Treasury Note Volatility Index ticker VXTYN began a week ago about a month too late for Octobers whipsaw. This bond-market indicator shot up dramatically in May matching levels of volatility last seen in Dec. Per the table below the one-and two-week returns signal outperformance compared to TLTs anytime performance.

Treasury Note Volatility Index ticker VXTYN began a week ago about a month too late for Octobers whipsaw.

This bond-market indicator shot up dramatically in May matching levels of volatility last seen in Dec. Volatility in US bonds is surging in stark contrast to the relatively placid run for equities leading some analysts to warn over the danger that central banks trigger a spasm of volatility in. Volatility indexes are essential parts of the financial markets. Kunal Mehta and Fatima Ait Moulay fixed income investment product specialists examine how the tracking errors of fixed income index funds can react to heightened market volatility. Secondary Market Corporate Credit Facility 250B in secondary market purchases Bonds within 5 years of maturity as well as ETFs in the investment grade and some in the high yield space 3. The bond market also debt market or credit market is a financial market where participants can issue new debt known as the primary market or buy and sell debt securities known as the secondary marketThis is usually in the form of bonds but it may include notes bills and so for public and private expendituresThe bond market has largely been dominated by the United States which.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

Municipal Liquidity Facility 500B in primary market purchases for short -term municipal issuances. It incorporates the weighted average of vols on the current 2Y 5Y 10Y. CBOE Volatility Index. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade US dollar-denominated fixed-rate taxable bond market. It can be historical or implied and volatility itself can also be a tradable market instrument.

Source: pinterest.com

Source: pinterest.com

See more on advanced chart. The Bank of America MOVE index which measures the volatility in the Treasury market implied by option pricing has leapt to its highest level since mid-2009. Volatility indexes are essential parts of the financial markets. Secondary Market Corporate Credit Facility 250B in secondary market purchases Bonds within 5 years of maturity as well as ETFs in the investment grade and some in the high yield space 3. ICE BOFAML US.

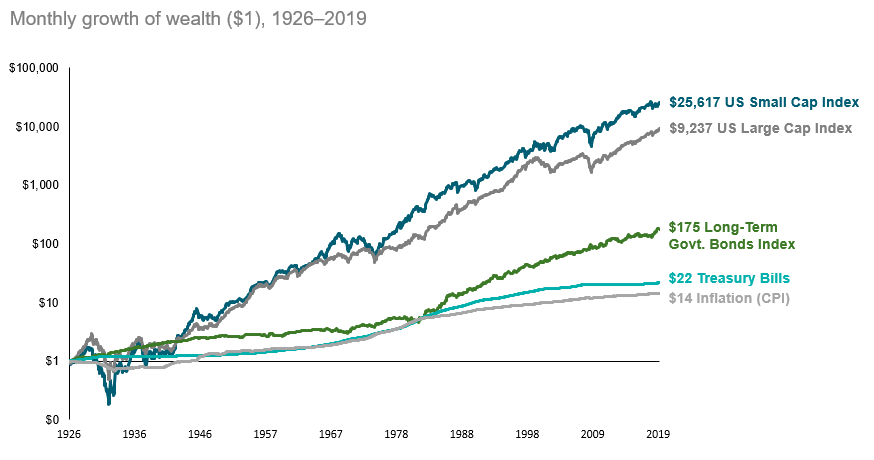

Source: morningstar.com

Source: morningstar.com

Bond Market Option Volatility Estimate Index GARCH Volatility Analysis Whats on this page. A perfect calm of the. Futures trading on the 10-year US. Treasury Note Volatility Index ticker VXTYN began a week ago about a month too late for Octobers whipsaw. Designed to generate returns more closely correlated with realized inflation over the near term and offer investors the potential for less volatility of returns relative to a longer-duration TIPS fund.

Source: raymondjames.com

Source: raymondjames.com

By Yoruk Bahceli. It has been one of the calmest years on record for the roughly 16 trillion US. We express volatility indices in both price and basis points the latter being more intuitive to interpret. Municipal Liquidity Facility 500B in primary market purchases for short -term municipal issuances. ICE BofAML US.

Source: bloomberg.com

Source: bloomberg.com

ICE BofAML US. Per the table below the one-and two-week returns signal outperformance compared to TLTs anytime performance. Derived Data See more on advanced chart. Index Daily Not Seasonally Adjusted 1990-01-02 to 2021-11-22 3 hours ago. Treasury that have a remaining maturity of less than five years.

Source: bloomberg.com

Source: bloomberg.com

Volatility indexes are essential parts of the financial markets. It can be historical or implied and volatility itself can also be a tradable market instrument. The 10-year Treasury note yield TMUBMUSD10Y 1594 stands at. Designed to generate returns more closely correlated with realized inflation over the near term and offer investors the potential for less volatility of returns relative to a longer-duration TIPS fund. Index Daily Not Seasonally Adjusted 1990-01-02 to 2021-11-22 3 hours ago.

Source: researchgate.net

Source: researchgate.net

Futures trading on the 10-year US. Futures trading on the 10-year US. It can be historical or implied and volatility itself can also be a tradable market instrument. The index includes Treasuries government-related and corporate securities mortgage-back securities agency fixed-rate pass-throughs asset-backed securities and collateralised mortgage-backed securities. We express volatility indices in both price and basis points the latter being more intuitive to interpret.

Source: investopedia.com

Source: investopedia.com

We document their empirical properties and discuss their possible applications. Derived Data See more on advanced chart. The index includes Treasuries government-related and corporate securities mortgage-back securities agency fixed-rate pass-throughs asset-backed securities and collateralised mortgage-backed securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade US dollar-denominated fixed-rate taxable bond market. A perfect calm of the.

Source: seekingalpha.com

Source: seekingalpha.com

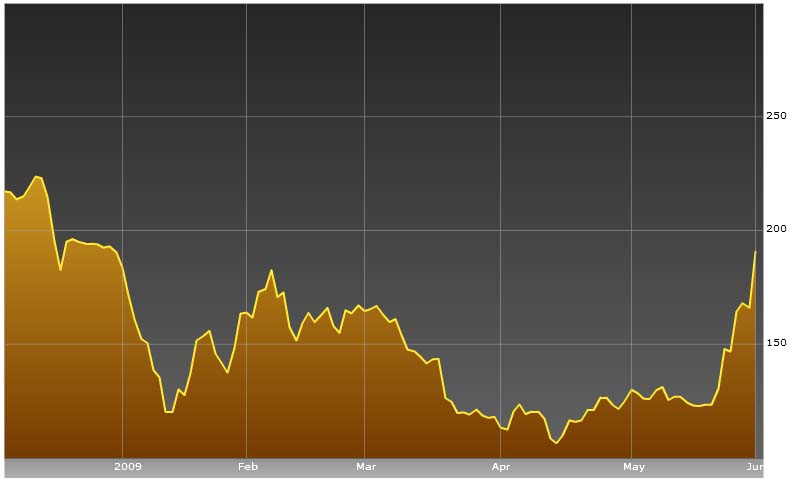

Bond timing volatility effect volatility premium. Volatility in US bonds is surging in stark contrast to the relatively placid run for equities leading some analysts to warn over the danger that central banks trigger a spasm of volatility in. The Bank of America MOVE index which measures the volatility in the Treasury market implied by option pricing has leapt to its highest level since mid-2009. Treasury Note Volatility Index ticker VXTYN began a week ago about a month too late for Octobers whipsaw. The 10-year Treasury note yield TMUBMUSD10Y 1594 stands at.

Source: fidelity.com

Source: fidelity.com

The bond market also debt market or credit market is a financial market where participants can issue new debt known as the primary market or buy and sell debt securities known as the secondary marketThis is usually in the form of bonds but it may include notes bills and so for public and private expendituresThe bond market has largely been dominated by the United States which. The MOVE Index is a yield-curve weighted index of the normalized implied volatility on 1-month Treasury options. It can be historical or implied and volatility itself can also be a tradable market instrument. High-yield or junk-bond market according to Deutsche Bank. It incorporates the weighted average of vols on the current 2Y 5Y 10Y.

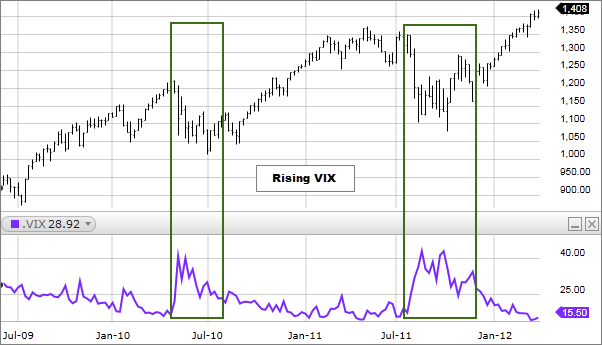

Source: ig.com

Source: ig.com

They offer investable opportunities and exposure to the volatility but most importantly those indexes offer forward-looking measures of option-implied uncertainty. They offer investable opportunities and exposure to the volatility but most importantly those indexes offer forward-looking measures of option-implied uncertainty. Kunal Mehta and Fatima Ait Moulay fixed income investment product specialists examine how the tracking errors of fixed income index funds can react to heightened market volatility. We create new volatility indices which reflect market pricing of subsequently realised volatility of underlying bond futures. We document their empirical properties and discuss their possible applications.

Source: fool.com

Source: fool.com

BOND MARKET OPTION VOLATILITY ESTIMATE INDEX TVC. It can be historical or implied and volatility itself can also be a tradable market instrument. CBOE Volatility Index. Secondary Market Corporate Credit Facility 250B in secondary market purchases Bonds within 5 years of maturity as well as ETFs in the investment grade and some in the high yield space 3. See more on advanced chart.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

Three Lead Market Makers LMMs have been appointed to make markets in VXTYN futures. Treasury Note Volatility Index ticker VXTYN began a week ago about a month too late for Octobers whipsaw. Derived Data See more on advanced chart. The bond market also debt market or credit market is a financial market where participants can issue new debt known as the primary market or buy and sell debt securities known as the secondary marketThis is usually in the form of bonds but it may include notes bills and so for public and private expendituresThe bond market has largely been dominated by the United States which. It has been one of the calmest years on record for the roughly 16 trillion US.

Source: ft.com

Source: ft.com

Period of time. They offer investable opportunities and exposure to the volatility but most importantly those indexes offer forward-looking measures of option-implied uncertainty. Oct 21 Reuters - Euro zone bond yields steadied on Thursday as the market continued to calm from a sell-off that had sent bond. ICE BofAML US. The index includes Treasuries government-related and corporate securities mortgage-back securities agency fixed-rate pass-throughs asset-backed securities and collateralised mortgage-backed securities.

Source: quantpedia.com

Source: quantpedia.com

The Merrill Option Volatility Expectations Index MOVE index a yield curve weighted index of the normalized implied volatility on 1-month Treasury options does reflect market estimate of future Treasury bond yield volatility but it isnt tradable. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade US dollar-denominated fixed-rate taxable bond market. 52906 725 Market Closed as of Nov 10 1555 EST. Municipal Liquidity Facility 500B in primary market purchases for short -term municipal issuances. Bond Market Option Volatility Estimate Index GARCH Volatility Analysis Whats on this page.

Source: tradingview.com

Source: tradingview.com

It has been one of the calmest years on record for the roughly 16 trillion US. This bond-market indicator shot up dramatically in May matching levels of volatility last seen in Dec. In depth view into CBOE 20 Year Treasury Bond ETF Volatility Index including performance historical levels from 2015 charts and stats. Bond Market Option Volatility Estimate Index GARCH Volatility Analysis Whats on this page. Bond timing volatility effect volatility premium.

Futures trading on the 10-year US. Treasury Note Volatility Index ticker VXTYN began a week ago about a month too late for Octobers whipsaw. Volatility Prediction for Monday November 22nd 2021. We create new volatility indices which reflect market pricing of subsequently realised volatility of underlying bond futures. CBOE Volatility Index.

Source: fidelity.com

Source: fidelity.com

The index includes Treasuries government-related and corporate securities mortgage-back securities agency fixed-rate pass-throughs asset-backed securities and collateralised mortgage-backed securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade US dollar-denominated fixed-rate taxable bond market. A market index called the VIX index is often used to measure the markets expectation of 30-day forward-looking volatility using inputs from SP 500 options. Three Lead Market Makers LMMs have been appointed to make markets in VXTYN futures. Seeks to track an index that measures the performance of inflation-protected public obligations of the US.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bond market volatility index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 20+ Angel broking market cap Best

- 30+ Dow average today Trading

- 25+ American stock exchange Trading

- 49++ Financial markets online Top

- 42++ S and p 500 index Top

- 23+ Black monday financial crisis Stock

- 45++ Polka dot crypto price Wallet

- 21+ The start of digital currency Coin

- 22+ Golem coinmarketcap Popular

- 42+ Nikkei volatility index Popular