12++ Best qoz funds News

Home » Mining » 12++ Best qoz funds NewsYour Best qoz funds coin are ready in this website. Best qoz funds are a trading that is most popular and liked by everyone this time. You can News the Best qoz funds files here. Get all royalty-free trading.

If you’re looking for best qoz funds images information linked to the best qoz funds keyword, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Best Qoz Funds. The investor gets to defer taxes then reduce their. Pollack Shores Opportunity Zone Fund Charleston NoMo. The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a. The Woodforest CEI-Boulos Opportunity Fund SIZE.

Qualified Opportunity Funds In Real Estate How To Invest From biggerpockets.com

Qualified Opportunity Funds In Real Estate How To Invest From biggerpockets.com

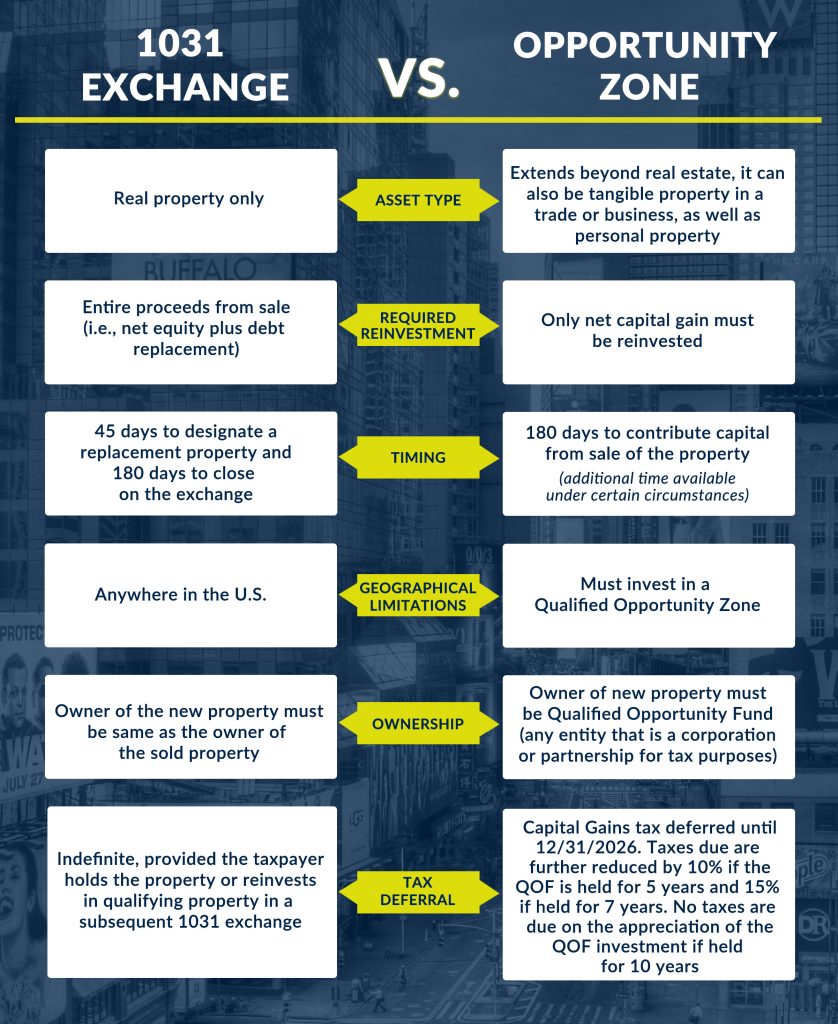

This means that if after 10 years the QOZ fund is worth 10 million he keeps the entire 10 million tax free. In addition to potential cash flow and capital appreciation QOZ investments also provide deferral and reduction of any gains not just those generated from the sale of investment properties. Investors who have eligible capital gains which could be from the sale of stocks real estate businesses or other investments earned before Jan. 101 rows Pollack Shores Opportunity Zone Fund Atlanta Beltline. On November 1 2026 the taxpayer receives a 10 adjustment to their cost basis in the Qualified Opportunity Zone investment amounting to 1 million. Another database with 147 listings to date was founded by the National Council of State Housing Agencies a nonprofit that focuses on affordable housing advocacy.

Because a QOF files the IRS Form 8996 it receives preferential tax treatment if investors buy and hold for 5 or more years.

The New York fund is looking to back start-ups in OZ communities focusing on internet infrastructure cellular coverage and green tech. These funds can use the investors money for a variety of reasons including but not limited to. Because a QOF files the IRS Form 8996 it receives preferential tax treatment if investors buy and hold for 5 or more years. QOZ funds invest in real estate projects new development or rehabilitation located in designated Qualified Opportunity Zones around the country. Origin QOZ Fund I was in the top 12 out of 853 Qualified Opportunity Zone Funds in terms of the amount of equity raised from the Novogradac Opportunity Zones Investment Report data through June 30 2021. While many QOZ locations are in path-of-growth areas and present great investment opportunities knowing how to navigate the needs of an emerging and.

Source: phtinvestmentgroup.com

Source: phtinvestmentgroup.com

Because it is the sale of the QOF interest that triggers the FMV step-up a fund was precluded. Because a QOF files the IRS Form 8996 it receives preferential tax treatment if investors buy and hold for 5 or more years. With the favorable acquisition costs and a growing vacation rental market total returns for real estate investments in the area can reach 15-20 before accounting for the individual Opportunity Zone program tax benefits. In this short article well take a look at two top ETFs. This means that if after 10 years the QOZ fund is worth 10 million he keeps the entire 10 million tax free.

Source: kitces.com

Source: kitces.com

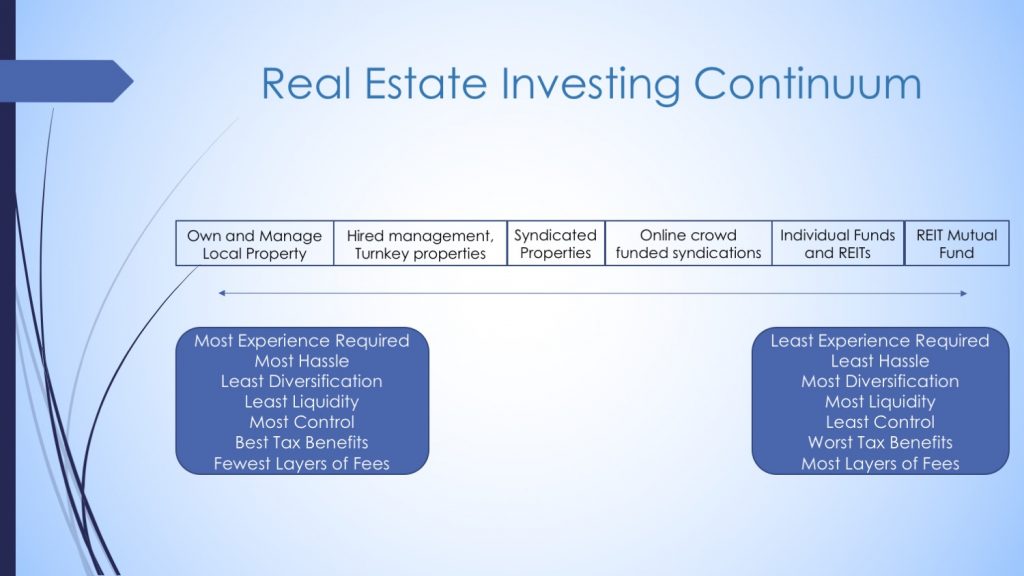

Betashares FTSE RAFI Australia 200 ETF ASX. Origins QOZ Fund II will embrace the same structure and strategy as its first QOZ fund which closed in August after raising 265 million and ranked in the top 2 of all QOZ funds nationally. Because a QOF files the IRS Form 8996 it receives preferential tax treatment if investors buy and hold for 5 or more years. For clients who are new to passive or direct investing in such properties and businesses who suddenly find themselves holding significant realized gains from the liquidation of their business real estate holdings or even such things as artwork and other tangible property investing in a QOZ fund or business is perilous. The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a.

Source: progresscapital.com

Source: progresscapital.com

This means that if after 10 years the QOZ fund is worth 10 million he keeps the entire 10 million tax free. Invest in QOZ Funds Take advantage of one of the best capital gains tax reduction programs of a generation. Because a QOF files the IRS Form 8996 it receives preferential tax treatment if investors buy and hold for 5 or more years. For clients who are new to passive or direct investing in such properties and businesses who suddenly find themselves holding significant realized gains from the liquidation of their business real estate holdings or even such things as artwork and other tangible property investing in a QOZ fund or business is perilous. This means that if after 10 years the QOZ fund is worth 10 million he keeps the entire 10 million tax free.

Source: biggerpockets.com

Source: biggerpockets.com

On December 31 2026 the taxpayer must recognize the deferred gain on the sale of the investment and their cost basis for determining the total gain is 1 million. In this short article well take a look at two top ETFs. On December 31 2026 the taxpayer must recognize the deferred gain on the sale of the investment and their cost basis for determining the total gain is 1 million. Pollack Shores Opportunity Zone Fund Charleston NoMo. Choosing Qualified Opportunity Zone Funds in 2021.

Source: origininvestments.com

Source: origininvestments.com

With the favorable acquisition costs and a growing vacation rental market total returns for real estate investments in the area can reach 15-20 before accounting for the individual Opportunity Zone program tax benefits. The New York fund is looking to back start-ups in OZ communities focusing on internet infrastructure cellular coverage and green tech. Because a QOF files the IRS Form 8996 it receives preferential tax treatment if investors buy and hold for 5 or more years. The investor gets to defer taxes then reduce their. This means that you can reinvest your net proceeds from the sale of a stock or a business.

Source: basarint.com

Source: basarint.com

QOZ locations are by definition low-income Census tracts which inherently makes them riskier investment locations than traditional market locations. Taxpayers who sold property for an eligible gain are generally required to reinvest the gain in a Qualified Opportunity Zone QOZ within 180 days from the date of the sale. The hallmark benefit of the Qualified Opportunity Zone QOZ program is that if an investor holds a QOZ interest for 10 years no tax will be recognized on the appreciation of the investment. This is accomplished through a basis step-up in the QOF interest to fair market value immediately prior to the sale. Thanks to the multiple tax benefits offered by the US government opportunity zone funds have received widespread attention amongst investors.

265M Equity Raised for Origin QOZ Fund I Total Cost of Origin QOZ Fund I Projects 11 Projects in Origin QOZ Fund I Top 2. Thanks to the multiple tax benefits offered by the US government opportunity zone funds have received widespread attention amongst investors. In this short article well take a look at two top ETFs. The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a. Choosing Qualified Opportunity Zone Funds in 2021.

Source: opportunitydb.com

Source: opportunitydb.com

1 2027 can roll their qualified gains into a qualified opportunity fundInvestors have 180 days or less from the realized gain to elect their eligible gain by filing Form 8949 as well. 300 rows Origin Investments QOZ Fund II Premium Listing. QOZ and Vanguard Australian Shares Index. The New York fund is looking to back start-ups in OZ communities focusing on internet infrastructure cellular coverage and green tech. Betashares FTSE RAFI Australia 200 ETF ASX.

Source: bestetfs.com.au

Source: bestetfs.com.au

Notice 2021-10 extends the investment window by giving investors until March 31 2021 to invest eligible gains into QOFs if the original 180-day window for investment would have ended any time from April 1 2020 through March. The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a. Taxpayers who sold property for an eligible gain are generally required to reinvest the gain in a Qualified Opportunity Zone QOZ within 180 days from the date of the sale. A Qualified Opportunity Fund or QOF is typically a corporation or other business entity that invests in a QOZ. These funds can use the investors money for a variety of reasons including but not limited to.

Source: ncsha.org

Source: ncsha.org

Invest in QOZ Funds Take advantage of one of the best capital gains tax reduction programs of a generation. The investor gets to defer taxes then reduce their. The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a. This means that if after 10 years the QOZ fund is worth 10 million he keeps the entire 10 million tax free. QOZ locations are by definition low-income Census tracts which inherently makes them riskier investment locations than traditional market locations.

Source: opportunitydb.com

Source: opportunitydb.com

In this short article well take a look at two top ETFs. For example 99 of Puerto Ricos beachfront is designated as QOZ including some of the best beaches in the Carribean. QOZ funds invest in real estate projects new development or rehabilitation located in designated Qualified Opportunity Zones around the country. The tax benefits of investing in a qualified opportunity fund. Origin QOZ Fund I was in the top 12 out of 853 Qualified Opportunity Zone Funds in terms of the amount of equity raised from the Novogradac Opportunity Zones Investment Report data through June 30 2021.

The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a. The sponsor has in QOZ locations. This is accomplished through a basis step-up in the QOF interest to fair market value immediately prior to the sale. The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a. On November 1 2026 the taxpayer receives a 10 adjustment to their cost basis in the Qualified Opportunity Zone investment amounting to 1 million.

Source: eisneramper.com

Source: eisneramper.com

A Qualified Opportunity Fund or QOF is typically a corporation or other business entity that invests in a QOZ. QOZ and Vanguard Australian Shares Index. This is accomplished through a basis step-up in the QOF interest to fair market value immediately prior to the sale. On November 1 2026 the taxpayer receives a 10 adjustment to their cost basis in the Qualified Opportunity Zone investment amounting to 1 million. 300 rows Origin Investments QOZ Fund II Premium Listing.

Source: qozmarketplace.com

Source: qozmarketplace.com

265M Equity Raised for Origin QOZ Fund I Total Cost of Origin QOZ Fund I Projects 11 Projects in Origin QOZ Fund I Top 2. The Woodforest CEI-Boulos Opportunity Fund SIZE. For clients who are new to passive or direct investing in such properties and businesses who suddenly find themselves holding significant realized gains from the liquidation of their business real estate holdings or even such things as artwork and other tangible property investing in a QOZ fund or business is perilous. 1 2027 can roll their qualified gains into a qualified opportunity fundInvestors have 180 days or less from the realized gain to elect their eligible gain by filing Form 8949 as well. Expect that QOZ funds especially the REIT model funds will be promoted.

Source: opportunitydb.com

Source: opportunitydb.com

Betashares FTSE RAFI Australia 200 ETF ASX. Thanks to the multiple tax benefits offered by the US government opportunity zone funds have received widespread attention amongst investors. An opportunity zone database founded last year aptly named OpportunityDb is a growing Opportunity Zone Fund Directory that currently lists 108 QOFs. Another database with 147 listings to date was founded by the National Council of State Housing Agencies a nonprofit that focuses on affordable housing advocacy. The New York fund is looking to back start-ups in OZ communities focusing on internet infrastructure cellular coverage and green tech.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

Because it is the sale of the QOF interest that triggers the FMV step-up a fund was precluded. Because it is the sale of the QOF interest that triggers the FMV step-up a fund was precluded. 265M Equity Raised for Origin QOZ Fund I Total Cost of Origin QOZ Fund I Projects 11 Projects in Origin QOZ Fund I Top 2. The Woodforest CEI-Boulos Opportunity Fund SIZE. The first income tax benefit is that the capital gains tax due on realized capital gains invested in either in a Qualified Opportunity Zone Fund QOF or directly into a.

Source: jdsupra.com

Source: jdsupra.com

1 2027 can roll their qualified gains into a qualified opportunity fundInvestors have 180 days or less from the realized gain to elect their eligible gain by filing Form 8949 as well. The hallmark benefit of the Qualified Opportunity Zone QOZ program is that if an investor holds a QOZ interest for 10 years no tax will be recognized on the appreciation of the investment. Origins QOZ Fund II will embrace the same structure and strategy as its first QOZ fund which closed in August after raising 265 million and ranked in the top 2 of all QOZ funds nationally. Expect that QOZ funds especially the REIT model funds will be promoted. This is accomplished through a basis step-up in the QOF interest to fair market value immediately prior to the sale.

Source: forbes.com

Source: forbes.com

Because it is the sale of the QOF interest that triggers the FMV step-up a fund was precluded. QOZ locations are by definition low-income Census tracts which inherently makes them riskier investment locations than traditional market locations. With the favorable acquisition costs and a growing vacation rental market total returns for real estate investments in the area can reach 15-20 before accounting for the individual Opportunity Zone program tax benefits. This means that if after 10 years the QOZ fund is worth 10 million he keeps the entire 10 million tax free. Because a QOF files the IRS Form 8996 it receives preferential tax treatment if investors buy and hold for 5 or more years.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title best qoz funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 32++ Sp 500 minimum volatility index Top

- 43+ Adx coinmarketcap News

- 10+ Bmo market cap Trending

- 10+ Investment opportunity Trend

- 35++ Fantom market cap Mining

- 29+ Tqqq premarket Top

- 26+ Dao coinmarketcap Bitcoin

- 34+ Us commodity market Mining

- 49++ New currencies on coinbase Top

- 23+ Coinmarketcap cashaa Mining