44++ Best opportunity zone funds Trend

Home » Trading » 44++ Best opportunity zone funds TrendYour Best opportunity zone funds exchange are available. Best opportunity zone funds are a bitcoin that is most popular and liked by everyone today. You can Get the Best opportunity zone funds files here. Get all free coin.

If you’re searching for best opportunity zone funds images information related to the best opportunity zone funds keyword, you have visit the ideal site. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

Best Opportunity Zone Funds. Opportunity Alabama HEADQUARTERS. By deferring the taxes on capital gains investors are. REVIVE Qualified Opportunity Zone. Any corporation or individual can take their unrealized capital gains and invest them in an opportunity fund.

Opportunity Zones Funds Aligning Public And Private Real Estate Capital Truvest Making An Impact In Real Estate Financial Wealth Capital Gains Tax Fund From pinterest.com

Opportunity Zones Funds Aligning Public And Private Real Estate Capital Truvest Making An Impact In Real Estate Financial Wealth Capital Gains Tax Fund From pinterest.com

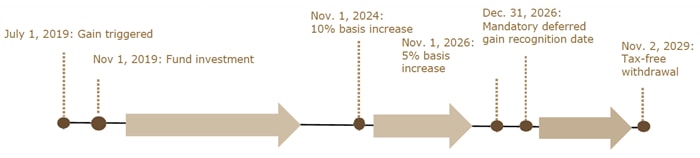

By deferring the taxes on capital gains investors are. If you owe capital gains taxes you can take the total amount and invest it into an opportunity zone fund and defer your taxes until 2026. Though the savings on capital gains will diminish slightly after this deadline investors can still reap considerable tax benefits from the program going forward but must invest capital gains in a QOF within 180 days of. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus. According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors. Fundrise 1 for example published its list of the top 10 Opportunity Zones in the country with more immediate growth potential.

Different Qualified Opportunity Funds are started by active real estate investors whether through partnerships limited liability companies LLC or corporations.

Several Opportunity Funds and organizations have produced their top picks for Opportunity Zones. The federal Opportunity Zone or OZ program created as part of the Tax Cuts and Jobs Act could become the most impactful federal incentive for equity capital investment in low-income and distressed communities. Opportunity Alabama HEADQUARTERS. Recently Atlanta received a 1 million grant from the Rockefeller Foundations Opportunity Zone Community Capacity Building Initiative. Different Qualified Opportunity Funds are started by active real estate investors whether through partnerships limited liability companies LLC or corporations. REVIVE Qualified Opportunity Zone.

Source: wyomingbusiness.org

Source: wyomingbusiness.org

As long as the money from these capital gains is not needed right away an Opportunity Fund can help investors use their money to grow their wealth. Liquid QOF I returned a 6 quarterly dividend in Q2 2021 making us one of the best performing opportunity zone funds in the country. Any corporation or individual can take their unrealized capital gains and invest them in an opportunity fund. Welcome to the Opportunity Zones Authority the Comprehensive Industry Leader. For example look for packaged investment opportunities that enable you to choose from a variety of investment structures that suit your investor profile and available funds.

1787 Capital Opportunity Zone Fund. Opportunity Zone Funds are investment vehicles that provide tax incentives for investors. These investment vehicles are designed to increase economic development and job creation in distressed communities as well as offer tax benefits to investors. For example look for packaged investment opportunities that enable you to choose from a variety of investment structures that suit your investor profile and available funds. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus.

Source: pinterest.com

Source: pinterest.com

Total Fund Size Authorized. Opportunity Funds will be evaluated on the quality of community engagement equity transparency and measurement and reporting that they incorporate into their investment practices based on The Opportunity Zones Reporting Framework developed by the US Impact Investing Alliance USIIA and the Beeck Center at Georgetown. Recently Atlanta received a 1 million grant from the Rockefeller Foundations Opportunity Zone Community Capacity Building Initiative. Compared to many other investment vehicles QOFs offer many tax benefits with few restrictions. Opportunity Alabama HEADQUARTERS.

Source: in.pinterest.com

Source: in.pinterest.com

101 rows Golden Door Partners Opportunity Zone Fund. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus. All rights reserved Powered by Shopify. Several Opportunity Funds and organizations have produced their top picks for Opportunity Zones. Opportunity Funds will be evaluated on the quality of community engagement equity transparency and measurement and reporting that they incorporate into their investment practices based on The Opportunity Zones Reporting Framework developed by the US Impact Investing Alliance USIIA and the Beeck Center at Georgetown.

Source: badermartin.com

Source: badermartin.com

1787 Capital Opportunity Zone Fund. Partnerships or corporations can establish Opportunity Zone Funds and then invest in a property located within a Qualified Opportunity Zone. Liquid QOF I returned a 6 quarterly dividend in Q2 2021 making us one of the best performing opportunity zone funds in the country. What can you expect when you invest with Liquid. These investment vehicles are designed to increase economic development and job creation in distressed communities as well as offer tax benefits to investors.

Source: selectsbcounty.com

Source: selectsbcounty.com

Opportunity Alabama HEADQUARTERS. Compared to many other investment vehicles QOFs offer many tax benefits with few restrictions. Welcome to the Opportunity Zones Authority the Comprehensive Industry Leader. By deferring the taxes on capital gains investors are. Recently Atlanta received a 1 million grant from the Rockefeller Foundations Opportunity Zone Community Capacity Building Initiative.

Source: wellsfargo.com

Source: wellsfargo.com

Opportunity Funds will be evaluated on the quality of community engagement equity transparency and measurement and reporting that they incorporate into their investment practices based on The Opportunity Zones Reporting Framework developed by the US Impact Investing Alliance USIIA and the Beeck Center at Georgetown. 300 rows Prospect Opportunity Zone Fund LP. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus. The federal Opportunity Zone or OZ program created as part of the Tax Cuts and Jobs Act could become the most impactful federal incentive for equity capital investment in low-income and distressed communities. 2021 Best Opportunity Zone Funds.

Source: pinterest.com

Source: pinterest.com

Any corporation or individual can take their unrealized capital gains and invest them in an opportunity fund. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus. To qualify for the full tax break that QOZ investments offer participants must harvest their capital gains and reinvest them in a Qualified Opportunity Zone Fund by the last day of 2019. If you owe capital gains taxes you can take the total amount and invest it into an opportunity zone fund and defer your taxes until 2026. Opportunity Zone Funds are investment vehicles that provide tax incentives for investors.

Source: pinterest.com

Source: pinterest.com

Recently Atlanta received a 1 million grant from the Rockefeller Foundations Opportunity Zone Community Capacity Building Initiative. West Oakland Uptown Jingletown and Coliseum Industrial. To qualify for the full tax break that QOZ investments offer participants must harvest their capital gains and reinvest them in a Qualified Opportunity Zone Fund by the last day of 2019. For example look for packaged investment opportunities that enable you to choose from a variety of investment structures that suit your investor profile and available funds. REVIVE Qualified Opportunity Zone.

Source: badermartin.com

Source: badermartin.com

West Oakland Uptown Jingletown and Coliseum Industrial. All rights reserved Powered by Shopify. 101 rows Golden Door Partners Opportunity Zone Fund. Theyre best for you if. 2021 Best Opportunity Zone Funds.

Source: pinterest.com

Source: pinterest.com

The federal Opportunity Zone or OZ program created as part of the Tax Cuts and Jobs Act could become the most impactful federal incentive for equity capital investment in low-income and distressed communities. Any corporation or individual can take their unrealized capital gains and invest them in an opportunity fund. It offers significant capital gains tax exemptions for taxpayers who invest in projects and businesses in low-income areas allowing. West Oakland Uptown Jingletown and Coliseum Industrial. Fundrise 1 for example published its list of the top 10 Opportunity Zones in the country with more immediate growth potential.

Source: pinterest.com

Source: pinterest.com

REVIVE Qualified Opportunity Zone. Opportunity Funds will be evaluated on the quality of community engagement equity transparency and measurement and reporting that they incorporate into their investment practices based on The Opportunity Zones Reporting Framework developed by the US Impact Investing Alliance USIIA and the Beeck Center at Georgetown. REVIVE Qualified Opportunity Zone. Several Opportunity Funds and organizations have produced their top picks for Opportunity Zones. Any corporation or individual can take their unrealized capital gains and invest them in an opportunity fund.

Source: badermartin.com

Source: badermartin.com

What can you expect when you invest with Liquid. REVIVE Qualified Opportunity Zone. According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors. Total Fund Stock Round A. Fundrise 1 for example published its list of the top 10 Opportunity Zones in the country with more immediate growth potential.

Source: badermartin.com

Source: badermartin.com

1787 Capital Opportunity Zone Fund. As long as the money from these capital gains is not needed right away an Opportunity Fund can help investors use their money to grow their wealth. Downtown and South Los Angeles. According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors. Opportunity Zone Funds are investment vehicles that provide tax incentives for investors.

Source: pinterest.com

Source: pinterest.com

What can you expect when you invest with Liquid. Compared to many other investment vehicles QOFs offer many tax benefits with few restrictions. Opportunity Zone Funds are investment vehicles that provide tax incentives for investors. Total Fund Stock Round A. 101 rows Golden Door Partners Opportunity Zone Fund.

Source: ncsha.org

Source: ncsha.org

Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus. Compared to many other investment vehicles QOFs offer many tax benefits with few restrictions. To qualify for the full tax break that QOZ investments offer participants must harvest their capital gains and reinvest them in a Qualified Opportunity Zone Fund by the last day of 2019. For example look for packaged investment opportunities that enable you to choose from a variety of investment structures that suit your investor profile and available funds. 101 rows Golden Door Partners Opportunity Zone Fund.

Source: stessa.com

Source: stessa.com

Partnerships or corporations can establish Opportunity Zone Funds and then invest in a property located within a Qualified Opportunity Zone. If you owe capital gains taxes you can take the total amount and invest it into an opportunity zone fund and defer your taxes until 2026. Partnerships or corporations can establish Opportunity Zone Funds and then invest in a property located within a Qualified Opportunity Zone. All rights reserved Powered by Shopify. 1787 Capital Opportunity Zone Fund.

Source: pinterest.com

Source: pinterest.com

It offers significant capital gains tax exemptions for taxpayers who invest in projects and businesses in low-income areas allowing. Opportunity Zone Funds are just one way for wealthier investors to pay back their communities in a tangible way and the benefit of receiving referred and lowered taxes is an added bonus. To qualify for the full tax break that QOZ investments offer participants must harvest their capital gains and reinvest them in a Qualified Opportunity Zone Fund by the last day of 2019. All rights reserved Powered by Shopify. For example look for packaged investment opportunities that enable you to choose from a variety of investment structures that suit your investor profile and available funds.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title best opportunity zone funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 20+ Angel broking market cap Best

- 30+ Dow average today Trading

- 25+ American stock exchange Trading

- 49++ Financial markets online Top

- 42++ S and p 500 index Top

- 23+ Black monday financial crisis Stock

- 45++ Polka dot crypto price Wallet

- 21+ The start of digital currency Coin

- 22+ Golem coinmarketcap Popular

- 42+ Nikkei volatility index Popular